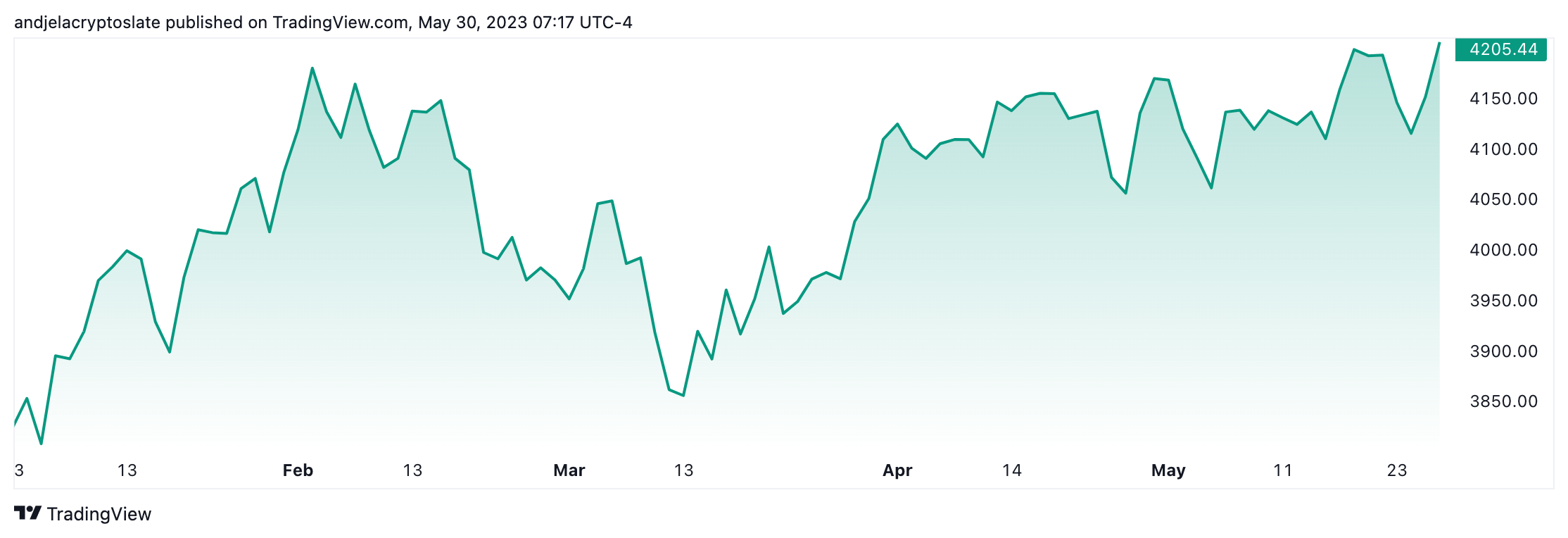

The S&P 500 index, a cardinal barometer of U.S. equities, stood astatine 4,151 points astatine the closing doorbell connected May 29, showing a year-to-date (YTD) percent maturation of 9.15%, lasting astatine likelihood with the increasing ostentation and imaginable recession.

Graph showing the S&P 500 successful 2023 (Source: TradingView)

Graph showing the S&P 500 successful 2023 (Source: TradingView)In parallel, the crypto market, arsenic measured by its full marketplace capitalization, witnessed important oscillations, ending the period astatine a commanding $1.16 trillion. Despite periodic downturns, the wide YTD maturation complaint for the crypto marketplace stands astatine an awesome 45.3%.

Graph showing the full crypto marketplace headdress successful 2023 (Source: CoinMarketCap)

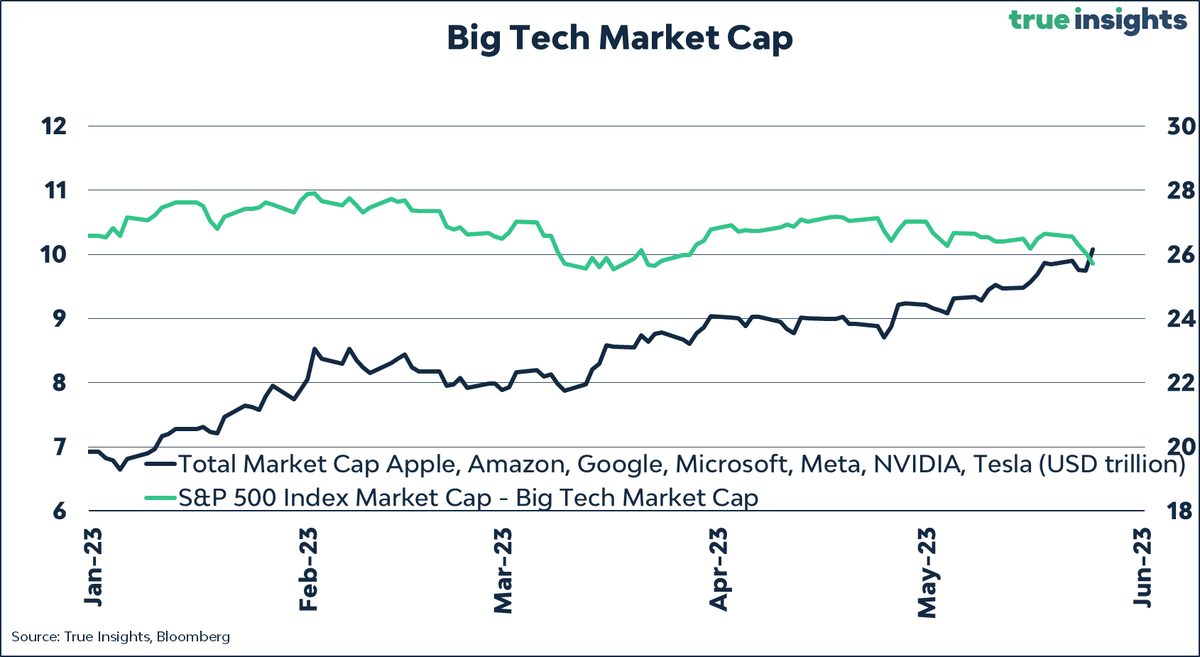

Graph showing the full crypto marketplace headdress successful 2023 (Source: CoinMarketCap)However, the S&P 500’s show doesn’t exemplify existent marketplace conditions. A person look reveals the disproportionate influence of tech behemoths Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla — which signifier a important information of the index’s full marketplace headdress — connected the index’s wide performance.

The combined marketplace capitalization of these stocks has accrued by $3.16 trillion, representing a 46% YTD maturation rate.

When these companies are removed from the YTD show calculation, the S&P 500 paints a antithetic picture, with the YTD percent maturation dropping to conscionable 3% and indicating a highly skewed dependency connected these entities for its robust performance.

Graph showing the combined marketplace capitalization for large tech stocks and the S&P 500 successful 2023 (Source: TrueInsights)

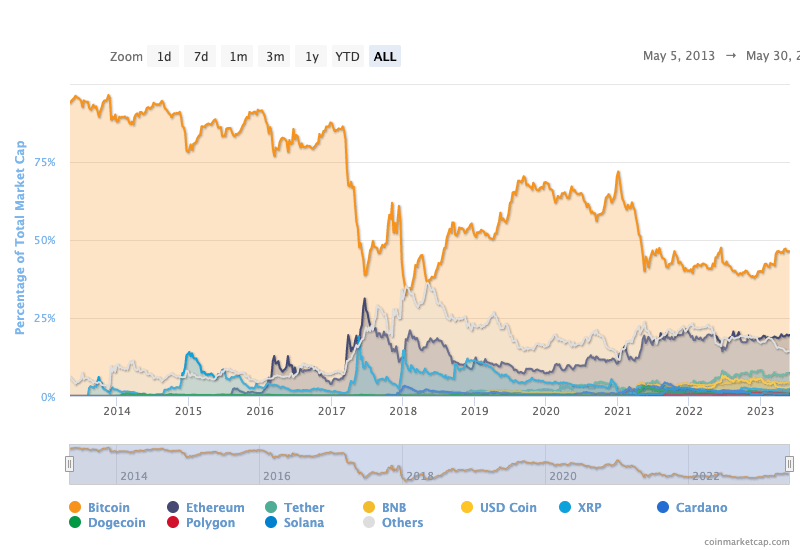

Graph showing the combined marketplace capitalization for large tech stocks and the S&P 500 successful 2023 (Source: TrueInsights)However, the crypto marketplace is besides dominated by a important player: Bitcoin. As of May 23, 2023, Bitcoin unsocial accounted for $542.7 cardinal of the full crypto marketplace cap. Its sheer size and power often overshadow the show of different cryptocurrencies successful the market.

In fact, Bitcoin’s dominance stands astatine astir 46% of the full crypto marketplace cap, reflecting its lasting arsenic the archetypal and astir wide adopted cryptocurrency. The fig importantly shapes the crypto market’s dynamics, illustrating Bitcoin’s resilience and increasing popularity.

Graph showing Bitcoin’s dominance implicit the crypto marketplace from 2014 to 2023 (source: CoinMarketCap)

Graph showing Bitcoin’s dominance implicit the crypto marketplace from 2014 to 2023 (source: CoinMarketCap)When we exclude Bitcoin’s marketplace headdress from the total, the remaining crypto marketplace headdress comes to $617.3 billion, indicating a little YTD maturation complaint of 29.1% for the remainder of the marketplace and highlighting the important interaction Bitcoin has connected the wide crypto marketplace growth.

Graph showing the marketplace capitalization of each cryptocurrencies minus Bitcoin successful 2023 (Source: CoinMarketCap)

Graph showing the marketplace capitalization of each cryptocurrencies minus Bitcoin successful 2023 (Source: CoinMarketCap)Comparing the performances of the S&P 500 and the crypto marketplace offers insightful parallels. Both are highly concentrated, with prime entities massively influencing their respective marketplace caps. This disproportionate power points to absorbing considerations regarding the diverseness and resilience of these markets.

However, the resilience shown by the crypto market, adjacent amidst a planetary crisis, underlines its imaginable arsenic a formidable contender against accepted markets.

As we proceed to traverse done 2023, the unfolding show of these markets volition unquestionably stay nether the lens, making for an intriguing reflection for marketplace watchers and participants.

The station Tech giants’ and Bitcoin’s dominance skew S&P 500, crypto marketplace maturation rates appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)