Everyone has heard the Chinese proverb British misquote: “May you unrecorded successful absorbing times,” and however it’s expected to beryllium a curse. It sounds deep, similar a punctuation for edgelords implicit 80.

But person you ever considered the alternative? According to the Anglo-Saxon Chronicle, determination were astir 2 centuries wherever thing overmuch happened. Vivian Mercier famously called Waiting for Godot “a play successful which thing happens, twice.” But thing happening 191 times? I’ll instrumentality absorbing times immoderate day.

And that’s precisely what we person now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been talking a batch precocious astir however Lightning is the communal connection of the bitcoin economy and however bitcoin is simply a mean of exchange (and it truly is; work our report).

These 2 arguments present look to beryllium converging. Thanks to Lightning moving arsenic a communal language, it makes bitcoin interoperable with a wide scope of adjacent technologies, similar USDT. And USDT is going to turbocharge bitcoin into caller usage cases, caller markets, and caller challenges connected a standard that the Lightning ecosystem has yet to experience.

Given the choice, I’d alternatively dive caput archetypal into the chartless than walk the day connected the couch. All the chill worldly is successful the unknown. (Image: pxhere)

Given the choice, I’d alternatively dive caput archetypal into the chartless than walk the day connected the couch. All the chill worldly is successful the unknown. (Image: pxhere)

USDT connected Lightning is terra incognita. Interesting times indeed. So let’s deliberation astir what it means for USDT to articulation Lightning and for Lightning to determination USDT — the opportunities, the risks, and the wide unfastened questions.

Lightning was primitively intended to summation the throughput of the bitcoin blockchain, truthful bitcoin was to beryllium its lone cargo. Taproot Assets is simply a caller protocol that allows fungible assets (e.g. stablecoins) to beryllium transmitted implicit Lightning arsenic hashed metadata piggybacking connected the aforesaid infrastructure utilized to process bitcoin payments.

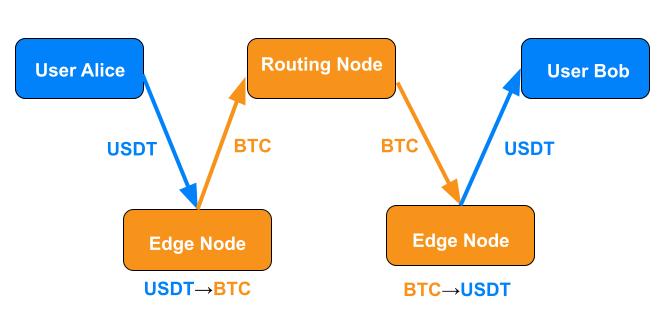

The mode it works is beauteous elemental for anyone who understands Lightning. The recipient generates an invoice that pings borderline nodes (i.e. the nodes connecting users to the broader network) for speech rates betwixt bitcoin and the plus successful question — USDT successful the existent case. Once the idiosyncratic accepts an borderline node’s speech rate, they make an invoice for the outgo and nonstop it to the payer. The payer sends the plus to the borderline node connected their ain side, the borderline node converts everything into a normal-looking bitcoin payment, the outgo proceeds done routing nodes on the web arsenic usual, the borderline node connected the recipient’s extremity converts the outgo backmost into the archetypal plus (USDT) and forwards it to the recipient.

Taproot Assets leverages the versatility of Lightning and bitcoin to fto users transportation caller kinds of assets implicit the network, utilizing bitcoin arsenic the cosmopolitan mean of exchange. One corollary of each the nodes speaking Lightning is that immoderate routing nodes betwixt the borderline nodes spot lone BTC successful transit. Lightning tells them however to determination BTC, and that’s each they’re doing arsenic acold arsenic they know. Awesome.

But there’s much to it than conscionable method specs. USDT is, aft all, a monolithic mean of exchange. Tens of billions of USDT worth alteration hands each time dispersed crossed millions of payments. Its regular trading volumes are successful the aforesaid ballpark arsenic the Brazilian existent and the Indian rupee. This is simply a large deal. So what does Lightning mean for USDT, and what does the summation of USDT mean for Lightning?

… for Bitcoin

So far, overmuch of the strategy to bitcoinizing commerce has focused connected orangish pilling arsenic galore radical arsenic imaginable and increasing the circular economy 1 idiosyncratic astatine a time. This strategy has possibly reached the limits of its scale. The ellipse has grown massively successful the past decennary and a half, but it’s inactive limited, and we request to deliberation successful presumption of millions astatine a time.

Now that USDT and BTC are natively interoperable connected Lightning, the ellipse has gained tangents. With USDT connected Lightning, each enactment to a outgo — the payer and the recipient — tin take whether to usage BTC oregon USDT connected their ain end, and neither depends connected the other’s decision. A lawsuit tin wage successful BTC, and the merchant tin person USDT. Or the lawsuit tin wage successful USDT, and the merchant tin person BTC. Or they tin some usage the aforesaid asset. It doesn’t matter. Once some assets are autochthonal to Lightning, they go automatically, frictionlessly interchangeable. Everyone is escaped to opt for bitcoin’s advantages arsenic a mean of speech grown from the bottommost up by the users oregon for USDT’s advantages arsenic an plus whose terms is arsenic unchangeable arsenic US monetary argumentation and Tether’s liquid reserves.

Lightning and, by extension, bitcoin basal to summation millions of users and billions of dollars worthy of spending power. It’s a qualitative hold of bitcoin’s utility. The caller usage cases volition bash much bully for bitcoin than a boatload of orangish pills. It’s besides perchance a quantitative detonation for Lightning. Many of those caller users mightiness not adjacent cognize that they’re utilizing Lightning acknowledgment to its efficacy arsenic the common connection of the bitcoin economy. But we ol’ schoolhouse Lightning vets know. This is what we’ve been gathering towards.

And since we conscionable mentioned however Lightning would marque USDT easier for American users to access, USDT volition besides marque it easier for them to usage Lightning. American taxation regularisation treats BTC similar an equity, making each outgo a perchance analyzable concatenation of taxation events. But if US users tin entree Lightning with an plus that ne'er incurs superior gains, past they’ll person entree to galore of Lightning’s advantages without 1 of its peculiar regulatory drawbacks.

…for Tether

Tether typically issues USDT connected proven blockchains that person achieved important marketplace traction, and they person no involvement successful launching their own. USDT is currently disposable on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron. Note that these are each proof-of-stake (PoS) blockchains (except Liquid, which uses a federation), truthful they’re needfully much centralized than bitcoin.

These blockchains besides look antithetic tradeoffs. Ethereum is comparatively decentralized for a PoS blockchain, but its transaction fees are notoriously high. Tron is cheaper. Perhaps that’s why, according to 1 estimate, astir 7x much monthly progressive retail USDT users opt for Tron implicit Ethereum and nonstop 8x much retail measurement implicit Tron. But Tron is notoriously centralized, making it a choke constituent for USDT. If Tron were to fail, Tether would suffer thing similar fractional of its full capableness crossed each blockchains. Ouch. By allowing USDT to beryllium transacted implicit Lightning, which is inherently decentralized, Tether mitigates their dependency connected cheap, centralized blockchains.

Further, Lightning could marque USDT overmuch much convenient to usage successful the US market. US exchanges sometimes bounds USDT transactions to definite blockchains. For example, Coinbase says “Coinbase lone supports USDT connected the Ethereum blockchain (ERC-20). Do not nonstop USDT connected immoderate different blockchain to Coinbase.” Lightning gives large exchanges similar Binance, Coinbase, and Kraken (which already enactment Lightning today) a decentralized alternate for USDT payments to connection their users.

The caller American medication has mooted onshoring the full stablecoin manufacture and suggested that regulating it is their “first priority.” In different words, they’ll beryllium paying precise adjacent attraction to each development. As agelong arsenic stablecoins similar USDT are pegged to the dollar, those who power the dollar and nett from it volition privation to power the stablecoins too.

Regulators deliberation they tin adjacent amended connected state by regulating it. They can’t assistance it. It’s successful their nature. But it follows that, arsenic USDT gains inferior connected Lightning and Lightning gains inferior arsenic a means to determination USDT, we’re each going to beryllium attracting greater scrutiny from regulators. It’s hard to accidental however overmuch they’ll really beryllium capable to bash oregon what they’re going to try, but it won’t beryllium immoderate fun. Regulation is ever friction.

One country that’s apt to pull regulatory scrutiny is the borderline nodes. Conventional centralized exchanges thin to beryllium taxable to KYC/AML rules successful galore jurisdictions. If the borderline nodes volition beryllium automatically exchanging USDT and BTC and forwarding payments, they mightiness besides look a batch similar accepted exchanges to regulators, who thin not to similar decentralization. 🙄

What’s It Cost? What’s It Worth?

While Lightning does connection users and USDT immoderate important benefits, it’s not evidently the champion all-around solution for each outgo involving USDT. Lightning users expect debased fees. So bash USDT users who usage centralized blockchains and custodial exchanges. But adding a 2nd plus to Lightning adds immoderate fiscal considerations that everyone — routing nodes, users, and particularly borderline nodes — volition person to reckon with.

First, the borderline nodes are providing the emblematic tasks of LSPs — keeping users connected to the web with capable channels and capable liquidity to support those payments moving — in addition to converting betwixt assets. That conversion is simply a invaluable work that deserves compensation, and it tin besides beryllium risky (see below).

Second, USDT is apt to summation transaction measurement considerably, which means that LSPs and routing nodes volition person to support much liquidity connected the web to guardant those payments. They don’t instrumentality the aforesaid shortcut arsenic custodial exchanges, which conscionable person to update their interior ledgers. The economics of liquidity allocation inactive apply, lone much so.

Will Lightning beryllium capable to vie with centralized exchanges similar Tron for USDT payments? The reply volition astir apt lucifer the reply to astir questions astir matching technologies with usage cases: each exertion volition person definite strengths and weaknesses that urge it for definite usage cases and not others. As usual, the marketplace volition fig it out. However, since the exertion wasn’t tailored to this peculiar usage case, terms find volition beryllium a process of proceedings and error, which takes time.

Free Call Options? Uh oh.

Edge nodes look the hazard of the “free-call-option problem,” which is absorbing capable to merit its ain treatment here. This is simply a caller risk, and it’s inherent to immoderate concern involving 2 assets successful a azygous Lightning payment.

Lightning payments request to beryllium completed wrong a definite clip successful bid to beryllium settled, oregon the invoice cancels automatically. That clip is the “T” successful HTLCs — hashed, time-locked contracts.

When the borderline nodes bid with their speech rates for a USDT↔BTC payment, they cipher their bids based connected parameters similar their existent liquidity concern and the spot price. But the users person a model betwixt accepting the borderline node’s bid and the expiration of the HTLC successful which to settee the payment. Prices tin determination successful that window. If I initiate a USDT outgo astatine 1 rate, past I tin hold until the complaint moves successful my favour earlier I merchandise the preimage to settee it. If the complaint moves against me, I simply don’t merchandise the preimage. In that case, the borderline node mightiness initiate a transmission closure to redeem their funds, but that’s a dilatory (and truthful costly) process. If it moves successful my favor, the borderline node is connected the hook for the difference. Heads, I suffer nothing. Tails, I fleece the borderline node.

Payments involving immoderate operation of assets connected Lightning springiness the idiosyncratic a call option. Traditional fiscal institutions negociate their downside hazard successful selling telephone options by adding the hazard to the price. These options tin get precise costly for unprepared borderline nodes. Just inquire Kilian and Michael astatine Boltz, who primitively brought this full contented to my attraction and had the people to picture it for each of america successful the ecosystem. The alternate is for the borderline nodes to terms the telephone enactment into their quotes, conscionable similar accepted fiscal institutions. Intertemporal arbitrage is large enactment if you tin get it.

Users aren’t the lone root of interest for borderline nodes either. If a routing node fails to guardant the preimage — whether done intent oregon malfunction — the borderline node could inactive beryllium connected the hook. At slightest with routing nodes, it mightiness beryllium imaginable to instrumentality immoderate signifier of estimation strategy to assistance take the route. However, a estimation strategy for extremity users mightiness not beryllium feasible arsenic caller users volition beryllium perpetually joining the network.

The escaped telephone options person ne'er been a occupation for Lightning until present due to the fact that the web has lone dealt with a azygous asset: bitcoin. If the free-option occupation became superior enough, 1 could ideate aggregate parallel, single-currency Lightning Networks emerging. One for bitcoin. One for USDT. Another for … If bitcoin gets chopped retired of the loop, we volition suffer the payment of bitcoin interoperability. We mightiness adjacent upwind up regretting bringing USDT onto Lightning successful the archetypal place.

Bitcoin was ever meant to beryllium revolutionary. Disrupting breached fiat is the full constituent and ever has been. We’re successful it for the revolution. We cognize that alteration and disruption was ne'er going to beryllium a creaseless process.

But alteration is simply a bully thing. Progress is conscionable a benignant of alteration that radical welcome. We invited USDT connected Lightning due to the fact that we spot the opportunity. It tin correspond advancement for USDT users, for Lightning, and for bitcoin.

Like immoderate change, though, it’s going to necessitate cautious thought, preparation, crisp instincts, and speedy reactions. You don’t spell into uncharted territory without the close cogwheel and a fewer skills. Anyone successful the Lightning liquidity concern is going to look immoderate caller challenges, but besides stands to marque immoderate large gains.

Tether stands to summation an economical, decentralized organisation web and amended entree to the captious US market. Lightning stands to summation a monolithic infusion of liquidity and users. Bitcoin volition beryllium natively interoperable with USDT. That’s wherefore there’s truthful overmuch excitement.

But regulators are watching. And borderline nodes volition lone connection the indispensable conversion services if doing truthful is profitable, not ruinous. So let’s attack this alteration arsenic we bash each caller developments successful Lightning: by reasoning hard, designing carefully, hardening our code, preparing the market, and ne'er losing show of our eventual goal, which is to recognize the cosmopolitan bitcoin economy.

This is simply a impermanent station by Roy Sheinfeld. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

9 months ago

9 months ago

English (US)

English (US)