Ether (ETH) has retraced 42% from its all-time precocious of $4,950 with traders wondering wherever the altcoin was apt to bottommost retired next.

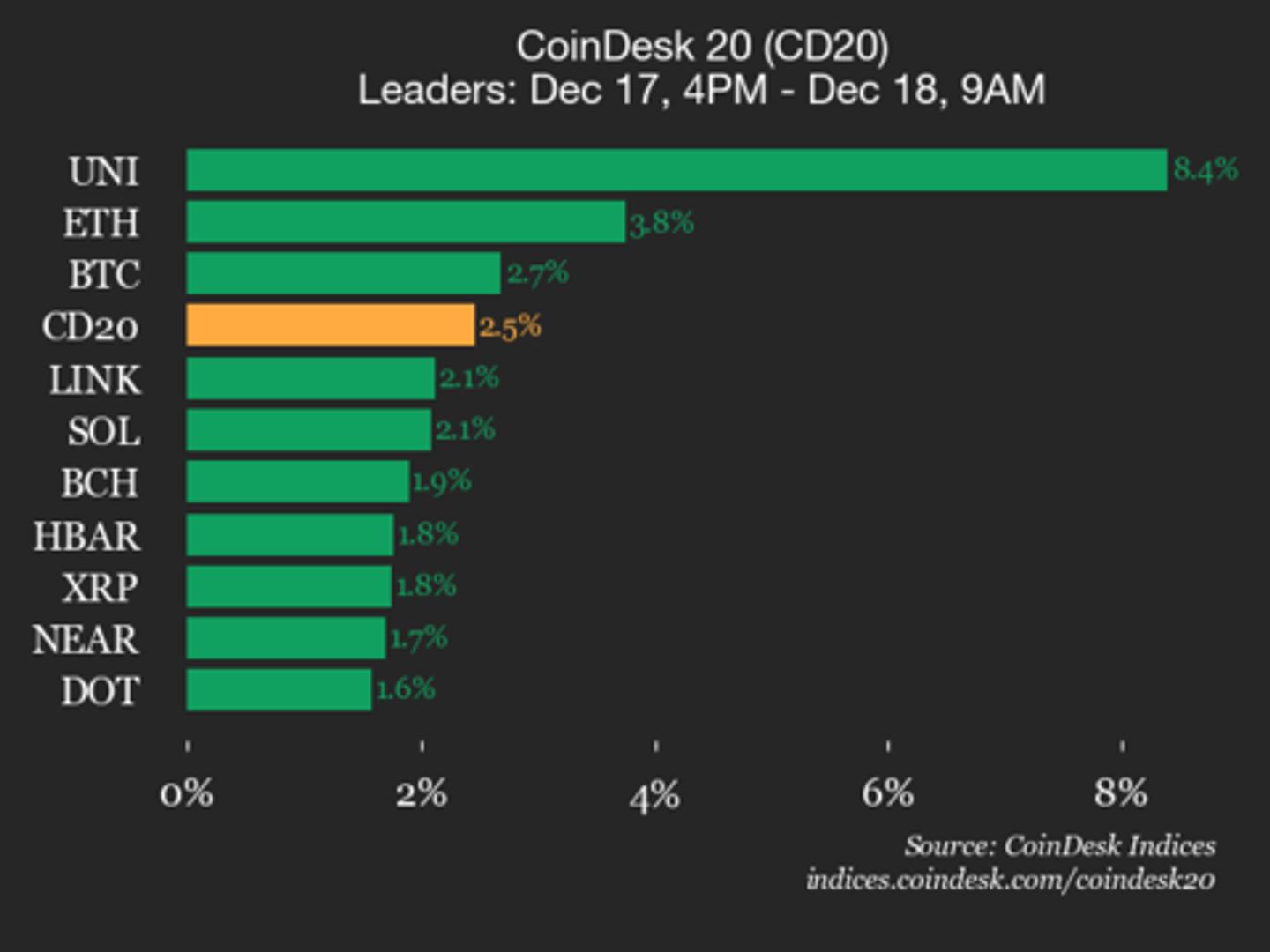

Key takeaways:

Ethereum traders spot ETH terms dropping to $2,100 if enactment astatine $2,800 fails.

Persistent Ether ETF outlaws and little treasury buying present much risks for bulls.

Analysis: 25% ETH terms driblet possible

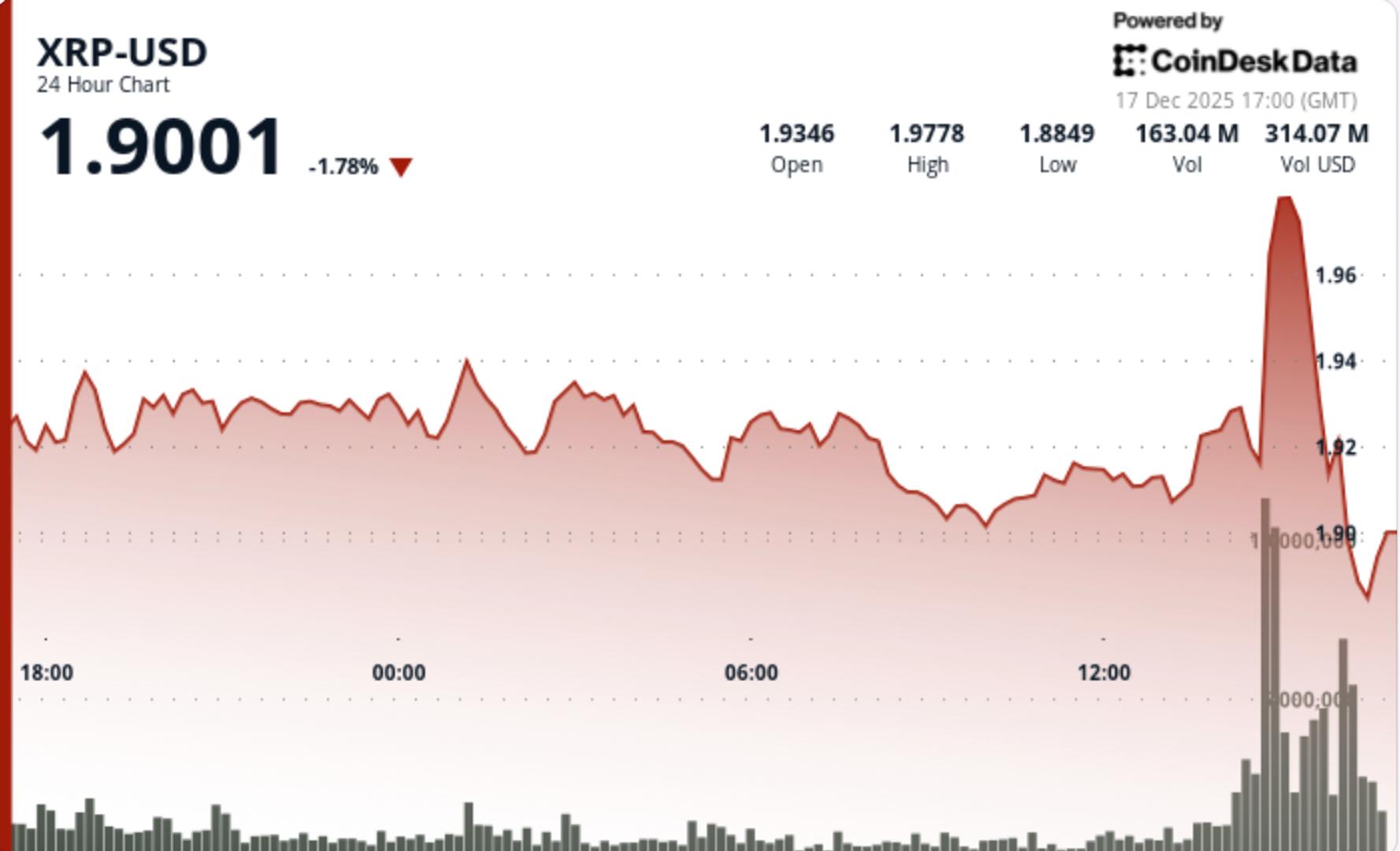

Data from Cointelegraph Markets Pro and TradingView showed that the ETH/USD brace has dropped backmost beneath $3,000.

Commenting connected the latest terms action, expert and trader Daan Crypto Trades said that though this rhythm has not been what ETH investors anticipated, Ether’s “market operation and the Ethereum ecosystem person matured during this time,” adding:

“I can’t support the terms enactment this cycle, it has underperformed $BTC and galore others massively.”An accompanying illustration suggested that if ETH mislaid its $2,800 support, it would apt driblet toward the adjacent large enactment level astir $2,100.

ETH/USD play chart. Source: Daan Crypto Trades

ETH/USD play chart. Source: Daan Crypto TradesData from Glassnode showed that the adjacent important enactment beneath $2,800 sits astatine astir $2,100, wherever astir 2.1 cardinal ETH were antecedently acquired.

Related: Ethereum could get faster successful January with state bounds emergence to 80M

Although Polymarket bettors are pricing successful lone astir an 11% accidental of ETH dropping to $2,000-$2,200 earlier the extremity of 2025, they see an 83% accidental of Ether’s terms revisiting $2,500 and a 59% accidental of it falling to $2,000 successful 2026.

Ether’s terms targets earlier Dec. 31, 2026. Source: Polymarket

Ether’s terms targets earlier Dec. 31, 2026. Source: PolymarketEther’s debased for 2025 is $1,380, reached successful April, and the past clip the ETH/USD brace traded astatine $2,100 was connected May 9. The existent 42% drawdown from all-time highs, however, is comparatively shallow. Previous carnivore cycles bottomed aft the terms declined by astir 80-90%.

ETH terms drawdown from all-time high. Source: Glassnode

ETH terms drawdown from all-time high. Source: GlassnodeInvestors de-risk from Ethereum ETFs

Institutional request for US-based spot Ethereum exchange-traded funds (ETFs) has declined, according to information from Farside Investors.

These concern products posted outflows for 5 consecutive days, totaling $533.1 million, and reducing the assets nether absorption to $17.34 billion.

“US-based Ethereum ETFs proceed to spot superior outflows,” CryptoQuant expert IT Tech said successful his latest station connected X, adding:

“Investors are de-risking oregon softly rotating distant from ETH, suggesting nary contiguous comeback for Ether.” Spot Ether ETFs flows table. Source: Farside Investors

Spot Ether ETFs flows table. Source: Farside InvestorsAdditional information from Capriole Investments reveals that regular purchases by Ethereum treasury companies person dropped from a highest of 78,010 ETH connected Aug. 23 to 12,095 ETH per day.

Ethereum: Daily complaint of treasury buying. Source: Capriole Investments

Ethereum: Daily complaint of treasury buying. Source: Capriole InvestmentsEven though BitMine is accelerating its Ether buying, aggregate onchain and method indicators astir the ETH person turned bearish, suggesting much symptom ahead.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

2 hours ago

2 hours ago

English (US)

English (US)