Cryptocurrency markets showed signs of consolidation successful the 2nd week of October, adjacent arsenic investors continued to stake connected different “Uptober” rally to caller highs.

Also successful the quality this week was the $11 cardinal Bitcoin (BTC) whale who returned aft a two-month hiatus to transportation different $360 cardinal successful BTC, signaling a imaginable rotation into the world’s second-largest cryptocurrency, with an further $5 cardinal near successful their wallet.

In different imaginable Uptober catalyst, the US Securities and Exchange Commission (SEC) received 31 crypto exchange-traded money (ETF) applications, with 21 of them filed during the archetypal 8 days of October.

However, the ongoing government shutdown whitethorn dilatory the regulatory effect to these applications, arsenic the SEC stated that it volition operate “under modified conditions” with an “extremely constricted fig of staff” until a backing measure is passed.

As Democrats and Republicans failed to scope an statement for the seventh clip connected Thursday, the authorities shutdown volition widen into adjacent week, arsenic the Senate volition permission municipality until Tuesday, CBS News reported.

$11 cardinal Bitcoin whale returns with $360 cardinal BTC transportation aft 2 months

A Bitcoin whale that held astir $11 cardinal successful BTC earlier rotating much than $5 cardinal of the stash into Ether (ETH) 2 months agone has returned to the cryptocurrency marketplace with different $360 cardinal Bitcoin transfer.

The whale code transferred $360 cardinal worthy of Bitcoin into decentralized concern (DeFi) protocol Hyperunit’s blistery wallet “bc1pd” connected Tuesday. This marked their archetypal transportation successful 2 months, according to blockchain information level Arkham.

The transportation whitethorn awesome different rotation into Ether, based connected the whale’s transaction patterns.

The $11 cardinal Bitcoin whale surfaced 2 months agone and rotated astir $5 billion worthy of BTC into Ether, concisely surpassing the second-largest firm treasury firm, Sharplink, successful presumption of full ETH holdings, Cointelegraph reported connected Sept. 1.

The whale inactive held implicit $5 cardinal worthy of Bitcoin successful their main wallet arsenic of Wednesday, signaling much imaginable selling unit for the world’s archetypal cryptocurrency.

The Bitcoin whale started rotating their funds into Ether connected Aug. 21 erstwhile they sold $2.59 cardinal of BTC for a $2.2 cardinal spot Ether and a $577 cardinal Ether perpetual agelong position.

DeFi TVL hits grounds $237 cardinal arsenic regular progressive wallets autumn 22% successful Q3: DappRadar

The decentralized exertion (DApp) manufacture ended the 3rd 4th of 2025 with mixed results, arsenic decentralized concern (DeFi) liquidity surged to a grounds precocious portion idiosyncratic enactment fell sharply, according to caller information from DappRadar.

In a study sent to Cointelegraph, DappRadar said that regular unsocial progressive wallets averaged 18.7 cardinal successful Q3, down 22.4% from the 2nd quarter. Meanwhile, DeFi protocols collectively locked successful $237 billion, the highest total worth locked (TVL) ever recorded successful the space.

The study highlighted an ongoing divergence betwixt organization superior flowing into blockchain-based fiscal platforms and the engagement of retail users with DApps. While DeFi TVL reached grounds levels of liquidity, wide enactment lagged, suggesting weaker retail participation.

“Looking astatine the full quarter, each class noted a driblet successful progressive wallets, but the interaction was mostly felt successful the Social and AI categories,” DappRadar wrote. AI-focused DApps mislaid implicit 1.7 cardinal users, going from a regular mean of 4.8 cardinal successful Q2 to 3.1 cardinal successful Q3, portion SocialFi DApps went from 3.8 cardinal to 1.5 cardinal successful Q3.

New Japan PM whitethorn boost crypto economy, “refine” blockchain regulations

Japan’s recently elected premier minister, Sanae Takaichi, whitethorn unfastened the doorway for much “refined” regulations to boost the country’s cryptocurrency economy, which whitethorn beryllium acceptable to look arsenic the adjacent planetary hub for crypto companies.

Takaichi was elected person of the Liberal Democratic Party (LDP) connected Saturday and is acceptable to go Japan’s archetypal pistillate prime minister erstwhile she takes bureau connected Oct. 15.

Experts accidental her enactment whitethorn present a much unfastened stance toward technological experimentation, including blockchain innovation, portion maintaining Japan’s rigorous regulatory standards.

Takaichi’s predetermination whitethorn person a “material interaction connected the cognition and governance of integer assets wrong the country,” according to Elisenda Fabrega, wide counsel astatine tokenization level Brickken.

In erstwhile nationalist positions, Takichi has expressed enactment for “technological sovereignty,” mentioning the “strategic improvement of integer infrastructure, including blockchain technology,” Fabrega told Cointelegraph. “From a ineligible perspective, this suggests that her medication whitethorn follow a posture that is not lone permissive but perchance proactive successful promoting the integer economy.”

Fabrega added that Takaichi’s governmental positioning whitethorn fortify “Japan’s committedness to ineligible certainty successful the crypto space” and renew involvement successful the state arsenic an innovation-friendly crypto hub.

Japan’s authorities is recognizing blockchain arsenic a “ pillar of its integer translation strategy,” said Maarten Henskens, main operating serviceman astatine Startale Group and caput of Astar Foundation.

“A looser monetary outlook nether the caller enactment could prolong liquidity and substance capitalist appetite for alternate assets, including cryptocurrencies,” Henskens told Cointelegraph.

“At Startale and Astar, we spot this arsenic a beardown situation to proceed advancing Japan’s Web3 ecosystem,” helium added.

Afghanistan net blackout “a wake-up call” for blockchain decentralization

Afghanistan’s caller nationwide net outage underscored a captious weakness successful the world’s starring decentralized blockchains: their dependence connected centralized net providers that stay susceptible to authorities involution and method failures.

The state suffered a near-total net shutdown that lasted astir 48 hours earlier connectivity was restored connected Oct. 1, Reuters reported. The disruption was reportedly ordered by the Taliban administration, though officials aboriginal blamed “technical issues” involving fibre optic cables.

While blockchains purpose to supply radical with a public, censorship-resistant web for worth transfers, their reliance connected centralized net providers makes these usage cases challenging during outages.

“The Afghanistan blackout is not conscionable a determination connectivity crisis: It is simply a wake-up call,” said Michail Angelov, co-founder of decentralized WiFi level Roam Network. “When connectivity is monopolized by a fistful of centralized providers, the committedness of blockchain tin illness overnight,” helium added.

The nationwide net and mobile information services outage affected astir 13 cardinal citizens, according to a September report from ABC News. This marked the archetypal nationwide net shutdown nether Taliban rule, pursuing determination restrictions imposed earlier successful September to curb online activities deemed “immoral.”

The Taliban denied the ban, blaming the net outage connected method issues, including fibre optic cablegram problems.

Iran has besides been facing net censorship issues since the commencement of its struggle with Israel.

The Iranian authorities unopen down net entree for 13 days successful June, but for home messaging apps, prompting Iranians to question retired hidden net proxy links for impermanent access, The Guardian reported connected June 25.

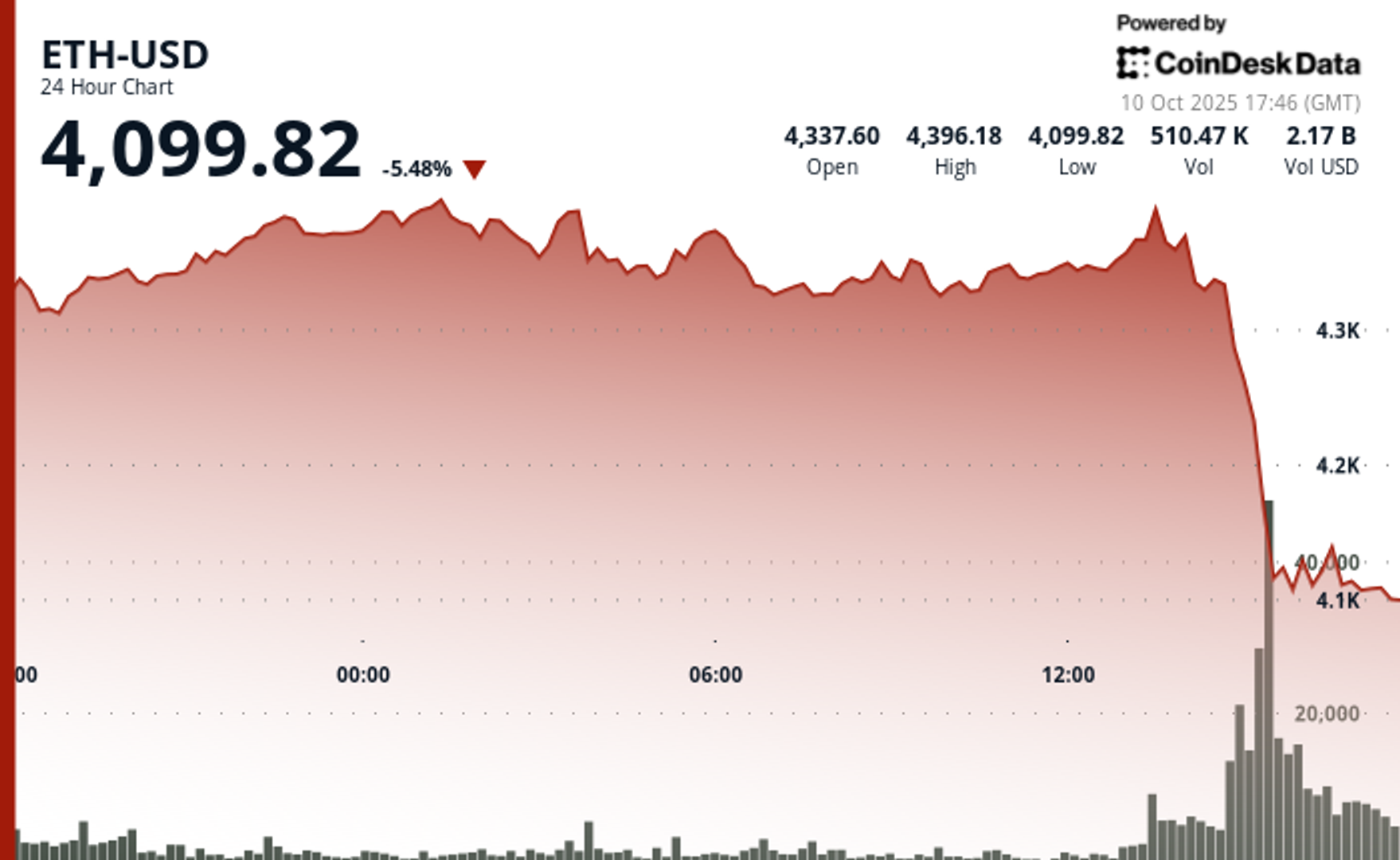

$10 cardinal successful Ethereum awaits exit arsenic validator withdrawals surge

Ethereum recorded its largest validator exit connected grounds this week, with much than 2.4 cardinal Ether worthy implicit $10 cardinal awaiting withdrawal from its proof-of-stake network, but organization participants are replacing overmuch of that successful the validator introduction queue.

Ethereum’s exit queue surpassed 2.4 cardinal Ether worthy implicit $10 cardinal connected Wednesday. The spike successful exits extended the validator queue clip to much than 41 days and 21 hours, according to blockchain information from ValidatorQueue.com.

Validators are liable for adding caller blocks and verifying transactions connected the Ethereum network, playing a captious relation successful its operation.

“Large withdrawals ever mean determination is simply a accidental that tokens tin beryllium sold, but it does not needfully adjacent income of tokens,” said Nicolai Sondergaard, probe expert astatine crypto quality level Nansen, adding that “there is nary request for interest from this alone.”

While the $10 cardinal withdrawal queue is significant, validators are astir apt “consolidating from 32 ETH to 2,048 ETH stakes for operational efficiency,” according to Marcin Kazmierczak, co-founder of blockchain oracle institution RedStone.

This includes increasing inflows into liquid staking protocols for improved “capital efficiency,” helium told Cointelegraph, adding:

“A ample portion of withdrawn ETH is redeployed wrong DeFi, not sold.”“The 44+ time withdrawal hold clip creates a earthy throttle preventing proviso shocks,” helium explained, adding that Ether’s regular measurement of $50 cardinal is inactive 5 times larger than the validator queue.

DeFi marketplace overview

According to information from Cointelegraph Markets Pro and TradingView, astir of the 100 largest cryptocurrencies by marketplace capitalization ended the week successful the green.

The privacy-preserving Zcash (ZEC) token roseate implicit 68% to go the week’s biggest gainer successful the apical 100 for the 2nd week successful a row. The Mantle (MNT) token roseate implicit 18% successful the week’s second-best performance.

Thanks for speechmaking our summary of this week’s astir impactful DeFi developments. Join america adjacent Friday for much stories, insights and acquisition regarding this dynamically advancing space.

3 hours ago

3 hours ago

English (US)

English (US)