Ethereum has officially breached beneath cardinal enactment levels, and marketplace sentiment is rapidly deteriorating arsenic large assets crossed the crypto scenery proceed to slide. Analysts are progressively calling for the accomplishment of a caller carnivore market, noting that some Bitcoin and the starring altcoins person mislaid captious method zones that antecedently held the broader operation together. ETH, present trading astatine multi-month lows, is feeling the afloat value of cascading liquidations, beardown sell-side volume, and evaporating capitalist confidence.

Adding to the increasing uncertainty, Lookonchain reports a striking development: successful conscionable 10 days, much than $61 cardinal successful nett has disappeared for a well-known marketplace subordinate often referred to arsenic the Anti-CZ Whale.

This trader antecedently gained attraction for aggressively opening shorts instantly aft CZ purchased ASTER — a determination that paid disconnected handsomely until the caller convulsive downturn reversed his fortunes.

The Anti-CZ Whale’s Unrealized Profit Collapse Adds Pressure

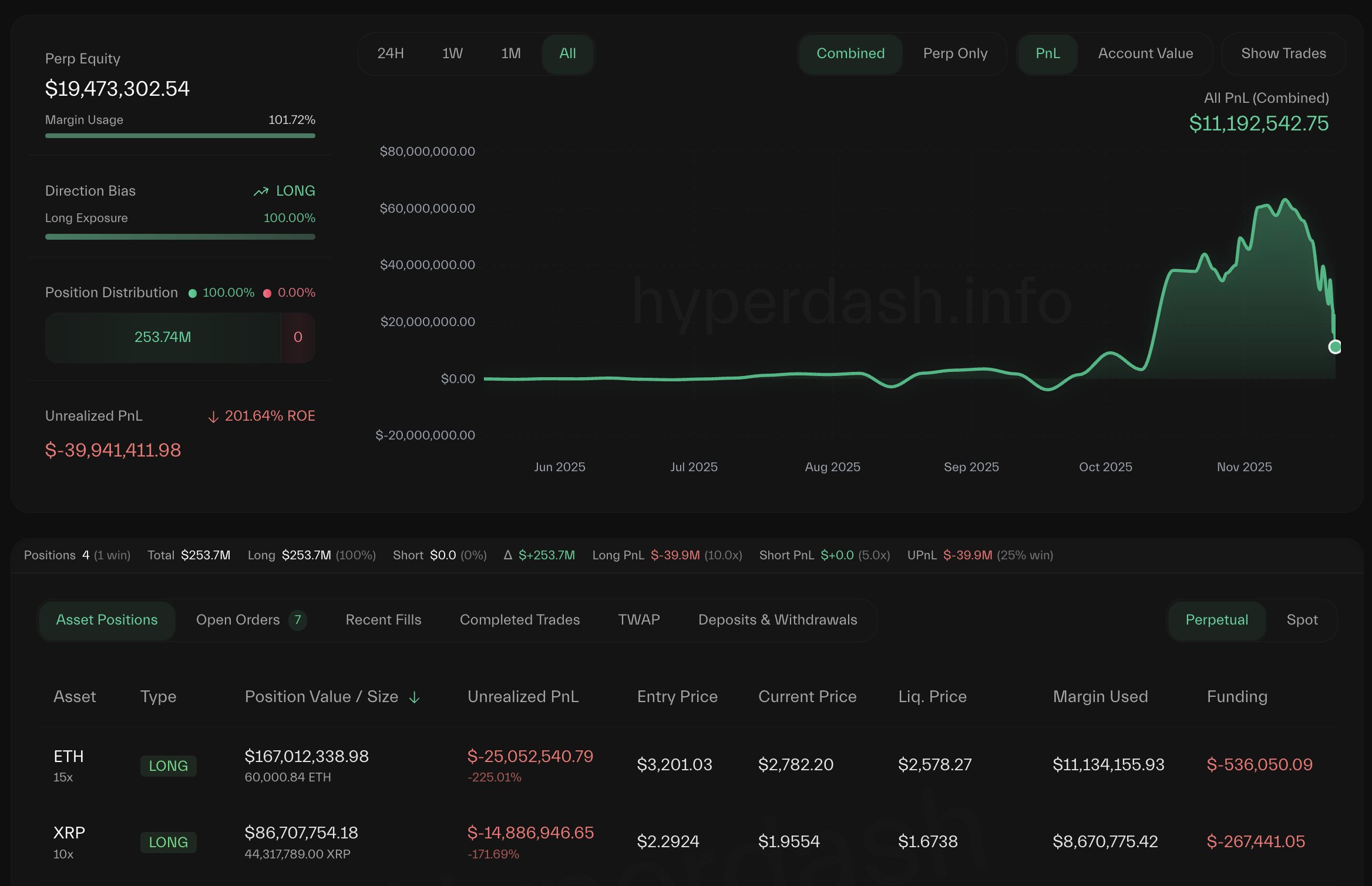

According to Lookonchain, the trader known arsenic the Anti-CZ Whale has taken a monolithic deed during the latest marketplace downturn — and Ethereum sits astatine the halfway of the damage. Just 10 days ago, this whale had accumulated astir $100 cardinal successful full nett connected Hyperliquid, mostly fueled by assertive positions built during periods of precocious volatility.

Anti-CZ Whale Ethereum and XRP Positions | Source: Lookonchain

Anti-CZ Whale Ethereum and XRP Positions | Source: LookonchainHowever, arsenic the crypto marketplace sharply corrected, his oversized ETH and XRP longs turned against him. The effect has been a brutal drawdown: his full nett has present fallen to conscionable $38.4 million, wiping retired much than 60% of gains successful little than 2 weeks.

This melodramatic reversal reflects much than 1 trader’s misfortune — it signals the grade of the unit weighing connected Ethereum. As ETH continues to diminution and capitalist sentiment deteriorates, adjacent the astir seasoned actors are struggling to navigate the volatility. The whale’s accelerated nett erosion highlights however rapidly bullish condemnation tin displacement erstwhile cardinal enactment levels fail.

For Ethereum, holding the existent portion is crucial. Price enactment has already inflicted important symptom crossed longs, short-term holders, and leveraged players. If ETH loses this enactment decisively, the adjacent question of forced selling could deepen losses and accelerate the broader marketplace capitulation.

ETH Price Analysis: Testing a Major Weekly Support Zone

Ethereum has entered a captious signifier connected the play timeframe, with terms pulling backmost sharply toward the $2,680 portion — a level that present acts arsenic the past meaningful enactment earlier a deeper marketplace breakdown. The illustration shows a beardown rejection from the $4,500 portion earlier this quarter, followed by a sustained bid of little highs and little lows, confirming a medium-term downtrend.

The 50-week moving mean has been mislaid decisively, and ETH is present sitting straight connected apical of the 100-week MA, a level that has historically acted arsenic a cardinal pivot during large marketplace corrections.

ETH mounting caller lows | Source: ETHUSDT illustration connected TradingView

ETH mounting caller lows | Source: ETHUSDT illustration connected TradingViewVolume has expanded during the caller drop, highlighting an situation driven by fearfulness and forced selling alternatively than controlled profit-taking. This aligns with broader marketplace conditions, wherever liquidity is bladed and volatility remains elevated crossed majors. A cleanable interruption beneath $2,650 would unfastened the doorway for a retest of the $2,300–$2,400 zone, which served arsenic beardown accumulation during erstwhile cycles.

However, the play illustration besides shows that ETH is entering a historically oversold area, akin to mid-2022 and late-2023, wherever reversals yet formed aft weeks of compression. For now, Ethereum indispensable clasp supra this play enactment to debar a deeper retrace and sphere the operation needed for a imaginable recovery.

Featured representation from ChatGPT, illustration from TradingView.com

2 hours ago

2 hours ago

English (US)

English (US)