The $0.1310–$0.1315 portion is present a absorption area, with further downside apt if measurement remains precocious connected declines.

Updated Dec 17, 2025, 4:18 a.m. Published Dec 17, 2025, 4:18 a.m.

Dogecoin mislaid a cardinal method level pursuing the Federal Reserve’s latest complaint decision, with dense measurement confirming a short-term displacement toward bearish control.

News background

Dogecoin declined 5% during Tuesday’s league arsenic crypto markets reacted to the Federal Reserve’s 25-basis-point complaint chopped and cautious guardant guidance. While rates were reduced to a 3.5%–3.75% people range, policymakers signaled interior disagreement connected the gait of further easing, dampening hazard appetite crossed integer assets.

Meme coins underperformed during the broader pullback, with DOGE facing outsized unit arsenic traders reduced vulnerability pursuing caller consolidation adjacent resistance. The determination appeared driven much by positioning and macro sentiment than by token-specific fundamentals.

Technical analysis

DOGE broke decisively beneath the $0.1310 consolidation zone, a level that had acted arsenic short-term enactment during caller range-bound trading. Once this level failed, selling accelerated quickly, confirming a breakdown alternatively than a little liquidity sweep.

Trading measurement surged to 769.4 cardinal tokens during the decline, acold supra caller averages, validating the determination arsenic progressive organisation alternatively than low-liquidity drift. Price formed a little precocious adjacent $0.1324 earlier rolling over, reinforcing bearish operation connected the intraday timeframe.

From a structural standpoint, the nonaccomplishment of $0.1310 shifts DOGE backmost into a corrective phase, with rallies present apt to look selling unit unless that level is reclaimed convincingly.

Price enactment summary

DOGE traded from $0.1315 down to a league debased adjacent $0.1266 earlier stabilizing. Buyers stepped successful astatine little levels, producing a humble rebound backmost toward $0.1291 into the close.

The recovery, however, occurred connected fading measurement and near terms beneath cardinal moving averages. Overnight trading showed continued pressure, with DOGE slipping from $0.1320 to $0.1314 connected dependable but controlled activity, suggesting sellers stay progressive connected rallies.

What traders should know

The $0.1310–$0.1315 portion present acts arsenic contiguous resistance. As agelong arsenic DOGE remains beneath this area, upside moves are corrective alternatively than trend-confirming.

On the downside, $0.1290 is the archetypal level to watch. A sustained interruption beneath this level would apt reopen the $0.1266 enactment area. Conversely, holding supra $0.1290 could let DOGE to consolidate earlier the adjacent directional move.

Volume behaviour remains key. Continued precocious measurement connected downside moves would corroborate further distribution, portion declining measurement adjacent enactment would suggest selling unit is opening to exhaust.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M successful full gross crossed its merchandise lines. The GoPlus App is the superior gross driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol astatine $1.7M.

- GoPlus Intelligence's Token Security API averaged 717 cardinal monthly calls year-to-date successful 2025 , with a highest of astir 1 cardinal calls successful February 2025. Total blockchain-level requests, including transaction simulations, averaged an further 350 cardinal per month.

- Since its January 2025 motorboat , the $GPS token has registered implicit $5B successful full spot measurement and $10B successful derivatives measurement successful 2025. Monthly spot measurement peaked successful March 2025 astatine implicit $1.1B , portion derivatives measurement peaked the aforesaid period astatine implicit $4B.

More For You

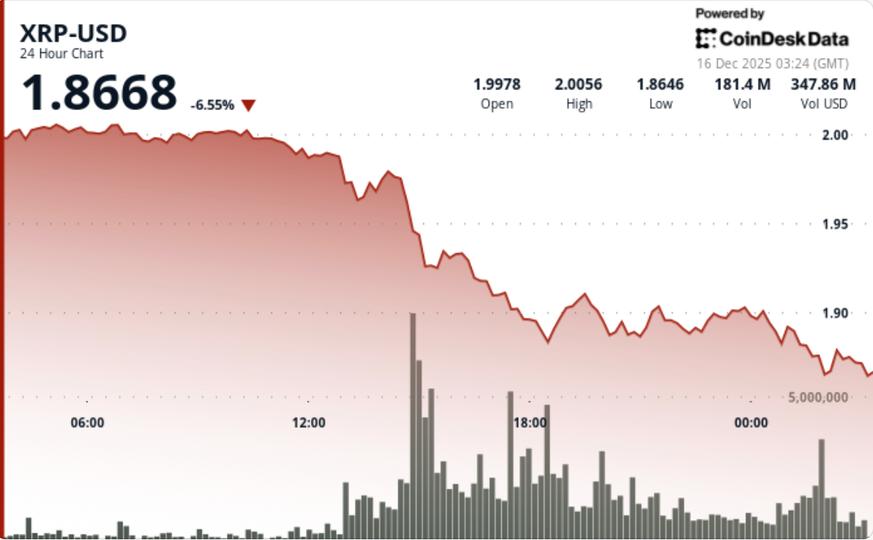

Why XRP’s driblet beneath $1.93 shifts short-term marketplace structure

The determination followed aggregate failed attempts to prolong momentum supra caller resistance, leaving XRP susceptible erstwhile enactment levels were tested again.

What to know:

- XRP fell 2.6% to $1.90 aft failing to interruption resistance, indicating short-term bearish control.

- The breakdown beneath the $1.93 Fibonacci level marked a method failure, with accrued measurement confirming progressive selling.

- Traders should ticker the $1.93 absorption and $1.88–$1.90 enactment levels for imaginable shifts successful momentum.

3 hours ago

3 hours ago

English (US)

English (US)