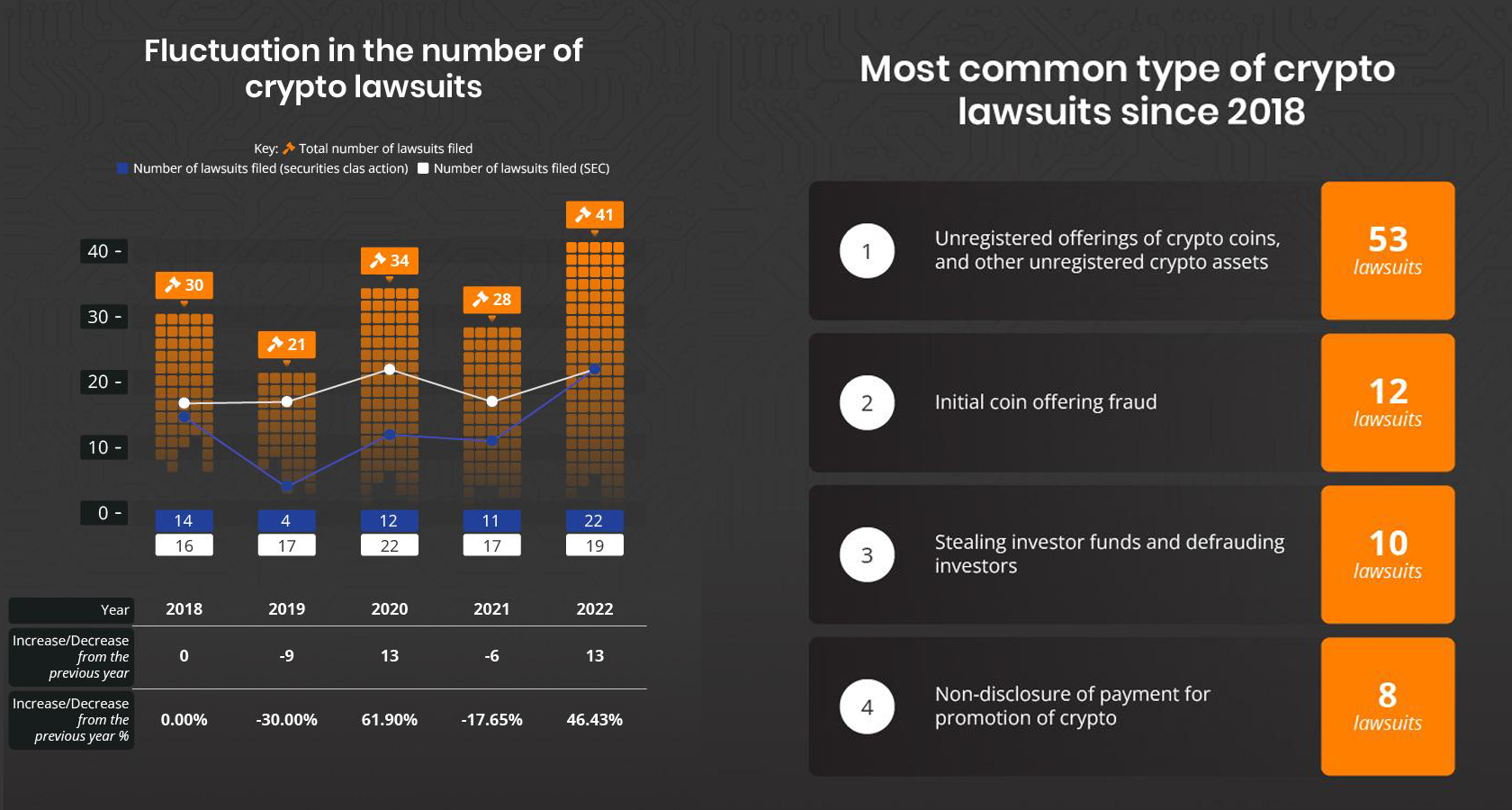

A caller survey connected integer currency-related lawsuits since 2018 shows a 42% summation successful crypto lawsuits successful 2022. The highest fig of claims successful a azygous twelvemonth was recorded past year, with 41 full claims successful the United States. The probe besides shows that the bulk of lawsuits came from the U.S. Securities and Exchange Commission (SEC).

Rise successful U.S. Crypto Lawsuits Tracked Since 2018: Report

Similar to the terms cycles experienced by cryptocurrencies, determination are fluctuations successful the fig of U.S. crypto-related lawsuits filed each year, according to caller probe published by hedgewithcrypto.com. The study notes a 40% summation successful crypto lawsuits betwixt 2018 and 2022, but determination person been immoderate decreases betwixt the highs. Out of each the years, 2022 saw the highest fig of lawsuits successful the United States, with a full of 41.

“In 2019, determination was a 30% alteration arsenic the fig of lawsuits dropped from 30 to 21,” the hedgewithcrypto.com researchers explain. “This was followed by a melodramatic summation of conscionable nether 62%, to 34 cases successful 2020, earlier different driblet to 28 successful 2021. Finally, determination was different summation (this clip of implicit 46%) successful 2022, with 13 much cases than successful 2021.”

Approximately 19 of the 2022 crypto lawsuits originated from the U.S. Securities and Exchange Commission (SEC), arsenic the country’s apical securities regulator has been cracking down connected unregistered services and securities. Throughout the years, lawsuits related to unregistered services and securities person been the astir communal successful the crypto industry, totaling 53 lawsuits since 2018. Initial coin offering (ICO) fraud accounted for 12 lawsuits, portion theft oregon fraud equated to 10 lawsuits since 2018.

Non-disclosure cases oregon the unlawful promotion of a cryptocurrency accounted for 8 lawsuits, portion making mendacious and misleading statements astir a crypto merchandise represented 5 of the full implicit the past 5 years. “Non-disclosure of outgo for the promotion of crypto products is 1 of the astir infamous cryptocurrency-related lawsuits, often involving celebrities,” the probe says.

For instance, the Emax promotion lawsuit involving Kim Kardashian and the SEC generated implicit 50,000 articles astir the taxable recorded connected Google’s hunt engine. The fewest lawsuits successful the past 5 years were related to falsifying institution gross and pyramid strategy fraud. Hedgewithcrypto.com researchers compiled the U.S. suit information from the SEC and suits recorded by Stanford Law.

Tags successful this story

2022, 40% increase, 42% increase, Celebrities, claims, Class Actions, Crypto, Crypto Products, cycles, decreases, Digital Currency, Emax promotion case, Enforcement, falsifying institution revenue, fluctuations, Fraud, Google, hedgewithcrypto.com, ico fraud, Kim Kardashian, lawsuit data, Lawsuits, legal battles, legal cases, Majority, non-disclosure cases, non-disclosure of payment, Product, pyramid strategy fraud, Research, SEC, SEC Cases, Stanford Law, study, Theft, United States, unlawful promotion, unregistered services and securities, US lawsuits, year-on-year rise

What bash you deliberation is driving the expanding fig of crypto-related lawsuits successful the U.S.? Do you judge that regulatory enactment by the SEC is indispensable for the manufacture to thrive, oregon does it stifle innovation? Share your thoughts successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)