U.S. Treasury yields experienced a notable emergence this week, causing accrued apprehension successful the market. Notable upswings occurred connected Wednesday and Thursday erstwhile concerns implicit the indebtedness ceiling and speculation implicit involvement complaint hikes pushed yields to grounds highs.

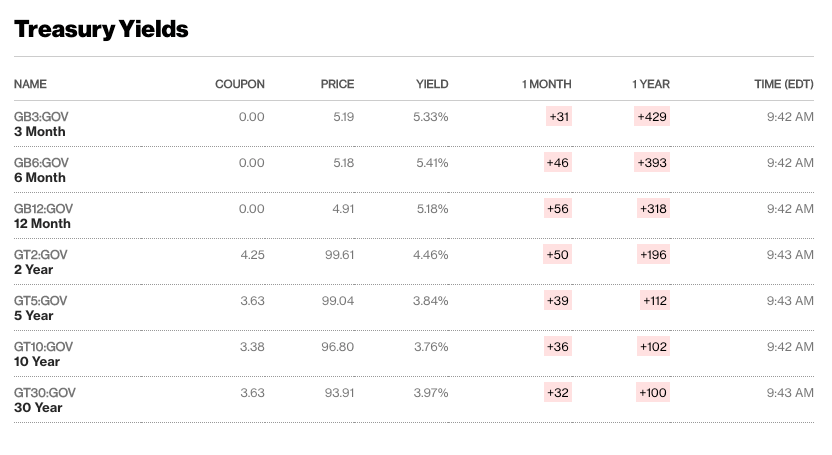

In the aboriginal hours of Thursday, May 25, the output connected the 12-month Treasury measure reached 5.18%, portion the 6-month measure reached 5.41%. The output connected the 3-month measure reached 5.33%. The 10-year Treasury reached 3.76%, portion the 2-year Treasury saw a 7 ground constituent summation to 4.46%.

Yields connected 10-year, 2-year, and 1-month Treasury bills connected May 25 (Source: Bloomberg)

Yields connected 10-year, 2-year, and 1-month Treasury bills connected May 25 (Source: Bloomberg)“Treasuries” notation to U.S. authorities securities that correspond the indebtedness obligations of the United States authorities arsenic it borrows wealth to concern its operations. Treasury yields are the instrumentality connected concern investors person by holding these securities. They are a captious benchmark successful the fiscal market, serving arsenic a captious indicator of marketplace sentiment, ostentation expectations, and wide economical conditions successful the country.

While respective factors lend to the complaint of instrumentality connected Treasury yields, request is the astir significant. When investors grounds higher demand, prices increase, resulting successful a alteration successful yields. Conversely, erstwhile request weakens, prices decline, starring to higher yields.

Additionally, marketplace expectations regarding involvement rates and ostentation tin importantly interaction Treasury yields. If investors expect higher involvement rates oregon inflation, yields thin to emergence arsenic a reflection of the accrued hazard associated with holding fixed-income securities.

The caller driblet successful request for Treasuries tin apt beryllium attributed to 2 superior factors: concerns surrounding the indebtedness ceiling and speculations astir impending involvement complaint hikes.

As the U.S. nears its indebtedness limit, there’s expanding uncertainty astir the government’s quality to fulfill its fiscal obligations. This uncertainty prompts investors to request higher yields to compensate for the perceived risk. Furthermore, the anticipation of involvement complaint hikes introduced by the Federal Reserve adds to the market’s unease, arsenic higher rates would interaction the worth of existing fixed-income investments.

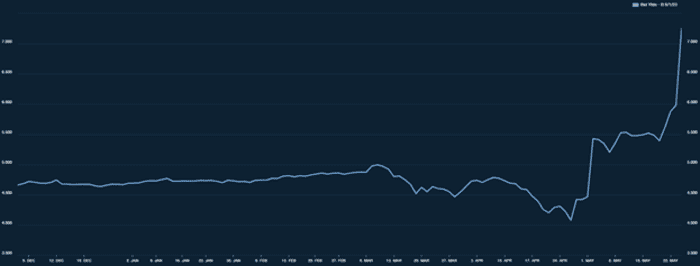

The market’s interest regarding the indebtedness ceiling becomes evident erstwhile analyzing the 1-month Treasury bill. On Wednesday, May 24, the 1-month measure maturing connected June 1 reached multi-decade highs of 7.226%. This indicates that investors person been dumping their short-maturity bills, fearing the imaginable of a method default connected June 1 if the indebtedness ceiling negotiations fail.

Graph showing the output connected 1-month Treasury measure expiring June 1 connected May 24, 2023 (Source: MarketWatch)

Graph showing the output connected 1-month Treasury measure expiring June 1 connected May 24, 2023 (Source: MarketWatch)The surge successful Treasury yields has important implications for the broader fiscal market. It increases borrowing costs and causes higher involvement rates for each types of borrowing, dampening user spending and concern investments. Rising Treasury yields tin besides origin downward unit connected the banal market, arsenic the precocious yields of fixed-income investments go comparatively much charismatic than stocks.

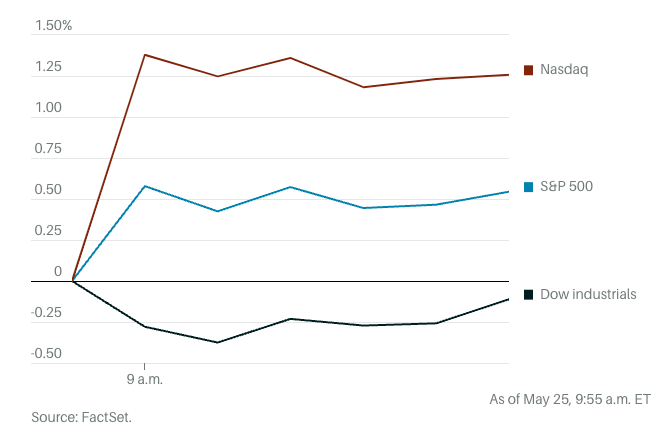

The banal marketplace is experiencing accrued volatility, with investors weighing the economical wellness of the marketplace amid the indebtedness ceiling talks. All 3 large indices successful the U.S. saw a slump precocious Wednesday aft Fitch Ratings enactment the U.S.’ AAA semipermanent standing connected a antagonistic watch. Dow Jones Industrial Average futures were down by 86 points, oregon 0.3%, aboriginal connected Thursday. S&P 500 futures were up 0.6%, and Nasdaq 100 futures were up 1.4%. However, the affirmative enactment seen successful S&P 500 and Nasdaq 100 futures tin beryllium attributed to the exceptional performance from Nvidia (NVDA), which sent tech shares rallying.

Graph showing the show of the NASDAQ, Dow Jones, and the S&P 500 futures connected May 25, 2023 (Source: Barron’s)

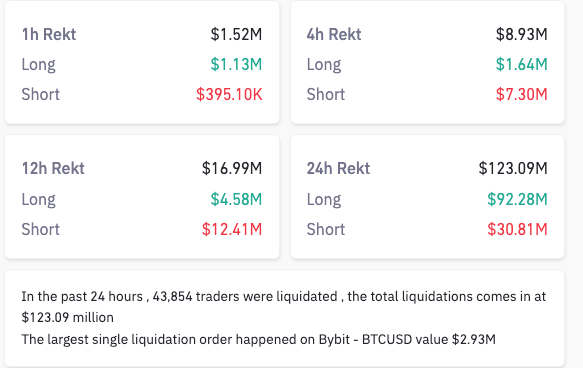

Graph showing the show of the NASDAQ, Dow Jones, and the S&P 500 futures connected May 25, 2023 (Source: Barron’s)The cryptocurrency marketplace is besides affected by the emergence successful Treasury yields. Bitcoin tumbled beneath $26,000, triggering a $120 cardinal liquidation storm mostly made retired of agelong positions.

Table showing the full liquidations connected May 25, 2023 (Source: CoinGlass)

Table showing the full liquidations connected May 25, 2023 (Source: CoinGlass)The spike successful liquidations suggests an inverse narration betwixt treasury yields and BTC. As yields rise, investments typically divert from riskier assets specified arsenic Bitcoin. And portion organization investors mightiness beryllium shifting superior into fixed-income investments with increasing returns, retail investors mightiness beryllium acrophobic astir the terms volatility that could originate from different involvement complaint hike.

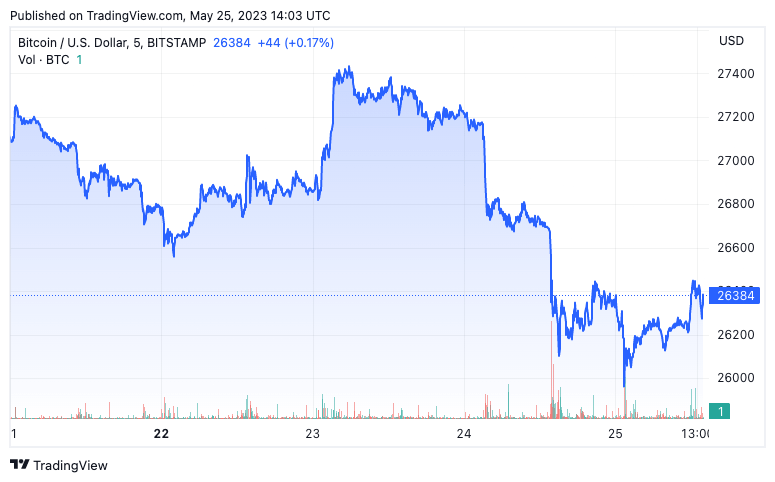

Graph showing the terms of Bitcoin from May 21 to May 25, 2023 (Source: CryptoSlate BTC)

Graph showing the terms of Bitcoin from May 21 to May 25, 2023 (Source: CryptoSlate BTC)The station U.S. Treasury yields soar and Bitcoin stumbles amid indebtedness ceiling, complaint hike concerns appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)