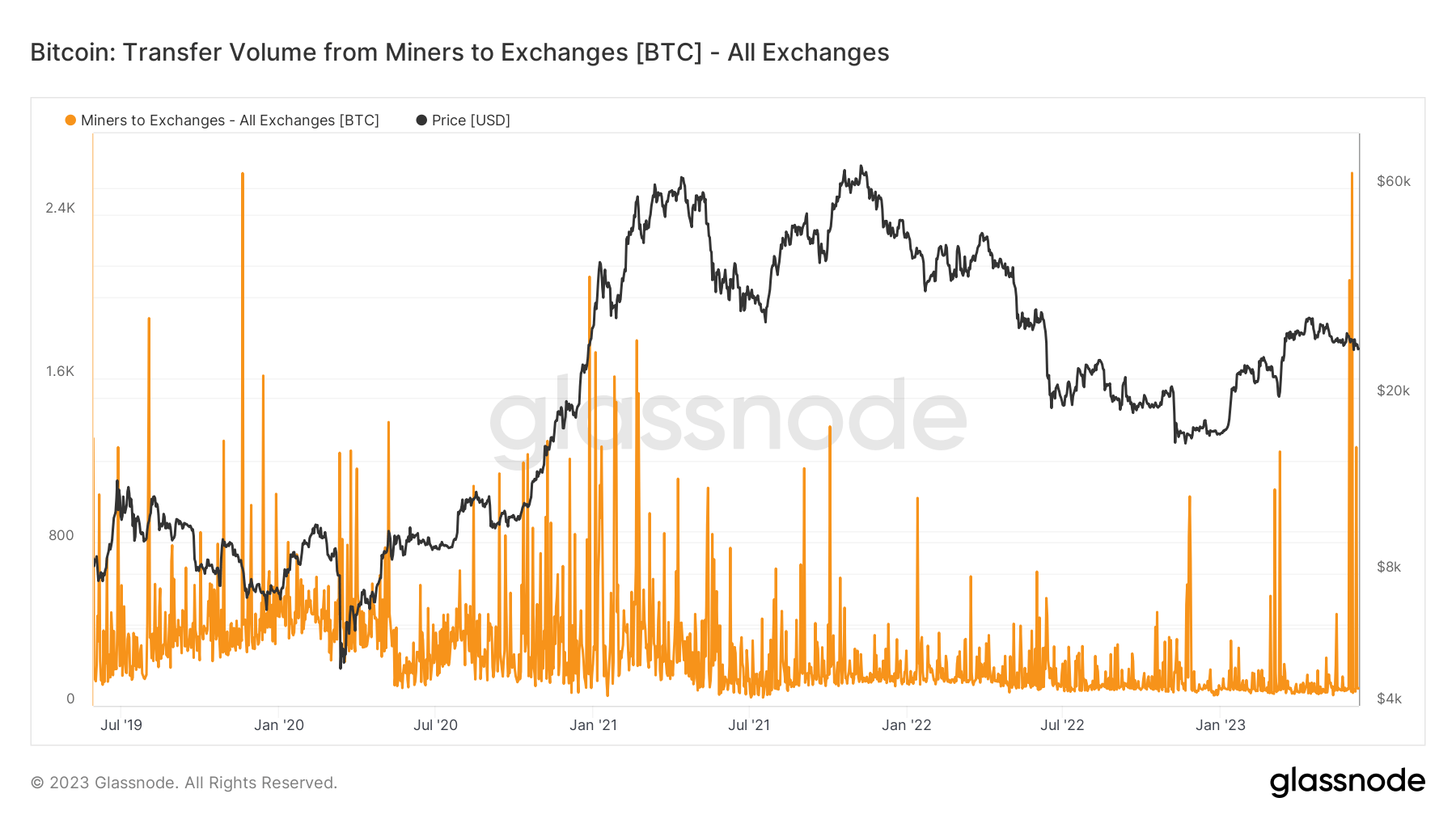

Analyzing miner-to-exchange flows is important for knowing marketplace sentiment, peculiarly erstwhile evaluating whether miners are liquidating oregon accumulating. A surge successful Bitcoin inflows to exchanges has historically preceded an summation successful merchantability orders, often starring to terms slumps arsenic the selling unit increases.

On June 3, miners transferred a sizeable measurement of BTC to exchanges, sparking market-wide statement astir the root of these inflows and their imaginable interaction connected the market. Data from Glassnode showed that conscionable implicit 2,606 BTC was transferred connected June 3, making it the highest transportation since March 26, 2019. At the time, miners sent implicit 4,083 BTC to exchanges.

Graph showing the transportation measurement of BTC from miners to exchanges from June 2019 to June 2023 (Source: Glassnode)

Graph showing the transportation measurement of BTC from miners to exchanges from June 2019 to June 2023 (Source: Glassnode)CryptoSlate investigation recovered that the main operator of the monolithic outflow was Poolin, 1 of the largest mining pools connected the market. Approximately a 3rd of each Bitcoin transferred from miners to exchanges connected June 3 tin beryllium attributed to Poolin, arsenic the excavation transferred 853.4 BTC.

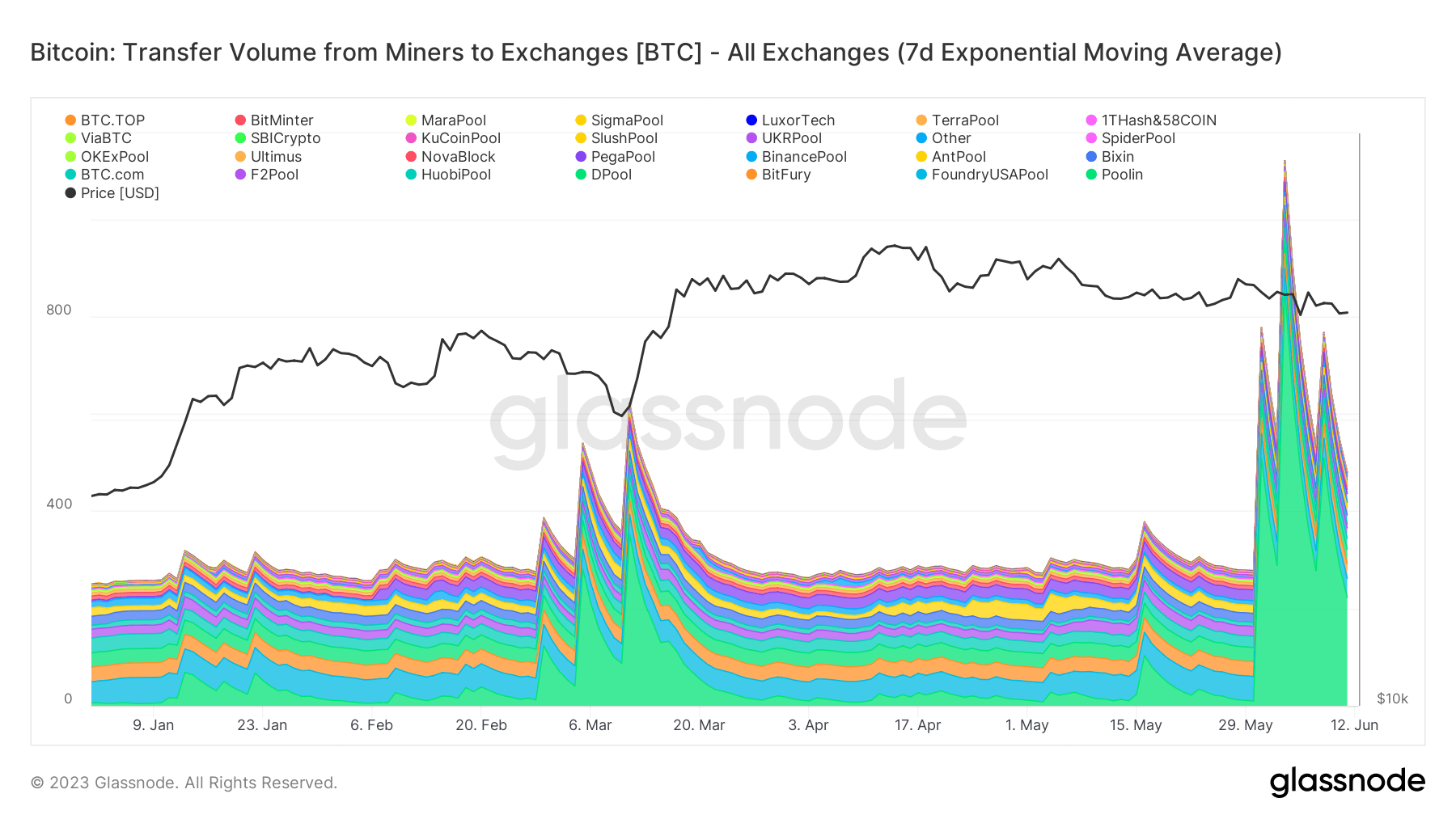

The transportation is not an isolated lawsuit — it is simply a continuation of a inclination from Poolin that began successful precocious May.

Since May 31, Poolin has sent an mean of 433.5 BTC to exchanges each day, peaking with the ample outflow connected June 3. For comparison, the adjacent largest contributor, Foundry USA, transferred 45.5 BTC connected the aforesaid time and maintained a regular transportation measurement betwixt 40 and 50 BTC since the extremity of May.

Graph showing the full magnitude of BTC transferred from miners to exchanges YTD (Source: Glassnode)

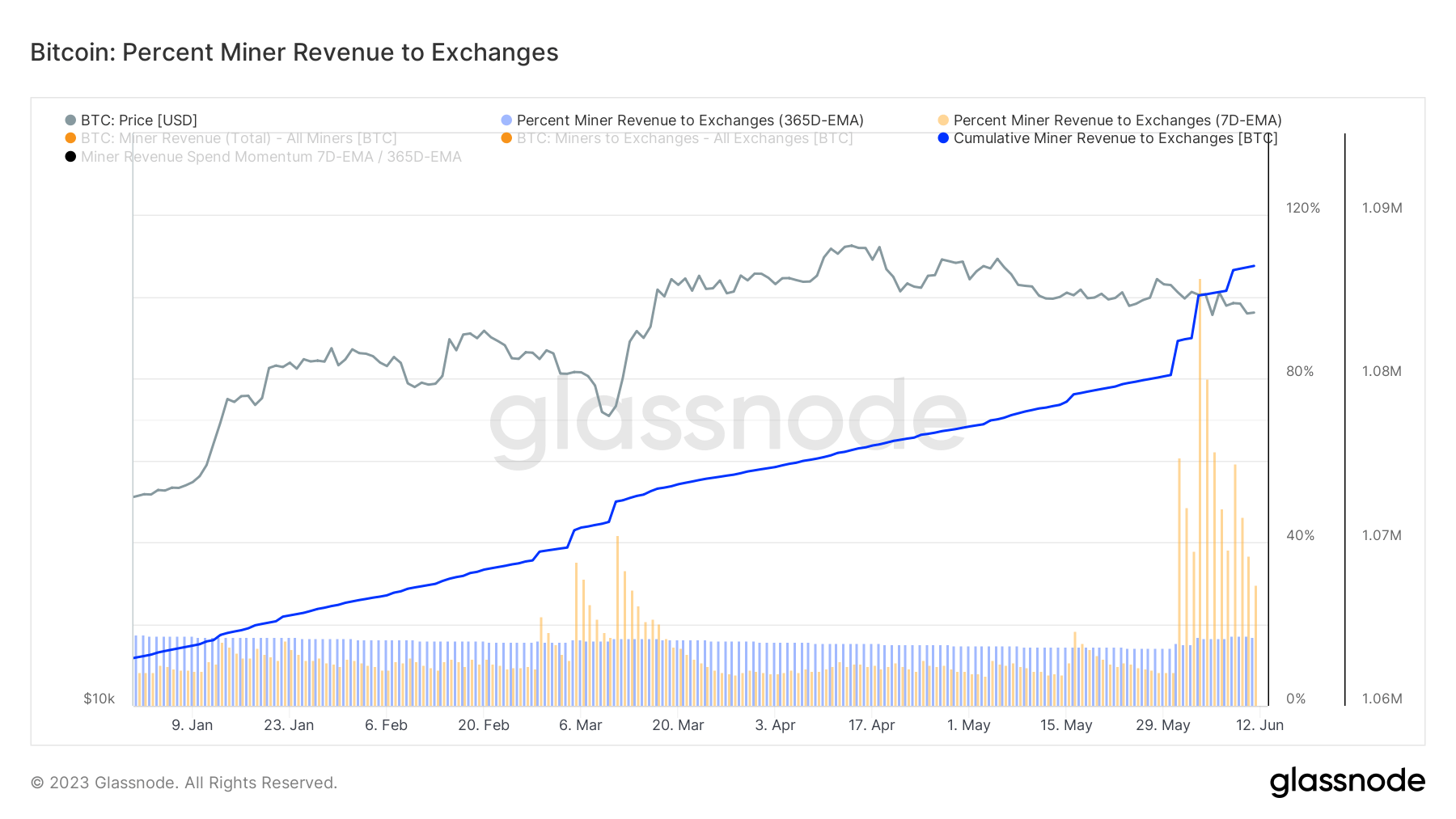

Graph showing the full magnitude of BTC transferred from miners to exchanges YTD (Source: Glassnode)The summation successful miner transfers led to an abrupt emergence successful the proportionality of miner gross sent to exchanges. CryptoSlate investigation recovered that the 7-day exponential moving mean (EMA) of miner gross to exchanges reached 104.5% connected June 3.

An EMA is simply a captious fiscal metric that provides much value to caller data, smoothing retired the information enactment and revealing inclination shifts much effectively. This EMA worth is the highest recorded since November 17, 2014, erstwhile it reached 131.7%.

Graph showing the percent of miner gross sent to exchanges YTD (Source: Glassnode)

Graph showing the percent of miner gross sent to exchanges YTD (Source: Glassnode)Bitcoin’s terms remained comparatively stable, hovering between $26,800 and $27,300 from May 31 to June 4. The crisp downturn connected June 5 was much apt a absorption to quality astir the SEC’s suit against Binance and Coinbase alternatively than an summation successful speech selling unit from miners, arsenic the terms rebounded wrong 24 hours.

Graph showing Bitcoin’s terms from May 18 to June 12 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from May 18 to June 12 (Source: CryptoSlate BTC)This suggests that miners whitethorn beryllium opting to liquidate their coins via over-the-counter (OTC) methods oregon clasp them connected exchanges successful anticipation of much favorable marketplace conditions.

The station What’s going connected down the scenes of June’s monolithic miner outflow? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)