Binance’s marketplace stock of the Bitcoin spot marketplace continues trending downwards — suggesting the warfare connected crypto is taking its toll connected the world’s largest exchange.

Shifting Bitcoin spot measurement dynamics

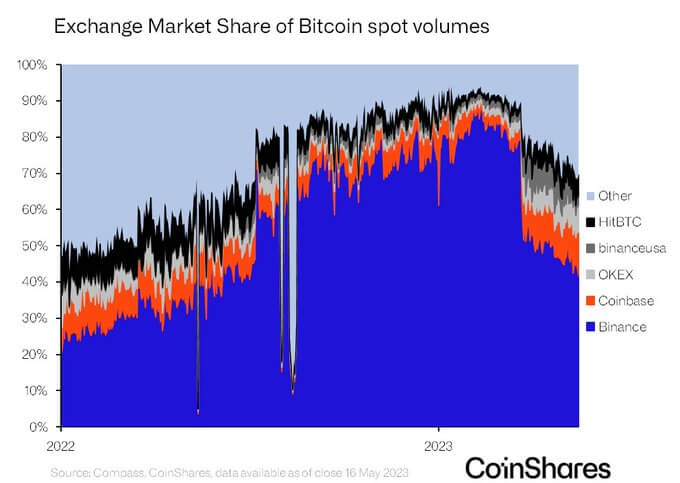

CoinShares’ Head of Research, James Butterfill, posted a illustration of Bitcoin spot measurement by centralized speech (CEX) marketplace share.

It showed 5 circumstantial CEXs and an further class labeled “Other” but did not specify the different CEXs that marque up this category.

Since 2022, Binance’s stock of the Bitcoin spot marketplace has been trending higher – from 20% to 85% by February 2023. From March onwards, a melodramatic fall-off saw a dip to 50% earlier trending down to astir 40% astatine present.

It was noted that, astatine the commencement of 2022, “Other” CEXes accounted for fractional of the Bitcoin spot marketplace — decreasing arsenic Binance’s dominance increased. However, “Other” CEXs are making a beardown comeback since March.

Coinbase and OKEX are emerging arsenic salient winners amid the shifting marketplace dynamics — reclaiming their erstwhile glories, arsenic seen successful aboriginal 2022.

Source: @jbutterfill connected Twitter.com

Source: @jbutterfill connected Twitter.comCFTC sues Binance

On March 27, the Commodities Futures Trading Commission (CFTC) filed against Binance, institution CEO Changepeng Zhao (CZ,) and Compliance Head Samuel Lim implicit allegations of violating commodities regulations.

Around this time, respective CEXs besides came nether regulatory actions, including Kraken — which, successful February, agreed to a $30 million colony with the Securities and Exchange Commission (SEC) implicit charges of failing to registry its staking work arsenic a information product.

Likewise, Coinbase received an SEC Wells Notice informing the institution of pending litigation successful March. At the time, Coinbase CEO Brian Armstrong said helium was assured that the institution is operating legally and “welcomes a ineligible process.”

Last period Coinbase sued the SEC to unit the bureau to stock its rule-making determination process. Chief Legal Officer Paul Grewal commented that the bureau had not fixed wide guidelines connected however the instrumentality applies to companies operating successful the crypto sector.

The frequence of enforcement actions — successful conjunction with unclear rules — led immoderate to reason that U.S. regulators are waging warfare connected crypto.

Last week, Binance announced it was leaving the Canadian market, saying it could nary longer run successful the region. Similarly, CZ said helium was looking astatine ways to trim his involvement successful Binance U.S. — suggesting intent to absorption connected different jurisdictions.

The station Binance’s stock of Bitcoin spot marketplace falls much than fractional since February highest of 85% appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)