Analysis conducted by CoinShares highlighted that crypto markets saw a 5th consecutive week of outflows with the existent week totaling a $32.1 cardinal loss.

CoinShares sourced information from integer plus concern providers, specified arsenic Grayscale and ProShares, which cater to organization and accredited investors.

Head of Research astatine CoinShares, James Butterfill, commented this was owed to “poor sentiment focussed connected BTC.”

Crypto markets endure 5th consecutive play outflow

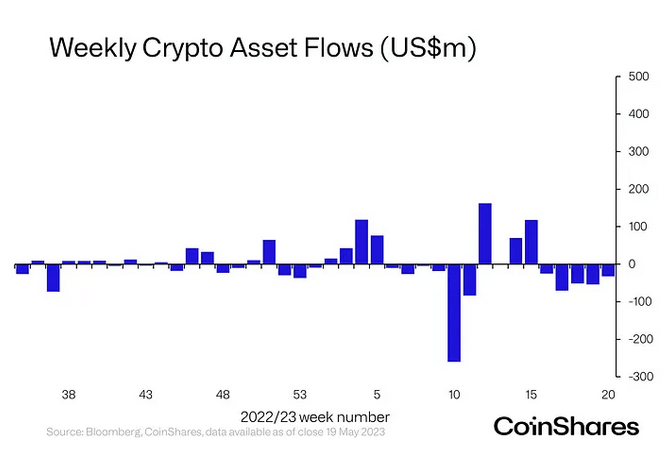

The illustration beneath shows the consecutive crypto plus outflows from week 16. The full outflows during this play amounted to $232 million.

Since the commencement of 2023, determination person been much outflow weeks than inflows, with week 10 (beginning Monday, March 6) representing the astir important play outflows this year, topping astir $270 cardinal during that period.

Early March was characterized by slope failures, which saw Silvergate, Signature Bank, and Silicon Valley Bank undone successful the existent high-interest complaint environment.

Source: CoinShares.com

Source: CoinShares.comAfter that period, the terms of Bitcoin recovered, bouncing from a debased of $22,390 to adjacent the week starting March 13 astatine $28,140, going connected to apical $31,000 a period later. Analysts attributed this to a displacement successful marketplace sentiment toward hard assets.

More recently, the narratives of U.S. regulatory hostility and uncertainty surrounding debates connected the U.S. indebtedness ceiling, person taken their toll connected crypto assets successful general.

Germany had the biggest outflows

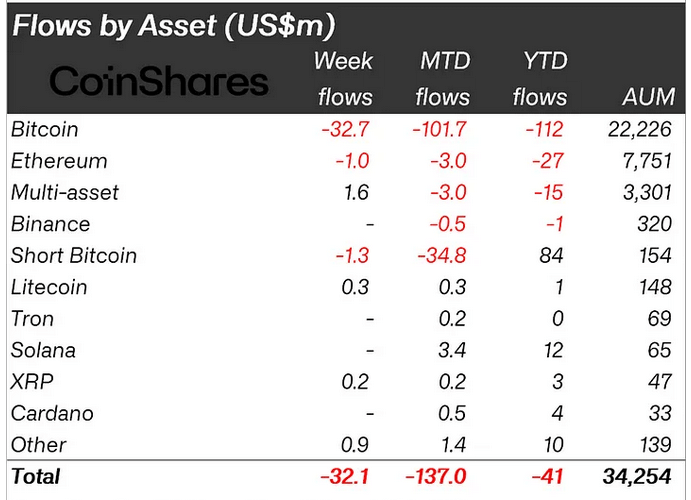

Flows by plus showed Bitcoin made up the astir important losses, coming successful astatine $32.7 cardinal during week 20. Ethereum and Short Bitcoin besides suffered losses – albeit astatine importantly little rates of $1 cardinal and $1.3 million, respectively.

Source: CoinShares.com

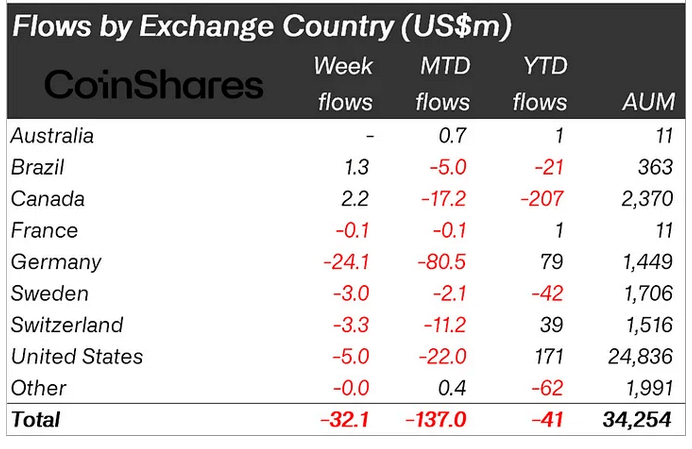

Source: CoinShares.comFurther investigation by state showed Germany was liable for the astir outflows, accounting for 75% of the play drain. The U.S. followed this astatine $5 million, past Switzerland astatine $3.3 million.

Source: CoinShares.com

Source: CoinShares.comCoinShares remarked that the outflow inclination was tied with volumes besides being materially down for some organization investors and spot markets.

“Volumes totaled US$900m for the week, 40% beneath this year’s average. Volumes for the broader marketplace connected trusted exchanges deed their lowest level since late-2020 astatine US$20bn for the week.”

The station Fifth consecutive play outflows constituent to crypto marketplace fragility appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)