Ethereum is attempting to regain stableness aft the crisp selloff connected Tuesday that sent its terms plunging beneath $3,100. The driblet triggered wide liquidations crossed the crypto market, with ETH concisely touching multi-week lows earlier uncovering support. As of today, bulls are trying to reclaim the $3,350 level, a short-term absorption portion that could find whether the plus stages a broader betterment oregon faces different limb down.

Despite the volatility, on-chain information reveals a antithetic communicative beneath the surface. Large investors — often referred to arsenic whales — person continued to accumulate ETH, signaling semipermanent assurance successful the network’s fundamentals. Their dependable buying enactment stands successful stark opposition to the broader market’s fear-driven behavior, suggesting that large holders presumption the caller correction arsenic a buying accidental alternatively than a reversal.

Historically, whale accumulation during heavy pullbacks has often preceded beardown rebounds, arsenic organization and semipermanent superior measurement successful portion retail sentiment weakens. The situation present lies successful whether Ethereum tin support momentum supra cardinal method levels, particularly arsenic wide marketplace confidence remains fragile. If buying unit continues to build, ETH could find the instauration for a sustained betterment heading into mid-November.

Whales Accumulate ETH, Hinting astatine Impulsive Move Ahead

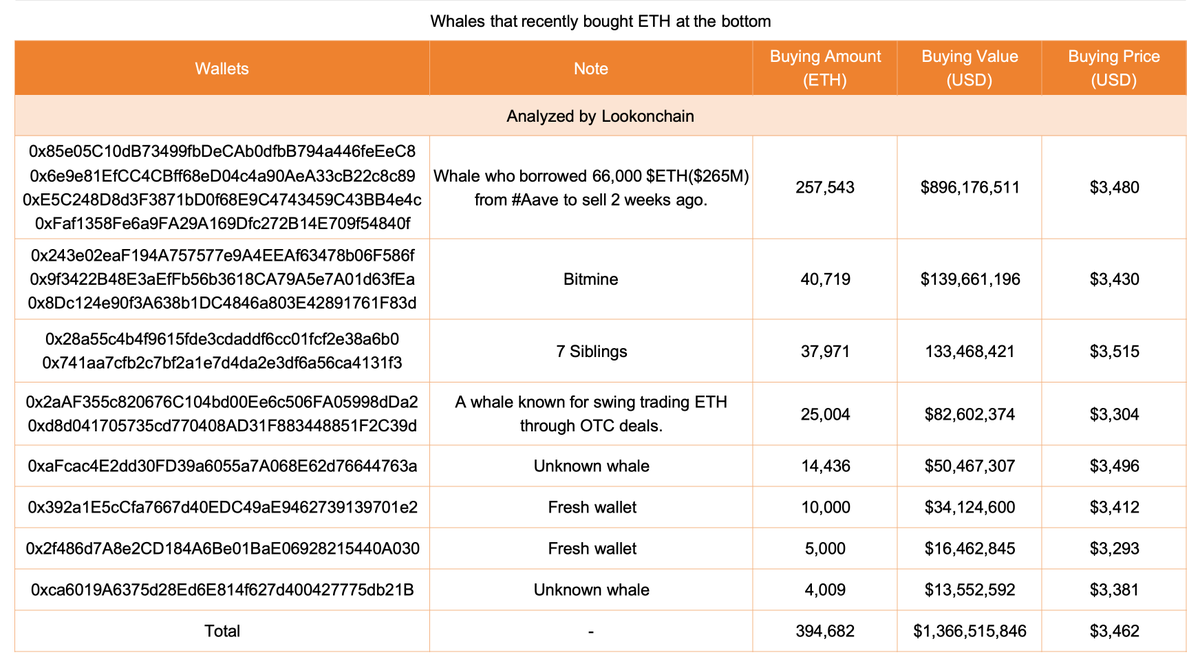

According to Lookonchain, Ethereum whales person collectively accumulated 394,682 ETH, worthy astir $1.37 billion, implicit the past 3 days. This question of large-scale buying comes arsenic prices consolidate beneath $3,400, signaling that deep-pocketed investors are positioning up of a imaginable marketplace rebound.

Ethereum Whale Activity Analyzed by Lookonchain | Source: Lookonchain

Ethereum Whale Activity Analyzed by Lookonchain | Source: LookonchainSuch assertive accumulation often indicates astute wealth assurance successful aboriginal upside potential. Historically, erstwhile whales bargain during periods of wide fearfulness and anemic terms action, it suggests they are anticipating an impulsive signifier — a crisp determination driven by renewed liquidity and marketplace sentiment recovery. The standard and velocity of this accumulation reenforce the thought that these entities expect Ethereum to outperform erstwhile selling unit fades.

This inclination besides aligns with broader marketplace behaviour seen aft large liquidations, wherever organization players thin to sorb proviso from shaken-out traders. If ETH holds supra its cardinal enactment astir $3,100, the operation of whale accumulation, improving on-chain inflows, and reduced leverage could enactment arsenic the catalyst for a breakout toward the $3,600–$3,800 range.

ETH Finds Support astatine 200-Day MA

Ethereum’s regular illustration shows that the plus has recovered impermanent alleviation aft Tuesday’s crisp selloff, which dragged prices beneath $3,100 for the archetypal clip successful weeks. The diminution brought ETH down to trial its 200-day moving mean (red line) — a cardinal semipermanent dynamic enactment that historically acts arsenic a springboard during corrective phases.

ETH consolidates astir $3,350 | Source: ETHUSDT illustration connected TradingView

ETH consolidates astir $3,350 | Source: ETHUSDT illustration connected TradingViewCurrently, Ethereum is trading astir $3,380, showing signs of a humble rebound. However, bulls look contiguous absorption adjacent the $3,500–$3,600 range, wherever the 50-day (blue) and 100-day (green) moving averages converge. This country has repeatedly rejected upward moves since precocious October and volition apt specify short-term direction.

A decisive interruption supra these averages could displacement momentum backmost successful favour of the bulls, opening the doorway for a betterment toward $3,800. On the downside, a nonaccomplishment to clasp supra the 200-day MA whitethorn trigger further weakness toward $3,000 oregon adjacent $2,850, wherever erstwhile request zones exist.

Featured representation from ChatGPT, illustration from TradingView.com

1 hour ago

1 hour ago

English (US)

English (US)