Despite billions flowing done centralised exchanges daily, determination remains nary accordant mode to measure their underlying operational quality. Surface-level metrics dominate, and transparency varies widely. CoinDesk’s Exchange Benchmark study addresses this spread by offering a structured, independently verified model to measure counterparty risk.

The April 2025 variation of the Exchange Benchmark study is our astir broad appraisal to date. It covers 89 exchanges crossed spot and derivatives markets and features refined scoring crossed each 8 categories, a much robust regulatory methodology and accrued integration of verified licensing information via VASPnet. This is complemented by greater engagement with owed diligence questionnaires (DDQs), enabling much transparent and accountable scoring.

The effect is simply a clearer favoritism betwixt exchanges operating astatine organization standards and those inactive falling abbreviated connected halfway hazard fundamentals.

Why benchmarking remains essential

As exchanges standard globally and regulatory scrutiny increases, meaningful owed diligence remains difficult. Self-reported figures, fragmented disclosures and varying licensing regimes tin disguise existent vulnerabilities. Without a standardised tool, exchanges tin look trustworthy, portion lacking basal interior controls oregon regulatory clarity.

The Exchange Benchmark study is the manufacture modular for assessing the hazard associated with integer plus exchanges. Each speech is evaluated connected 100+ metrics and assigned a people from AA to F based connected show crossed 8 categories: marketplace quality, security, regulation, KYC, transparency, information provision, speech enactment and antagonistic events. Grades BB and supra are considered top-tier and are eligible for inclusion successful CoinDesk’s CCIX notation rate.

This model is not astir popularity oregon scale; alternatively it acts arsenic a indispensable filter that allows regulators, institutions and counterparties to abstracted robust venues from those that simply look so.

Key findings from April 2025

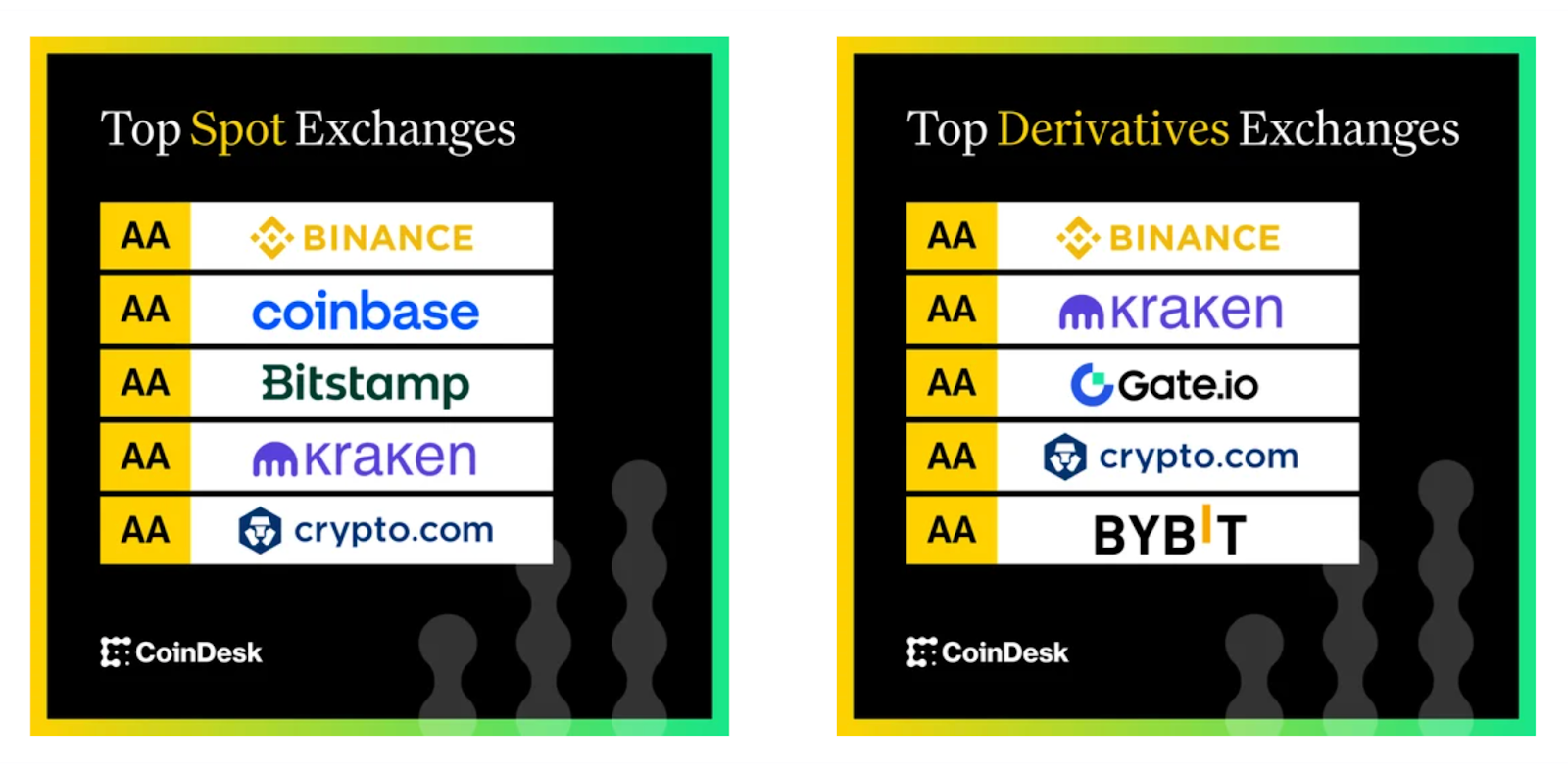

Six spot exchanges earned an AA rating: Binance, Coinbase, Bitstamp, Kraken, Crypto.com and Bullish. This is much than successful the erstwhile 2 editions and reflects continued strengthening astatine the apical extremity of the market.

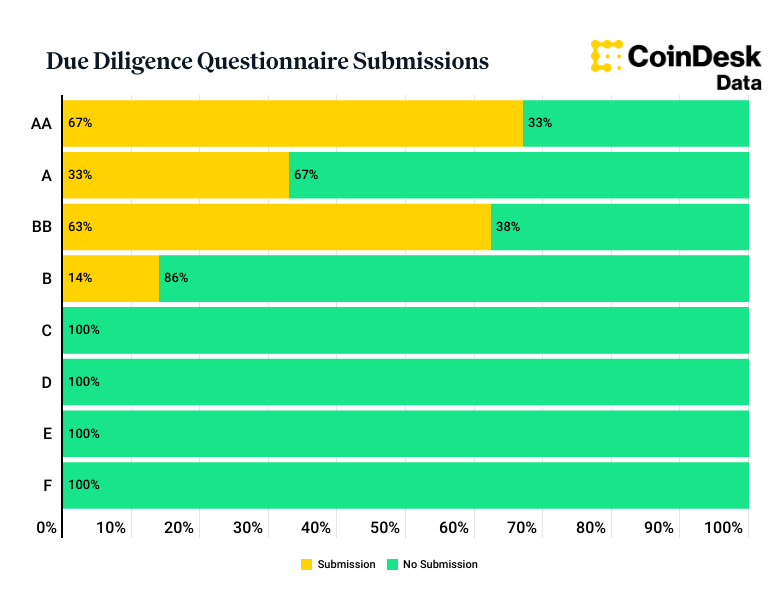

Nineteen exchanges were classified arsenic top-tier overall, up from 16 successful November 2024. Gate.io, Bitvavo and WhiteBIT were caller entrants this cycle, supported by verified submissions of owed diligence questionnaires. More than 60 percent of top-tier exchanges submitted DDQs, allowing for autarkic validation of cardinal inputs and improved people reliability.

DDQ engagement continues to correlate powerfully with higher scores and benchmark movement.

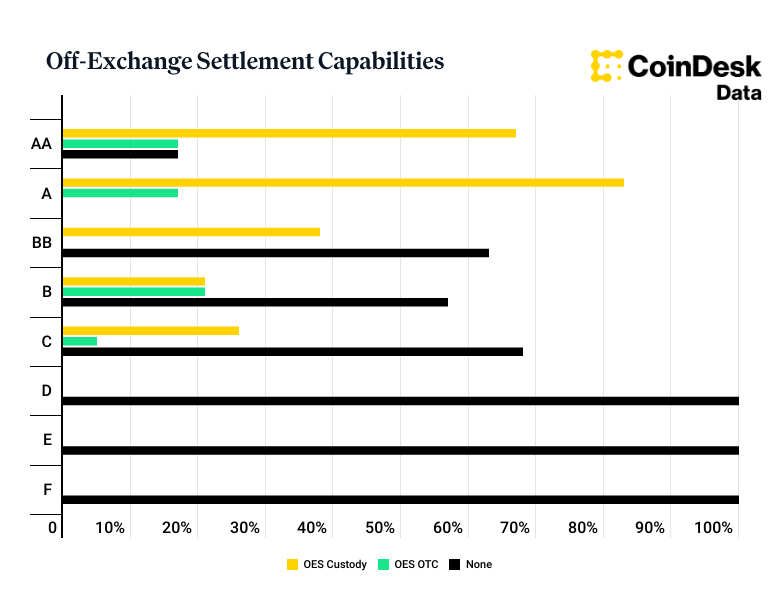

Support for off-exchange colony besides expanded. Sixty-seven percent of AA-rated exchanges present connection the enactment for assets to stay successful third-party custody portion inactive facilitating trading access. This operation reduces nonstop vulnerability to exchange-held wallets and improves alignment with organization hazard frameworks.

Volume and risk

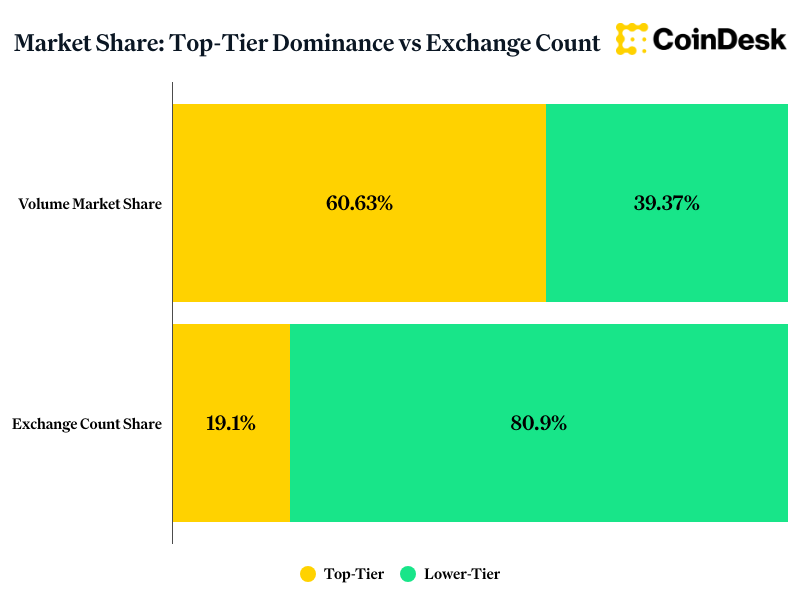

Top-tier exchanges accounted for implicit 60 percent of Q1 spot volume, contempt making up little than 20 percent of ranked venues. AA-rated exchanges unsocial contributed much than 40 percent of planetary activity. View the afloat rankings breakdown here.

The illustration supra illustrates however operational prime continues to correlate with measurement attraction astatine the apical of the market.

At the aforesaid time, respective high-volume exchanges stay successful the little tiers owed to gaps successful licensing, surveillance oregon interior transparency. The benchmark study highlights these disconnects and supports a much risk-aware attack to evaluating volume.

Looking ahead

The adjacent variation of the Exchange Benchmark volition beryllium published successful November 2025. Exchanges seeking to beryllium included indispensable implicit a owed diligence questionnaire and supply capable entree for information integration.

As scrutiny from regulators, counterparties and organization allocators increases, the outgo of mediocre infrastructure is lone rising. The benchmark study plays a captious relation successful mounting expectations and keeping the manufacture accountable — acting arsenic an indispensable instrumentality for navigating hazard successful an progressively analyzable and consequential portion of the crypto ecosystem.

Explore the afloat results and rankings successful the April 2025 Exchange Benchmark study here.

4 months ago

4 months ago

English (US)

English (US)