Reports person disclosed that 16 wallets picked up 431,018 Ether betwixt September 25 and 27, spending astir $1.73 cardinal to bash so. The buys came done names similar Kraken, Galaxy Digital, BitGo, FalconX and OKX.

That standard of accumulation pushed attraction backmost to who is buying the dip, and wherefore larger players look consenting to adhd vulnerability portion prices wobble.

Exchange Balances Fall To 9-Year Low

According to Glassnode data, the magnitude of ETH held connected exchanges has plunged from astir 31 cardinal to astir 14.8 cardinal ETH — a driblet of 52% from 2016 levels.

Many of those coins are apt successful staking contracts, acold wallets oregon organization custody, and the caller motorboat of the archetypal Ethereum staking ETF has helped propulsion much proviso disconnected exchanges.

Lower speech balances mean less coins acceptable to beryllium sold instantly connected exchanges, which tin marque terms moves sharper erstwhile large orders deed the market.

ETH Hovers Near $4,000 As Volatility Rises

Based connected TradingView readings, ETH is trading astir $4,011, down astir 0.33% implicit the past 24 hours and much than 10% implicit the past week.

The token concisely slipped nether $3,980 earlier successful the league earlier climbing back, and it remains beneath a caller adjacent of $4,034.

This two-week pullback has returned ETH to a cardinal $4,000 enactment area, and short-term swings person go much pronounced arsenic holders reposition.

$3,700 Becomes A Line In Sand

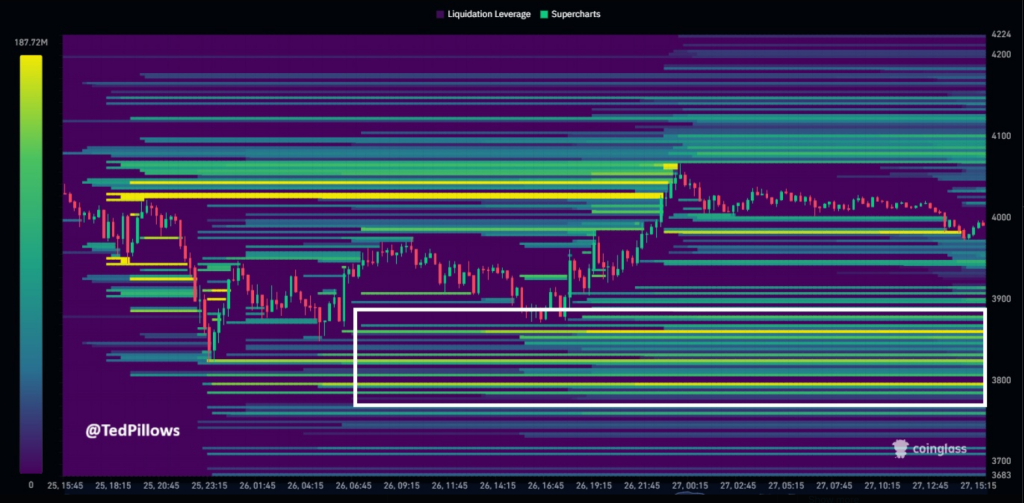

Crypto expert Ted Pillows has warned that the $3,700 to $3,800 portion could look dense pressure. Reports enactment that if ETH falls beneath $3,700, galore borderline positions could beryllium wiped retired and spark forced selling that pushes prices lower.

$ETH liquidity heatmap is showing decent agelong liquidations astir the $3,700-$3,800 level.

This level could beryllium revisited again earlier Ethereum shows immoderate recovery. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

With less coins connected exchanges and concentrated borderline exposure, the short-term outlook is much fragile adjacent arsenic longer-term request indicators look solid.

ETF Outflows Show Institutional Mood Can Flip

US-listed ETH funds recorded astir $800 cardinal successful outflows this week, their largest redemptions to date. Still, astir $26 cardinal sits successful Ethereum ETFs, adjacent to 5.37% of full supply.

Whales support accumulating $ETH!

16 wallets person received 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX successful the past 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Those numbers underline however rapidly organization sentiment tin change: large inflows tin vanish conscionable arsenic fast, and ETF flows present adhd a new, sizable furniture to terms dynamics.

Lookonchain information besides highlighted a anterior accumulation of astir $204 cardinal successful ETH, showing akin patterns of ample players stepping up during dips.

Retail traders look much cautious for now. But the series of large buys from institutional-grade custodians suggests immoderate buyers presumption dips arsenic buying chances portion others take to hold connected the sidelines.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)