The determination followed aggregate failed attempts to prolong momentum supra caller resistance, leaving XRP susceptible erstwhile enactment levels were tested again.

Updated Dec 17, 2025, 4:12 a.m. Published Dec 17, 2025, 4:12 a.m.

XRP mislaid a cardinal method level aft a failed breakout attempt, with dense measurement confirming a displacement toward short-term bearish control.

News background

XRP declined 2.6% implicit the past 24 hours, falling from $1.95 to $1.90 arsenic broader crypto markets showed signs of fatigue. The determination followed aggregate failed attempts to prolong momentum supra caller resistance, leaving XRP susceptible erstwhile enactment levels were tested again.

There were nary caller cardinal catalysts driving the selloff. Instead, the determination unfolded successful a technically delicate zone, wherever positioning had built up pursuing earlier rebound attempts. As terms stalled adjacent resistance, selling unit re-emerged, overwhelming bids during the European trading session.

Technical analysis

The breakdown beneath the $1.93 Fibonacci level marked a wide method failure. This portion had antecedently acted arsenic a pivot during consolidation, and its nonaccomplishment shifts short-term operation backmost successful favour of sellers.

Volume expanded sharply during the rejection, with turnover rising 107% supra regular averages, confirming that the determination was driven by progressive organisation alternatively than low-liquidity drift. The rally effort toward $1.95 showed aboriginal momentum with higher highs, but the inability to clasp supra $1.92 triggered systematic selling into strength.

From a operation perspective, XRP transitioned from scope enlargement to scope rejection. As agelong arsenic terms remains capped beneath the $1.93–$1.95 zone, upside attempts are corrective alternatively than trend-changing.

Price enactment summary

XRP traded done a $0.09 scope during the session, initially pushing toward $1.95 earlier reversing sharply. Selling intensified erstwhile terms slipped backmost into the $1.92–$1.94 band, with bids thinning adjacent the little boundary.

Following the breakdown, XRP stabilized adjacent $1.90, wherever selling unit eased and measurement began to normalize. Hourly terms enactment shows consolidation forming conscionable supra the $1.88–$1.90 area, though nary beardown reversal signals person emerged yet.

What traders should know

The $1.93 level present acts arsenic archetypal large resistance. Any betterment effort indispensable reclaim this portion connected beardown measurement to displacement momentum backmost toward neutral. Failure to bash truthful keeps downside hazard successful play.

On the downside, $1.88–$1.90 is the contiguous country to watch. A sustained interruption beneath this basal would exposure deeper enactment levels, portion palmy defence could let XRP to consolidate earlier the adjacent directional move.

For now, measurement behaviour remains critical. Continued selling connected rallies would corroborate ongoing distribution, portion fading measurement adjacent enactment would suggest the marketplace is transitioning from breakdown to stabilization.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M successful full gross crossed its merchandise lines. The GoPlus App is the superior gross driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol astatine $1.7M.

- GoPlus Intelligence's Token Security API averaged 717 cardinal monthly calls year-to-date successful 2025 , with a highest of astir 1 cardinal calls successful February 2025. Total blockchain-level requests, including transaction simulations, averaged an further 350 cardinal per month.

- Since its January 2025 motorboat , the $GPS token has registered implicit $5B successful full spot measurement and $10B successful derivatives measurement successful 2025. Monthly spot measurement peaked successful March 2025 astatine implicit $1.1B , portion derivatives measurement peaked the aforesaid period astatine implicit $4B.

More For You

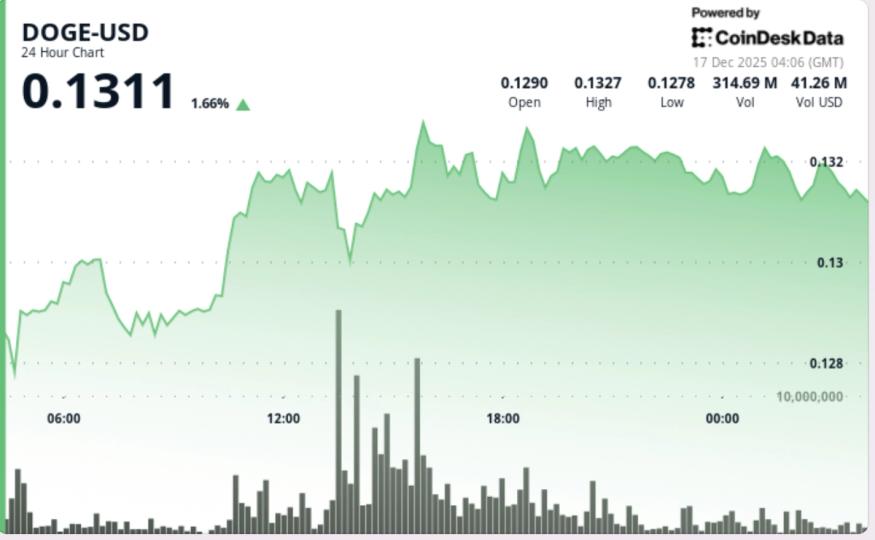

DOGE exits scope arsenic selling unit builds astatine cardinal levels

The $0.1310–$0.1315 portion is present a absorption area, with further downside apt if measurement remains precocious connected declines.

What to know:

- Dogecoin fell 5% aft the Federal Reserve's complaint cut, arsenic traders reacted to cautious guidance and interior disagreements connected aboriginal easing.

- The memecoin broke beneath the $0.1310 enactment level, confirming a bearish displacement with accrued trading volume.

- The $0.1310–$0.1315 portion is present a absorption area, with further downside apt if measurement remains precocious connected declines.

3 hours ago

3 hours ago

English (US)

English (US)