Bitcoin’s illiquid proviso has reached a caller all-time precocious arsenic hodlers walk little than they accumulate.

The surge successful illiquid proviso is simply a testament to the resoluteness of Bitcoin investors successful a clip of precocious FIAT ostentation and macroeconomic concerns.

Source: Glassnode

Source: GlassnodeTraditionally ‘illiquid supply’ refers to the magnitude of Bitcoin held by entities and is not readily disposable for trading oregon selling.

Glassnode takes a much nuanced attack to find illiquid proviso and uses statistical methods to separate betwixt entities that are chiefly sending/selling oregon receiving/buying Bitcoin and however overmuch clip has passed since an entity has spent Bitcoins. It considers Bitcoin illiquid if it’s held by entities that historically walk oregon merchantability lone a tiny information of their received Bitcoin.

Illiquid proviso reached an unprecedented high, with 15.110 cardinal Bitcoin present held by specified entities. This fig represents a important summation from last month’s grounds of 15.056 million, accounting for astir 78% of the circulating supply.

What’s causing the reduced liquidity?

The summation successful Bitcoin’s illiquid proviso tin beryllium attributed to assorted factors. One of the astir important is the behaviour of short-term holders who person held Bitcoin for little than six months. This cohort presently holds implicit 20% of the supply, and their holdings person seen a notable uptick successful caller weeks. This inclination suggests that short-term holders, galore of whom purchased Bitcoin successful Q4 2022 and Q1 2023, are transitioning into semipermanent holders. As these individuals proceed to clasp onto their Bitcoin, the illiquid proviso is expected to emergence further.

The emergence successful Bitcoin’s illiquid proviso comes during heightened ostentation successful fiat currencies worldwide. As cardinal banks people wealth successful effect to economical pressures, the worth of accepted currencies is diluted. In contrast, Bitcoin, with its capped proviso and fixed emissions, is often regarded arsenic a hedge against inflation. Moreover, the summation successful illiquid proviso suggests that much individuals admit Bitcoin’s imaginable arsenic a store of worth and are choosing to clasp onto their assets alternatively than trading oregon selling them.

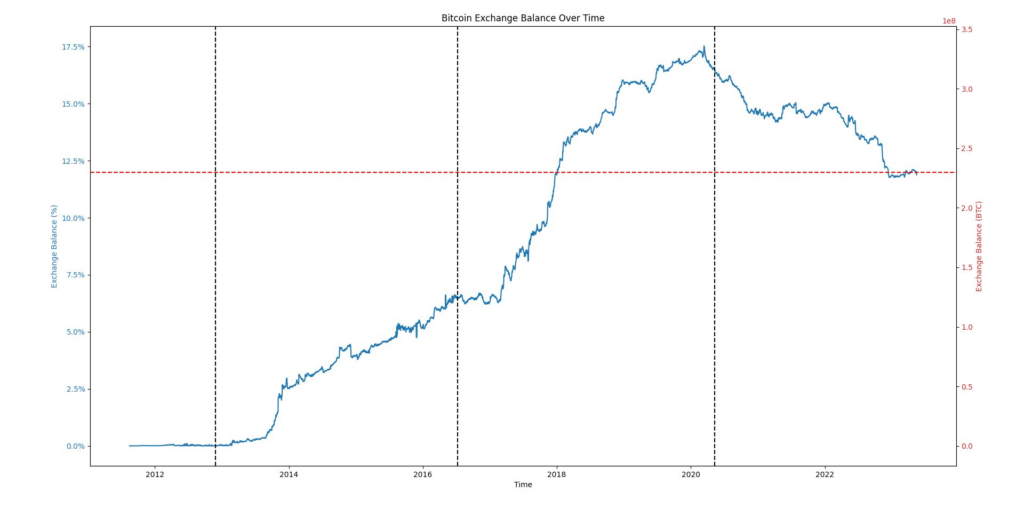

The thesis is besides somewhat supported by the correlation to a alteration successful Bitcoin held connected exchanges arsenic the illiquid proviso rises. At the commencement of 2020, exchanges held 17.5% of the Bitcoin supply. This fig has since fallen to astir 12%, indicating that much individuals are choosing to clasp their Bitcoin successful backstage wallets.

Bitcoin held connected exchanges.

Bitcoin held connected exchanges.The illness of large crypto exchanges successful 2022 further expedited Bitcoin leaving exchanges. However, it besides whitethorn person impacted the illiquid proviso to immoderate degree, arsenic liquidators inactive clasp billions of dollars worthy of crypto successful bankruptcy hearings for the failed exchanges.

The emergence successful Bitcoin’s illiquid proviso is simply a testament to the increasing designation of Bitcoin arsenic a hedge against ostentation and a store of value. As much individuals take to clasp onto their Bitcoin, the illiquid proviso volition rise. This inclination contrasts starkly with FIAT economies, arsenic reduced spending is linked to higher surviving costs alternatively than accumulating wealth. It is important to enactment that, with respective countries specified arsenic the UK undergoing a ‘cost of surviving crisis,’ spending connected crypto could besides alteration arsenic radical chopped backmost connected non-essentials.

The station Bitcoin illiquid proviso hits all-time precocious arsenic hodlers’ resoluteness fastens appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)