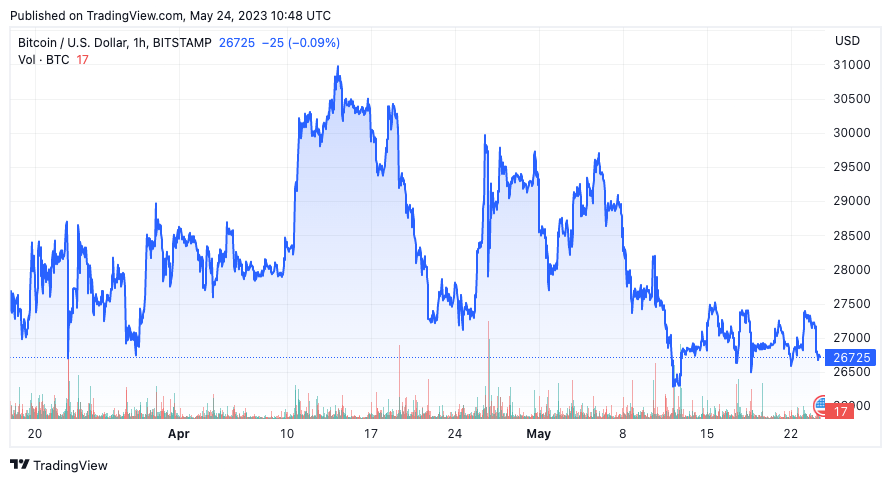

The Bitcoin marketplace has been calm for the amended portion of May, arsenic prices hover successful a comparatively unchangeable scope betwixt $26,000 and $28,000.

Graph showing Bitcoin’s terms from March 17 to May 24 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from March 17 to May 24 (Source: CryptoSlate BTC)However, beneath this seemingly tranquil surface, respective on-chain metrics bespeak imaginable shifts successful marketplace sentiment and capitalist behavior.

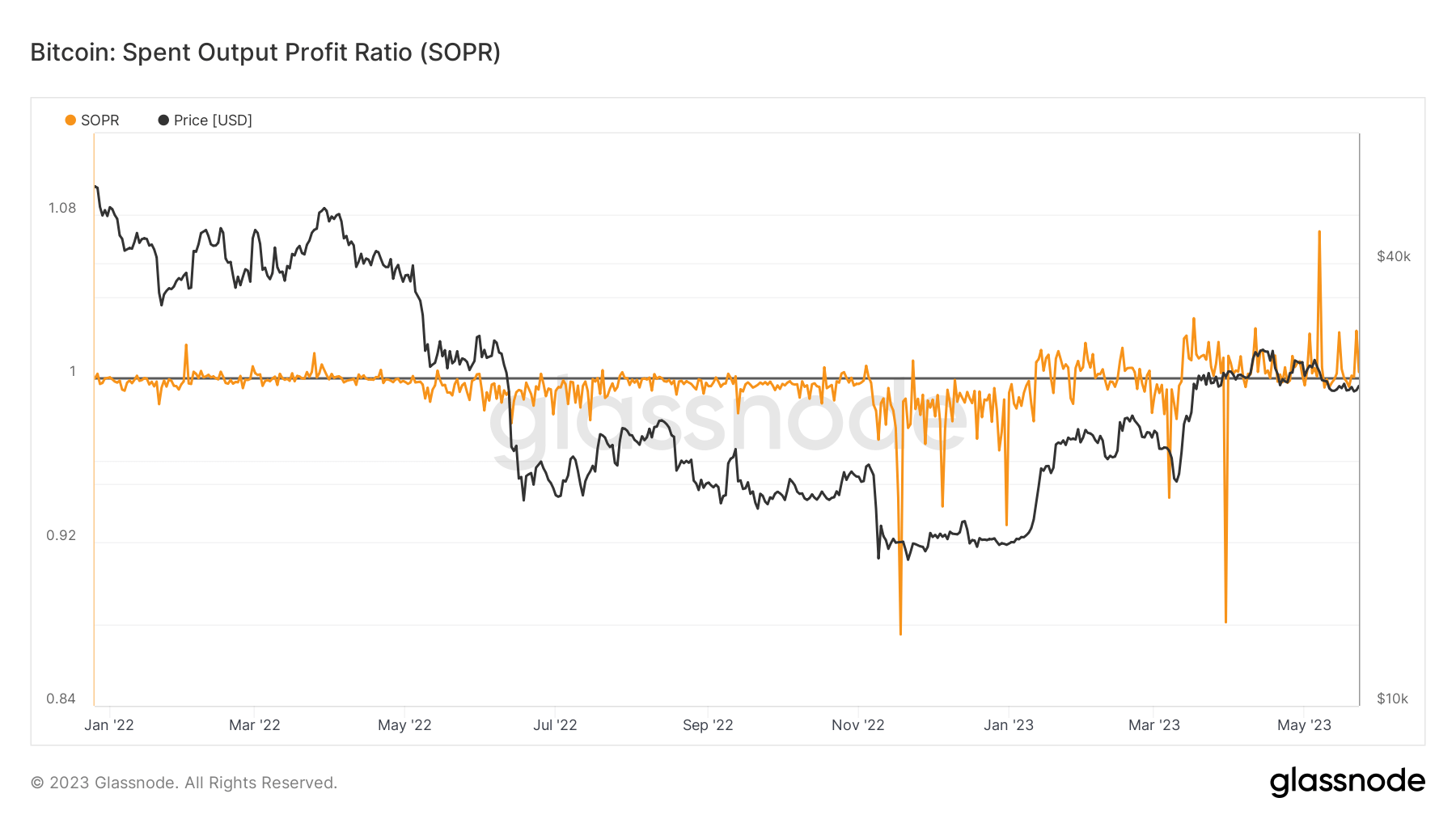

The Spent Output Profit Ratio (SOPR) is simply a invaluable gauge of profitability and losses that the marketplace has incurred. SOPR worth greater than 1 suggests that, connected average, the coins moved on-chain during that play are being sold astatine a profit. Conversely, a SOPR worth little than 1 implies that coins are, connected average, being sold astatine a loss.

SOPR is trending little and is gradually approaching the captious threshold of 1. While this whitethorn look similar a origin for concern, it is important to enactment that declining SOPR values whitethorn besides bespeak a marketplace signifier wherever investors are holding their assets, anticipating favorable marketplace conditions oregon higher prices successful the future.

Graph showing the Bitcoin SOPR ratio from January 2022 to May 2023 (Source: Glassnode)

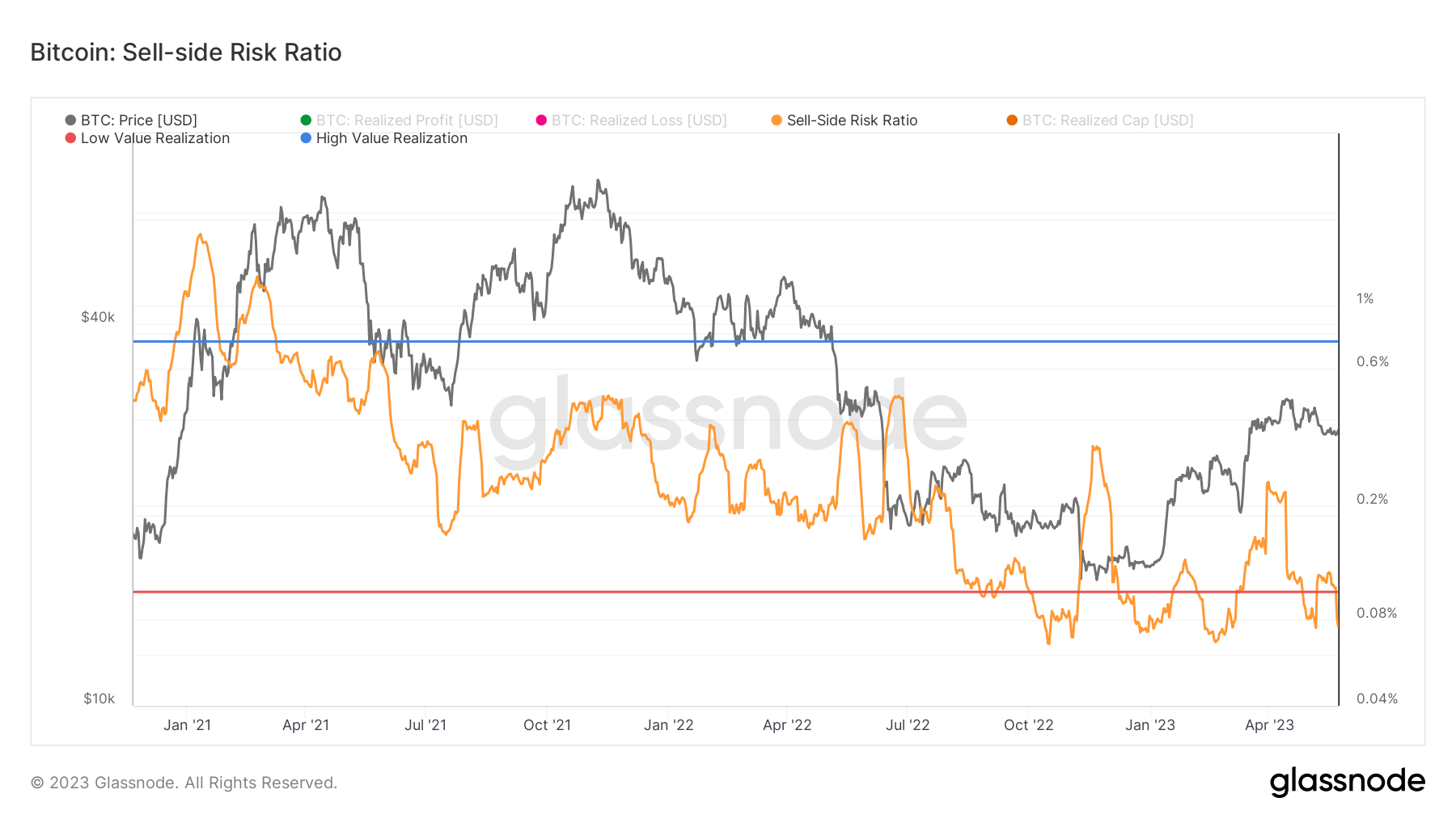

Graph showing the Bitcoin SOPR ratio from January 2022 to May 2023 (Source: Glassnode)The Sell-side Risk Ratio provides invaluable insights into the wide sell-side unit successful the market, comparing the full USD worth spent by investors on-chain to the full realized marketplace capitalization. When the ratio is low, it indicates that the aggregate sell-side hazard successful the marketplace is comparatively minimal. This suggests a play of low-value realization and reduced marketplace volatility, which is often associated with marketplace consolidation and sideways trends.

Graph showing Bitcoin’s Sell-side Risk Ratio from January 2021 to May 2023 (Source: Glassnode)

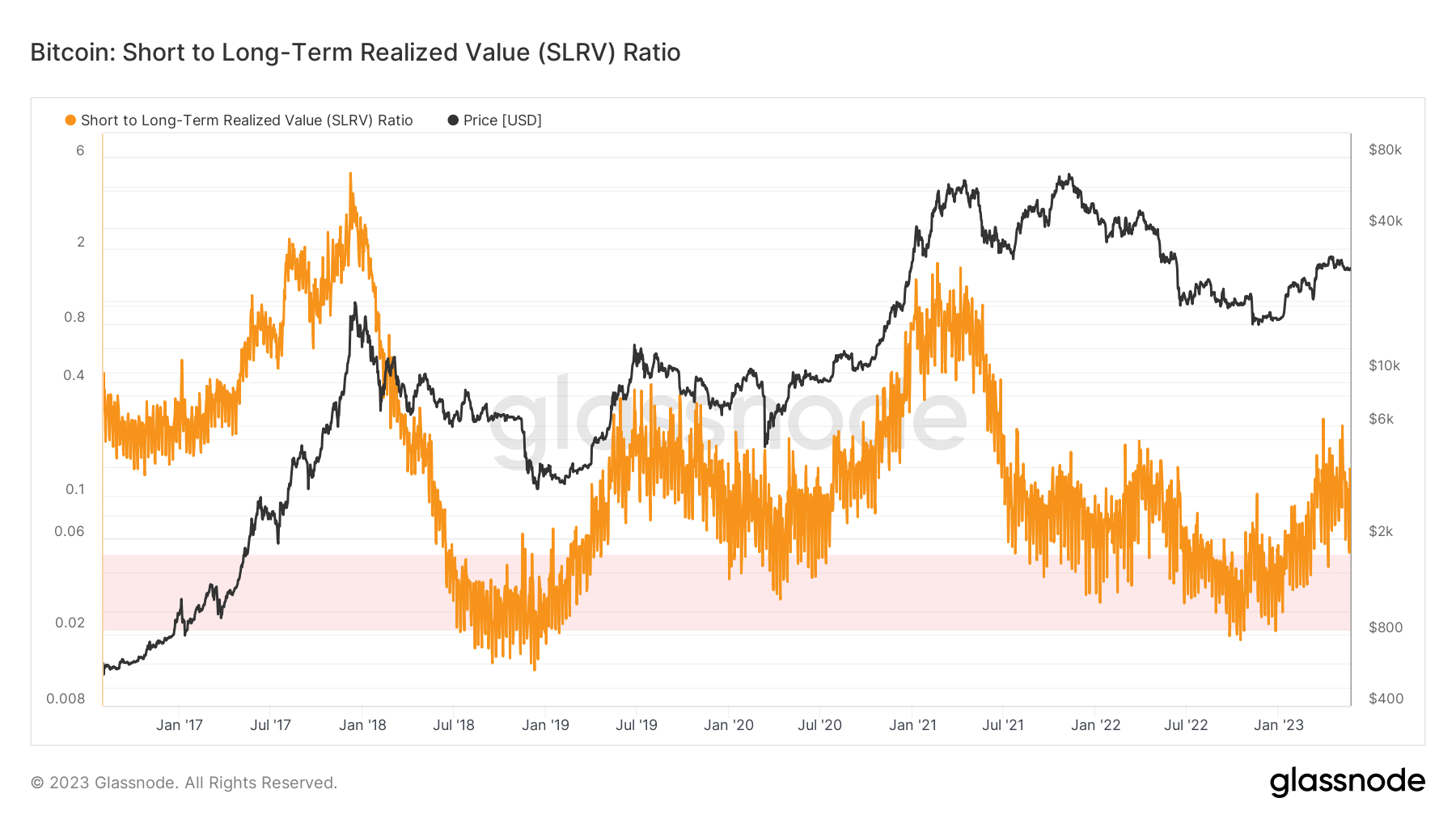

Graph showing Bitcoin’s Sell-side Risk Ratio from January 2021 to May 2023 (Source: Glassnode)The Short-to-Long-Term Realized Value Ratio assesses short-term transactional enactment versus semipermanent holding. A debased SLRV ratio suggests constricted short-term enactment and involvement successful Bitcoin oregon the emergence of a increasing basal of semipermanent holders. This tin bespeak an accumulation signifier and a comparatively debased sell-side hazard environment.

A CryptoSlate analysis earlier contiguous recovered that whales holding implicit 10,000 BTC accumulated for the amended portion of April and person entered different accumulation spree.

Since the opening of May, the SLRV Ratio has been exhibiting a downward trend. This is successful enactment with erstwhile findings and further confirms the broader marketplace inclination of debased sell-side risk, creating fertile crushed for accumulation.

Graph showing Bitcoin’s SLRV ratio from January 2017 to May 2023 (Source: Glassnode)

Graph showing Bitcoin’s SLRV ratio from January 2017 to May 2023 (Source: Glassnode)The existent authorities of the Bitcoin marketplace presents an uneventful facade, but a deeper investigation of on-chain metrics reveals subtle nuances that could signifier its aboriginal terms movements. The declining SOPR, debased Sell-side Risk Ratio, and SLRV ratio bespeak a marketplace situation characterized by reduced volatility, consolidation, and a imaginable accumulation phase.

The station Despite caller stillness, on-chain metrics bespeak imaginable volatility up for Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)