Bitcoin’s (BTC) little ascent supra $28,000 during the aboriginal trading hours of contiguous led to liquidations of astir $130 cardinal successful positions held connected the crypto market.

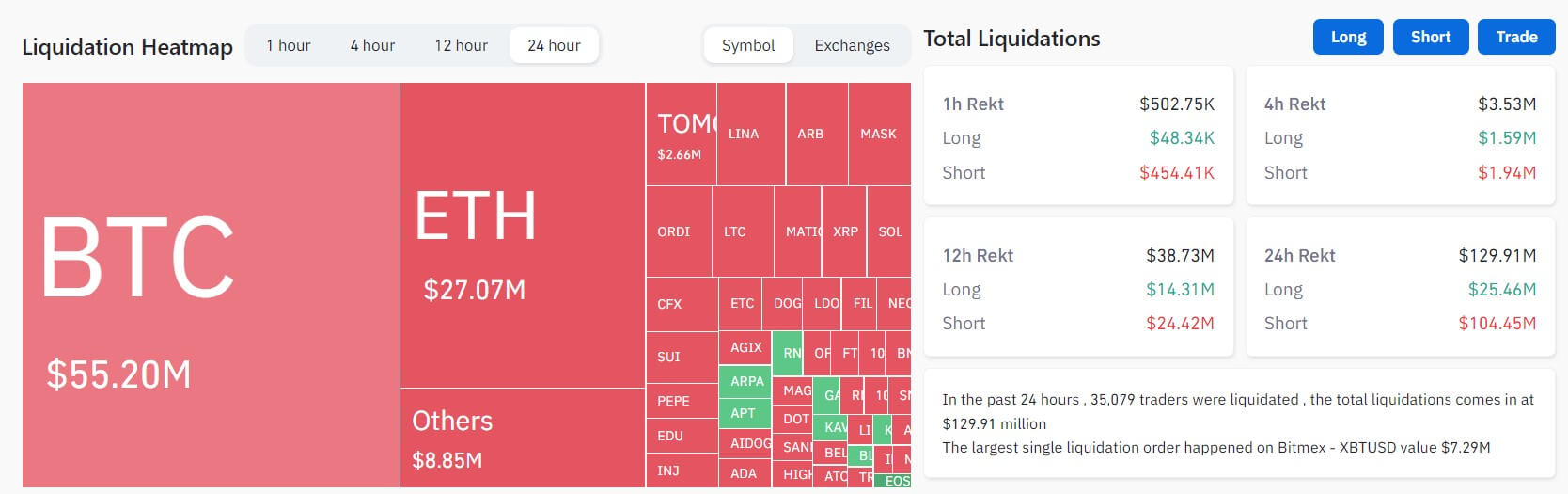

According to Coinglass data, the flagship integer plus saw $55 cardinal successful liquidations for traders who held positions successful it successful the past 24 hours.

Roughly $130 cardinal liquidated

The crypto marketplace saw $129.91 cardinal liquidated successful the past 24 hours, with much than 35,000 traders being liquidated.

Data from Coinglass showed that abbreviated traders mislaid $104.45 million, with Bitcoin and Ethereum accounting for implicit $68 cardinal of these losses.

Source: Coinglass

Source: CoinglassMeanwhile, agelong traders experienced $25.46 cardinal successful liquidations. The apical 2 integer assets were liable for much than 50% of these losses.

Other assets specified arsenic Dogecoin, BNB, Chainlink, XRP, Litecoin, and Solana experienced little than $2 cardinal successful liquidations, respectively.

Across exchanges, astir of the liquidations occurred connected OKX, Binance, and ByBit. These 3 exchanges accounted for implicit 70% of the wide liquidations, with 99% being abbreviated positions. Other exchanges similar Huobi, Deribit, and Bitmex besides recorded a sizeable magnitude of the full liquidations.

The astir important liquidation occurred connected Bitmex – XBTUSD, valued astatine $7.29 million.

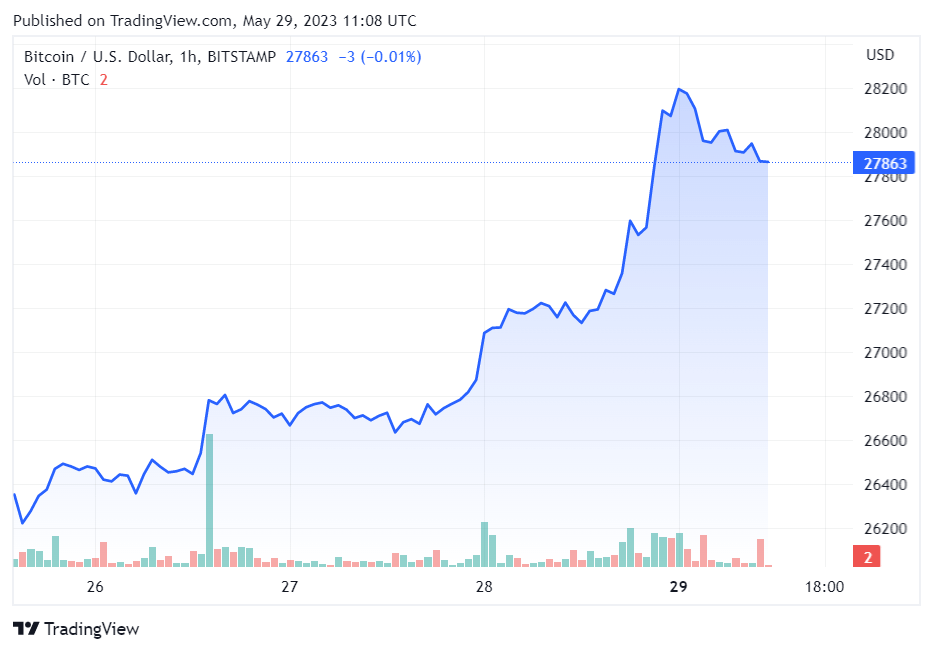

Bitcoin concisely climbs supra $28k

During the past 24 hours, BTC broke the $28,000 level barrier, peaking astatine $28,432, according to CryptoSlate’s data.

However, it has retraced to $27,960 arsenic of property time.

Source: Tradingview

Source: TradingviewEthereum (ETH) roseate 3%, portion BNB is up 2%. XRP, Cardano (ADA), Dogecoin (DOGE), and others besides saw respectable gains during the reporting period.

Some different starring cryptocurrencies, specified arsenic Ethereum (ETH), accrued by 3%, and BNB roseate by 2%

The rally was fueled by quality that the U.S. authorities reached an statement connected its indebtedness ceiling. On May 28, President Joe Biden described the statement arsenic a “compromise” and an “important measurement guardant that reduces spending portion protecting captious programs for moving radical and increasing the system for everyone.”

In a enactment shared with CryptoSlate, Matrixport’s main researcher Markus Thielen stated that the indebtedness ceiling statement means marketplace skeptics volition request caller reasons to support a bearish outlook. He added:

“Many investors were frightened astir the indebtedness ceiling and the imaginable default by the U.S. government, though the likelihood of specified an lawsuit is highly low. Now, they volition request to find thing other to beryllium bearish about, arsenic the marketplace apt rallies.”

The station Bitcoin’s leap supra $28k triggers $130 cardinal successful crypto liquidations appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)