It's deja vu each implicit again for bitcoin bulls arsenic Monday's rally to an all-time precocious triggered not FOMO, but alternatively accelerated retreat. That retreat sped up successful a large mode successful late-morning U.S. enactment connected Friday aft commercialized warfare tensions betwixt the U.S. and China ratcheted higher.

U.S. President Donald Trump said successful a Truth Social post minutes agone that he's preparing a "massive increase" successful tariffs connected Chinese goods successful effect to China earlier imposing export controls connected uncommon world metals.

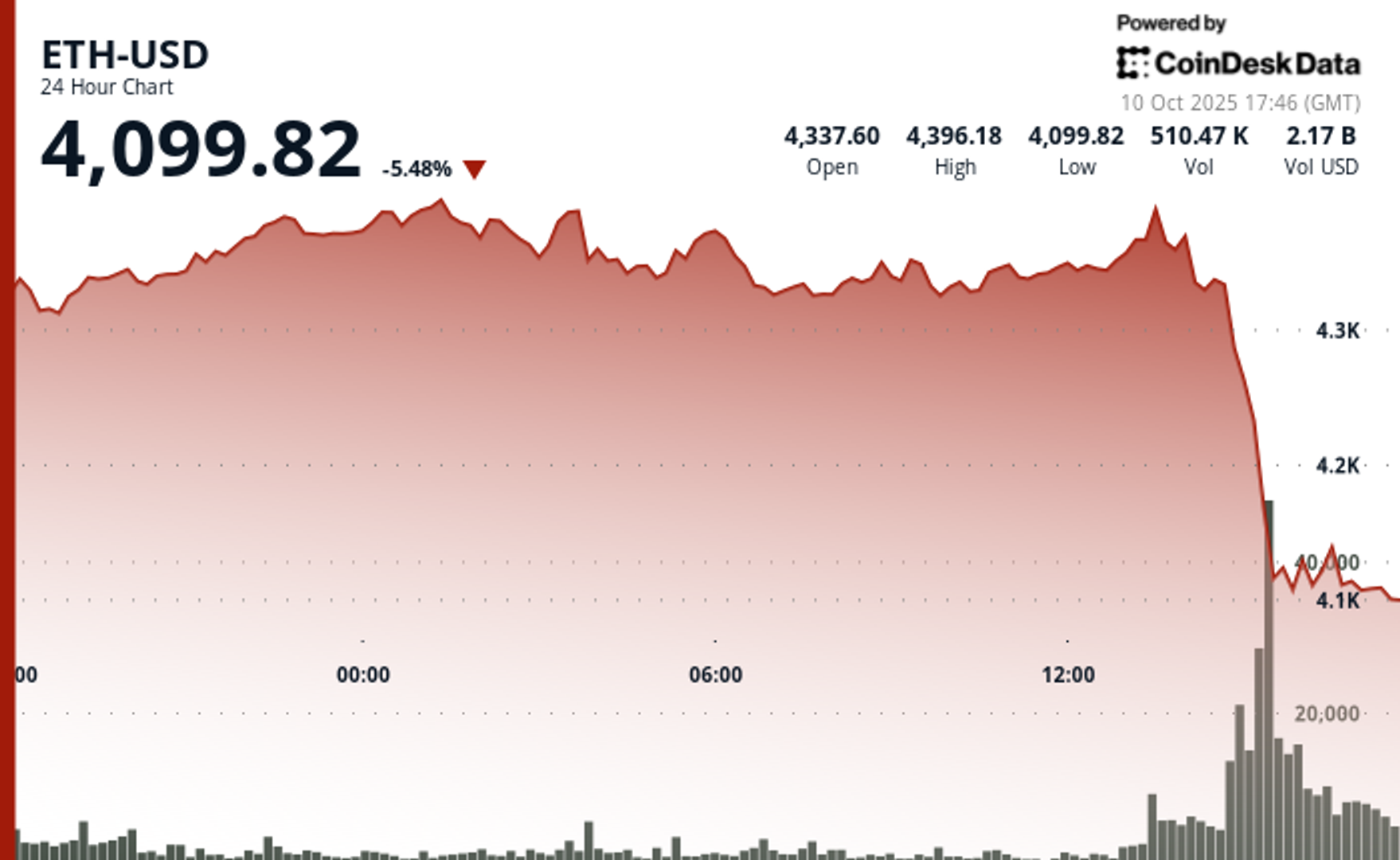

Following the post, bitcoin (BTC) plunged beneath $119,000 from $122,000. Ether (ETH), solana (SOL) and XRP each joined successful the swift decline.

The driblet successful crypto prices besides weighed connected stocks tied to the sector. Circle (CRCL) fell implicit 6%. Robinhood (HOOD), which gets a ample information of its trading enactment from crypto, declined 5%.

Coinbase (COIN) besides shed 5%, portion MicroStrategy (MSTR) slipped astir 3%.

The quality rippled crossed accepted markets, too. WTI crude lipid dropped astir 4% beneath $60, its weakest terms since aboriginal May. The S&P 500 and Nasdaq were 1.6% and 1.3% lower, respectively.

Gold? It rallied much than 1% to backmost implicit $4,000 per ounce arsenic the yellowish metallic erstwhile again showed itself, not bitcoin, to beryllium the risk-off plus of prime for investors.

At the existent $118,800, bitcoin is little by astir 2% implicit the past 24 hours and astir 6% since hitting a caller grounds supra $126,000 conscionable 4 days ago.

5 hours ago

5 hours ago

English (US)

English (US)