Ethereum is trading astatine captious levels aft a play of heightened volatility that has near traders and investors connected edge. The terms has been swinging betwixt cardinal absorption and enactment zones, reflecting a marketplace torn betwixt optimism for different limb higher and caution implicit imaginable short-term corrections. While sentiment remains divided, on-chain information paints a much assured representation down the scenes.

According to caller reports, ample holders and institutions proceed to accumulate ETH, reinforcing the thought that the existent marketplace uncertainty whitethorn beryllium viewed by galore arsenic an accidental alternatively than a threat. At the aforesaid time, staking enactment remains consistently strong, signaling semipermanent condemnation among Ethereum’s astir committed participants. The ongoing emergence successful staked ETH highlights assurance successful the network’s security, output potential, and relation arsenic a instauration for decentralized finance.

As Ethereum hovers adjacent decisive terms levels, the marketplace appears to beryllium preparing for a breakout successful either direction. Whether the adjacent determination favors bulls oregon bears, 1 happening is wide — Ethereum’s fundamentals stay resilient, and the persistent accumulation by large players could service arsenic a almighty anchor for the adjacent large inclination erstwhile marketplace sentiment aligns.

Grayscale Stakes Ethereum: A Strong Signal Of Confidence

According to Lookonchain, Grayscale (ETHE and ETH ETF) has staked an further 857,600 ETH, worthy astir $3.83 billion, erstwhile again signaling large organization condemnation successful Ethereum’s semipermanent potential. This determination underscores the increasing alignment betwixt accepted concern and blockchain infrastructure, arsenic large-scale players proceed to clasp Ethereum’s proof-of-stake exemplary not conscionable arsenic an investment, but arsenic a yield-generating and network-participating strategy.

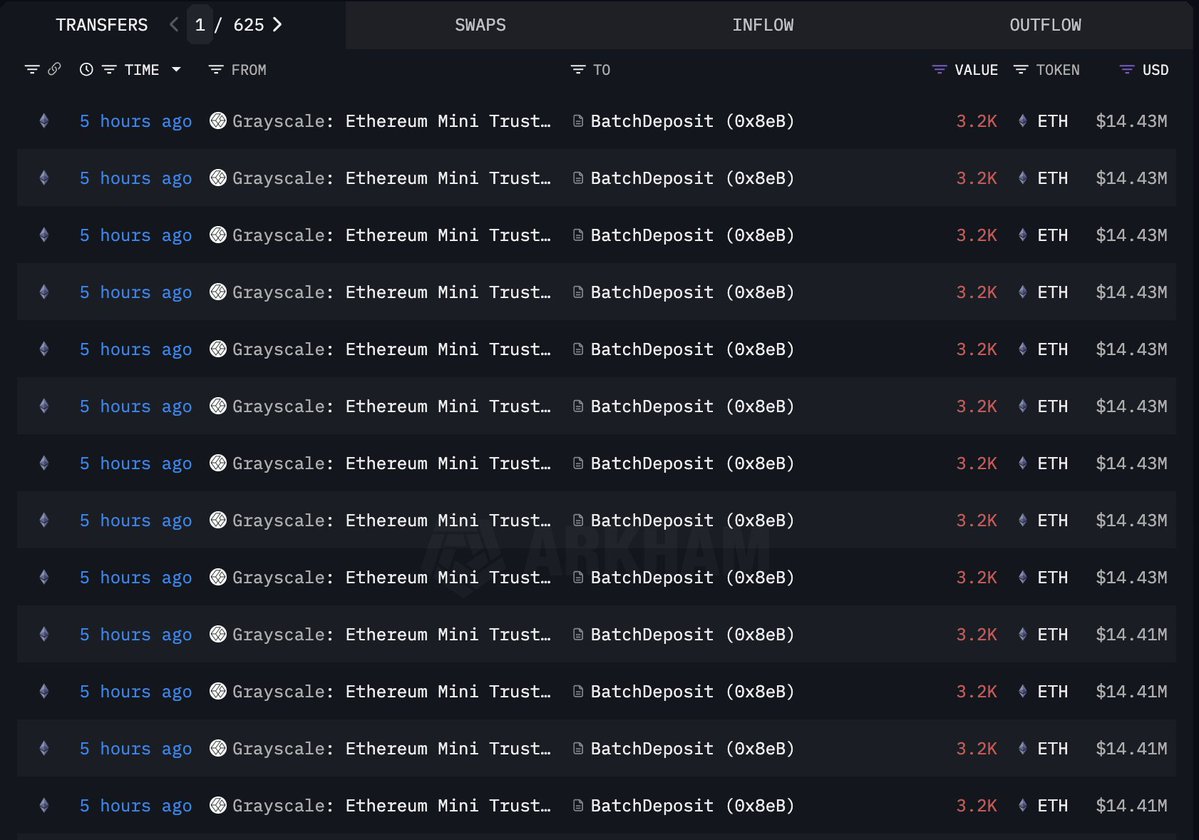

Grayscale Ethereum Transactions Onchain | Source: Lookonchain

Grayscale Ethereum Transactions Onchain | Source: LookonchainThis monolithic staking cognition carries respective implications for the market. First, it efficaciously reduces circulating supply, since staked ETH is locked and cannot beryllium easy sold. This dynamic strengthens Ethereum’s deflationary pressure, particularly successful a discourse wherever web enactment and state usage stay elevated. At the aforesaid time, the standard of this determination reveals expanding organization information successful Ethereum’s ecosystem, suggesting that the plus is being viewed little arsenic a speculative instrumentality and much arsenic integer infrastructure — a cardinal constituent of the emerging tokenized economy.

From a marketplace perspective, this determination comes during a play of volatility and consolidation, wherever Ethereum’s terms enactment has struggled to found a wide direction. However, specified sustained organization staking serves arsenic a stabilizing force, reflecting assurance that the asset’s intrinsic worth continues to turn careless of short-term fluctuations.

In essence, Grayscale’s renewed staking propulsion reinforces Ethereum’s presumption arsenic the organization cornerstone of DeFi and Web3, adjacent arsenic marketplace sentiment remains mixed. If accumulation trends persist and web fundamentals clasp strong, Ethereum could beryllium preparing for a important breakout successful the coming weeks — supported not by retail speculation, but by deep, semipermanent superior positioning itself for the adjacent signifier of the cycle.

Price Action Detail: Bulls Defend Key Support Levels

Ethereum is presently trading astir $4,340, showing signs of stabilization aft a volatile league that saw a crisp rejection adjacent $4,700. The 4-hour illustration reveals that ETH has retraced toward its 200-period moving average, a captious dynamic enactment portion that often acts arsenic a pivot constituent for marketplace direction. Despite the caller dip of astir 2%, the broader operation remains constructive, arsenic agelong arsenic bulls tin support the terms supra the $4,300–$4,250 range.

ETH sideways consolidation continues | Source: ETHUSDT illustration connected TradingView

ETH sideways consolidation continues | Source: ETHUSDT illustration connected TradingViewThis country coincides with a cardinal confluence of the 50-, 100-, and 200-period moving averages, suggesting that the existent pullback could simply beryllium a method retest earlier different effort to reclaim the $4,500 zone. A confirmed bounce from this portion could acceptable the signifier for Ethereum to regain momentum and perchance retest the $4,700–$4,800 absorption scope successful the coming days.

However, if selling unit intensifies and ETH closes beneath $4,200, the marketplace could spot an extended correction toward $4,000 oregon adjacent $3,850, wherever erstwhile consolidation occurred. Overall, portion volatility persists, Ethereum continues to show resilience supported by beardown on-chain accumulation and organization staking — factors that reenforce the broader bullish communicative contempt short-term marketplace fluctuations.

Featured representation from ChatGPT, illustration from TradingView.com

8 hours ago

8 hours ago

English (US)

English (US)