The U.S. Securities and Exchange Commission (SEC) sued Binance and Coinbase earlier this week, introducing sizeable volatility into the crypto market.

Bitcoin reacted powerfully to these events — connected June 5, it dropped from $27,300 to $25,300, a 7.3% decrease. This crisp dip incited interest among investors, arsenic the ineligible uncertainty raised the anticipation of a further diminution successful Bitcoin’s value.

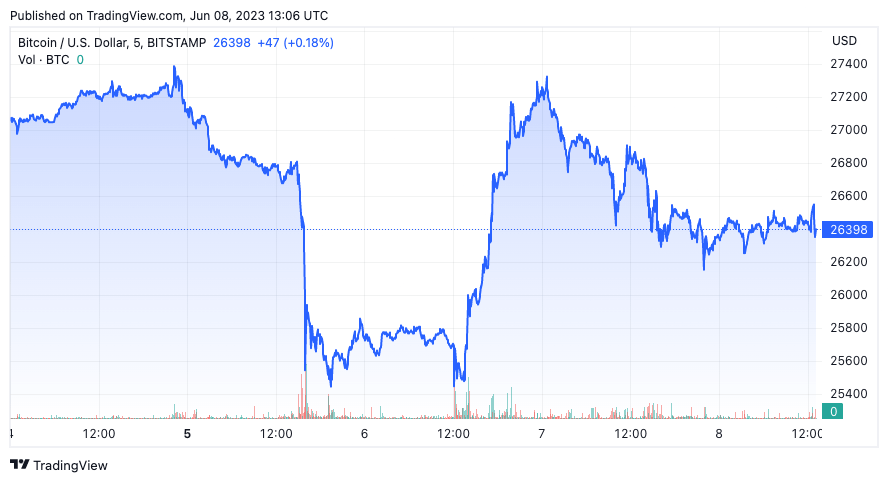

Graph showing Bitcoin’s terms from June 4 to June 8, 2023 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from June 4 to June 8, 2023 (Source: CryptoSlate BTC)However, Bitcoin’s driblet halted astatine $25,300. By June 7, the cryptocurrency had regained its losses, posting a betterment of 7.9%. Bitcoin’s quality to support its worth supra $25,300 tin beryllium attributed to the important absorption level that falls wrong the trading scope the cryptocurrency has sustained for the past 30 days.

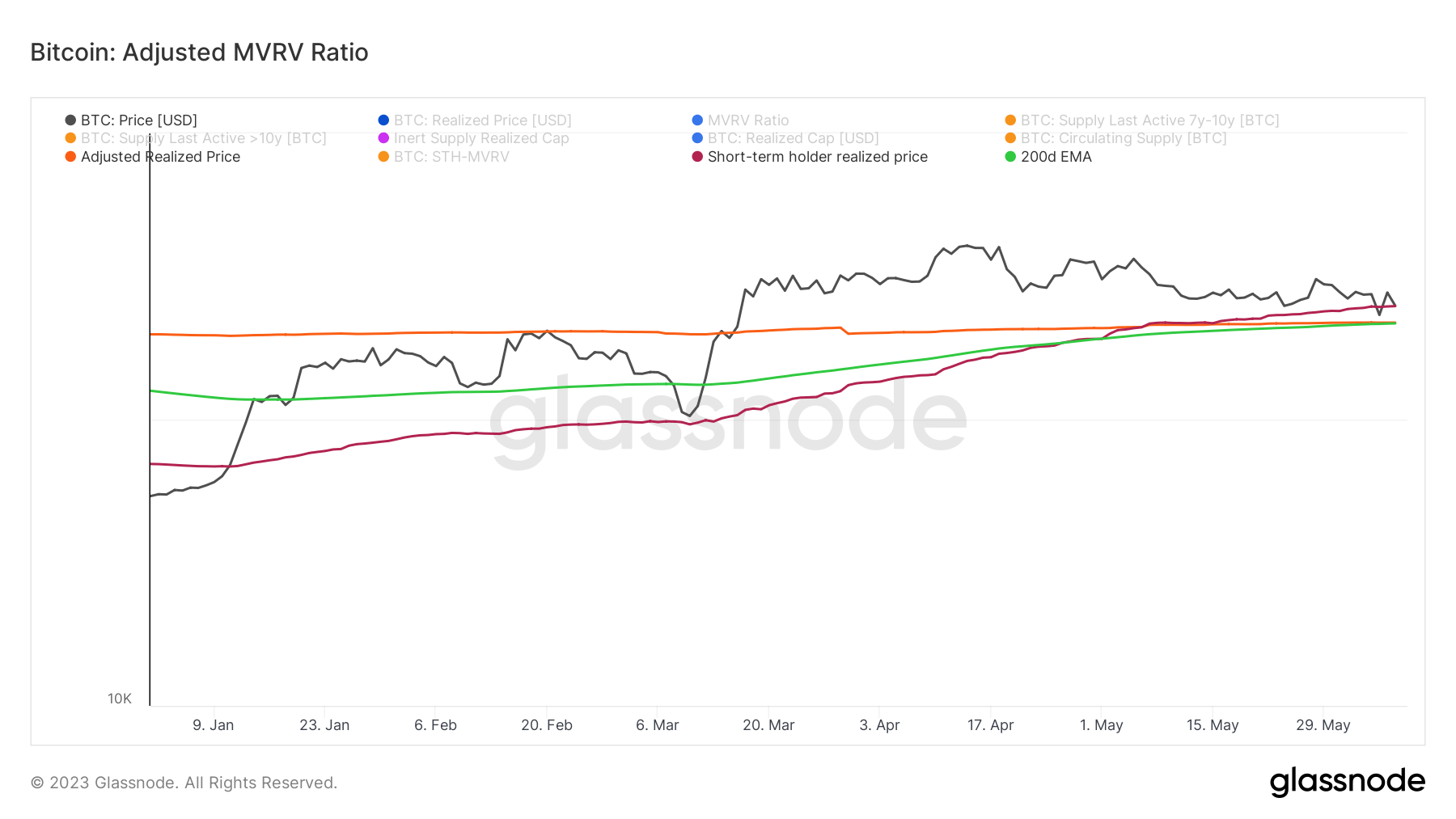

This trading scope comprises 3 important terms points: the upper, middle, and lower. The precocious level corresponds to the short-term holder outgo basis, the mediate to the 200-day exponential moving mean (EMA), and the little to the adjusted realized price. Each of these metrics is integral to assessing marketplace sentiment for Bitcoin.

The short-term holder outgo ground reflects the mean terms astatine which short-term holders person purchased Bitcoin. This metric provides invaluable accusation astir the imaginable merchantability threshold for these investors, which tin pass wide marketplace sentiment.

The 200-day EMA is simply a wide utilized instrumentality successful marketplace analysis. It calculates the mean closing terms of a information implicit the past 200 days, but dissimilar a elemental moving average, the EMA assigns much value to caller prices. This diagnostic makes the EMA much responsive to caller terms changes, which tin assistance observe imaginable inclination reversals earlier. As such, it provides penetration into semipermanent marketplace sentiment, allowing for a broad presumption of terms trends.

The adjusted realized terms refers to the mean terms astatine which each coins successful the marketplace were past moved, with adjustments for mislaid and unmoved coins. It provides a notation constituent for evaluating whether astir investors are successful nett oregon loss.

On June 4, Bitcoin’s adjusted realized terms stood astatine $25,300. The short-term holder realized terms was $26,300, portion the 200d EMA was $25,300.

Graph showing Bitcoin adjusted realized price, short-term holder realized price, and the 200d EMA from May 8 to June 8, 2023 (Source: Glassnode)

Graph showing Bitcoin adjusted realized price, short-term holder realized price, and the 200d EMA from May 8 to June 8, 2023 (Source: Glassnode)Analyzing Bitcoin’s realized terms is indispensable erstwhile establishing enactment and absorption levels. Examining realized terms metrics and adjusting them based connected entities specified arsenic semipermanent and short-term holders provides a much precise knowing of Bitcoin’s imaginable trading range.

Such knowing becomes important for identifying terms bottoms and the commencement of marketplace cycles. Therefore, contempt the marketplace volatility sparked by the SEC lawsuits, Bitcoin maintained its worth supra $25,300, indicating the market’s robustness.

The station Why is Bitcoin is holding beardown successful spite of the SEC’s regulatory crackdown? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)