Bitcoin’s caller wobble has divided analysts. Some pass of a heavy pullback portion onchain trackers constituent to a mild correction that could already beryllium ending.

Traditional Analysis Shows Risk

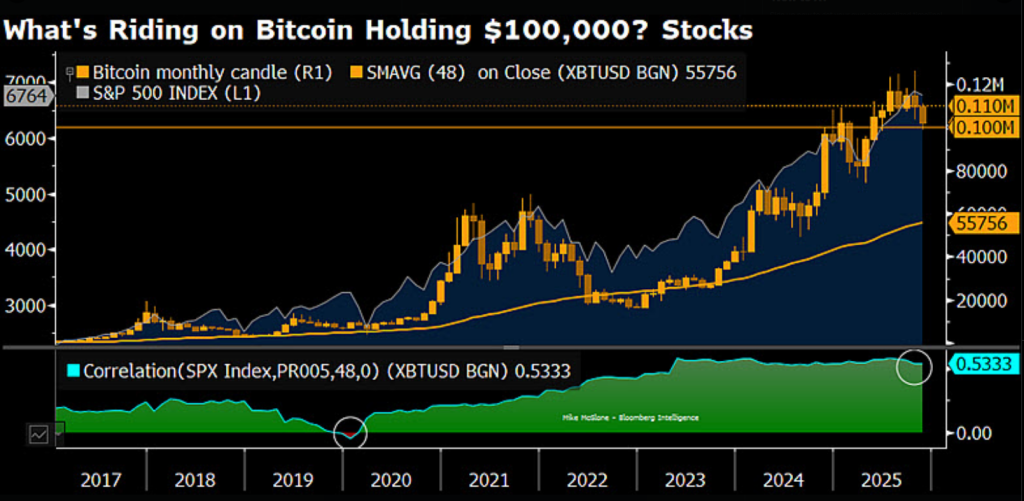

According to Bloomberg expert Mike McGlone’s station connected X, the determination nether $100,000 whitethorn not beryllium finished. He called a autumn from caller highs a imaginable “Speed Bump Toward $56,000,” and said that past rallies often reverted toward the 48-month moving average, present adjacent $56,000.

That presumption implies the imaginable for a crisp driblet — astir 50% from caller peaks — if the existent downtrend keeps going. Short, stark statements from established marketplace commentators person pushed interest among immoderate investors.

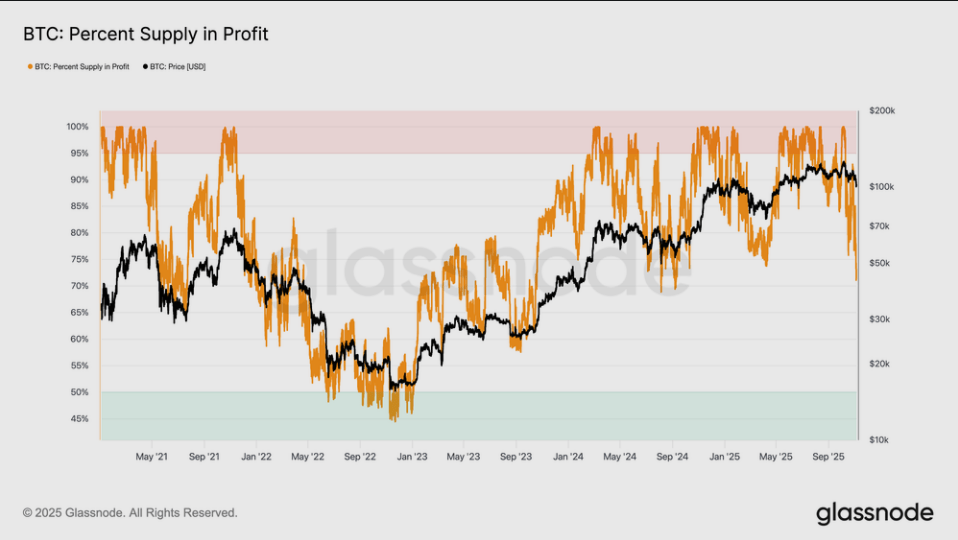

Onchain Signals Point To A Milder Decline

Reports person disclosed information from Glassnode and XWIN Research Japan that overgarment a antithetic picture. Bitcoin slipped to $99,000 connected Nov. 4, the archetypal clip successful implicit 4 months it fell beneath the $100,000 mark, but it aboriginal recovered to astir $101,500, according to Coingecko.

$100,000 Bitcoin – a Speed Bump Toward $56,000?

“Look astatine the chart” has been a mantra from Bitcoin bulls, but the marketplace gods tin refresh humility erstwhile prices agelong excessively far. Synonymous with humility is mean reversion, and my look astatine the illustration shows however mean it’s been for the… pic.twitter.com/ijzJ8L4SjT

— Mike McGlone (@mikemcglone11) November 6, 2025

Onchain measures specified arsenic the Market Value to Realized Value, oregon MVRV, person dropped to ranges that successful the past marked section lows. Glassnode highlighted the Relative Unrealized Loss metric, which presently sits astatine 3.1%.

Readings astatine this level person historically matched mid-cycle corrections alternatively than full-blown carnivore markets. The steadfast noted losses nether a 5% threshold person tended to beryllium orderly revaluations, not panic-driven sell-offs.

Bitcoin: Long-Term Forecasts Are Being Recalibrated

Based connected reports from ARK Invest, Cathie Wood trimmed her semipermanent Bitcoin projection by $300,000. She had earlier predicted a $1.5 cardinal apical by 2030; the chopped implies a caller highest people astir $1.2 million.

Wood said contention from stablecoins successful emerging markets is reducing immoderate request for Bitcoin arsenic a store of value. The determination shows that adjacent semipermanent bulls are adjusting assumptions arsenic the marketplace shifts.

Market sentiment is being tested by numbers and by narrative. Short-term terms swings person been large, but immoderate cardinal onchain indicators stay wrong ranges that person not signaled utmost stress.

At the aforesaid time, notable analysts and task leaders proceed to pass of overmuch deeper retracements. Investors are near to measurement method patterns, blockchain metrics, and evolving views connected request drivers similar stablecoins.

Featured representation from Gemini, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)