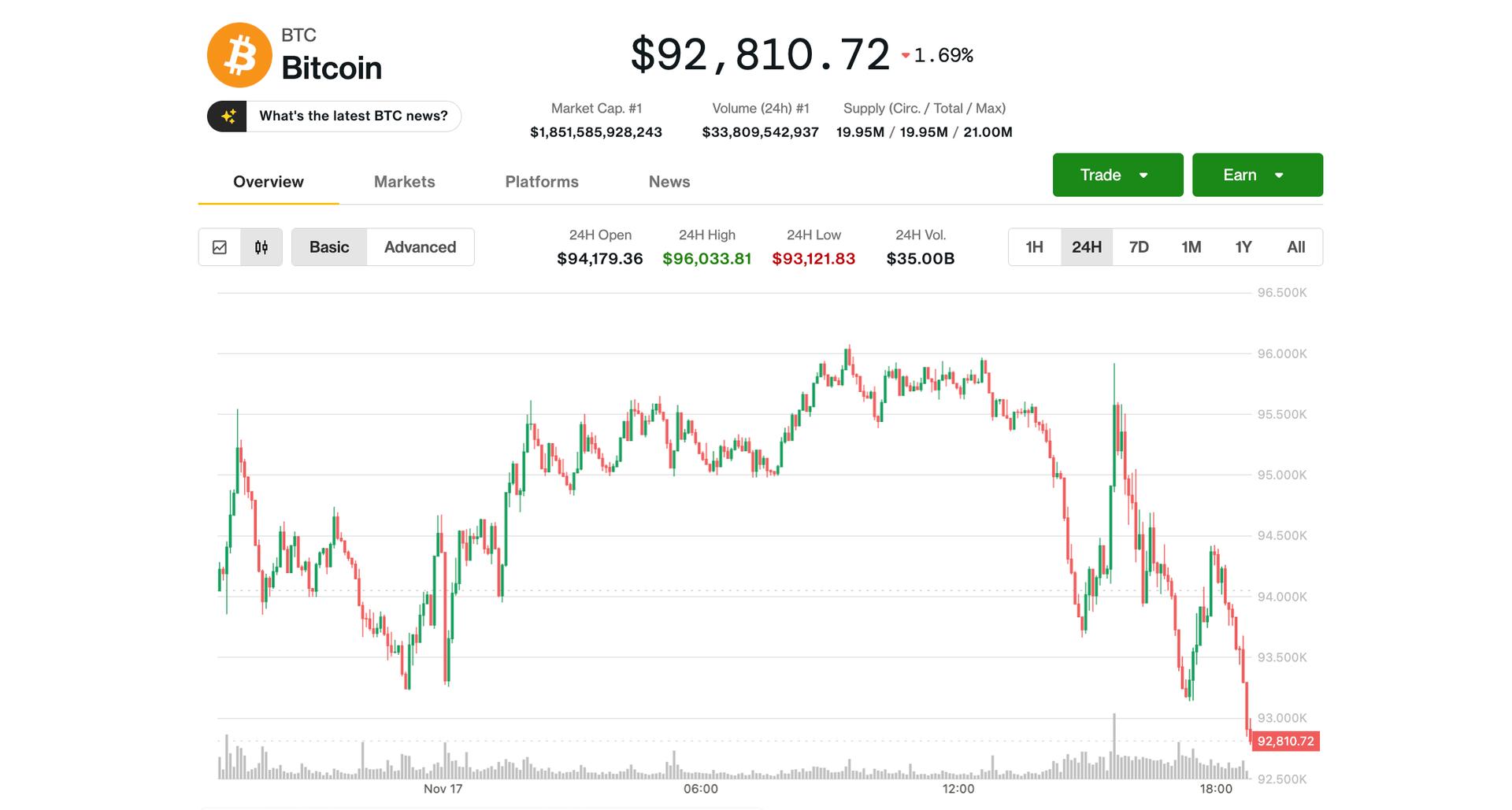

Crypto executives speculate that outflows from crypto exchange-traded funds, semipermanent whale income and escalating geopolitical tensions whitethorn beryllium to blasted for the caller marketplace slump, arsenic Bitcoin dropped to astir $93,000 connected Sunday.

Bitcoin concisely fell to a year-to-date debased of $93,029 connected Sunday. The wide marketplace capitalization has besides seen a pullback successful the past 7 days, from $3.7 trillion connected Nov. 11 to $3.2 trillion connected Monday, according to CoinGecko.

Speaking to Cointelegraph, Ryan McMillin, main concern serviceman of Australian crypto concern manager Merkle Tree Capital, said it’s not 1 azygous daze that’s causing the marketplace slump.

Multiple factors are tanking crypto prices

McMillin points to the onchain information showing semipermanent holders “finally cashing successful aft an bonzer run,” arsenic 1 cause, and “good fundamentals and liquidity process winds for the terms to spell overmuch lower.”

“At the aforesaid time, spot Bitcoin ETFs and different vehicles that were immense buyers earlier successful the rhythm person swung to nett outflows conscionable arsenic planetary markets person turned much risk-off and rate-cut hopes person been pushed out.”“Put that unneurotic and you person aged coins being distributed into a softer bid successful a macro situation that’s a batch little forgiving than it was six months ago,” McMillin added.

Matt Poblocki, the wide manager of Binance Australia and New Zealand, said the volatility is simply a reminder that crypto remains a maturing plus people influenced by planetary macroeconomic and governmental events.

Meanwhile, Holger Arians, the CEO of Banxa, a crypto outgo and compliance infrastructure provider, said markets are moving precise blistery comparative to the authorities of the world.

“We’re dealing with respective unresolved and successful immoderate cases escalating geopolitical tensions. At the aforesaid time, planetary tech valuations person kept rising connected aboriginal expectations. A broader risk-off infinitesimal was astir inevitable aft a twelvemonth of optimism,” helium said.

“And portion crypto tin sometimes determination independently from accepted markets, this is 1 of those periods wherever radical are simply waiting, watching, and trying to marque consciousness of a turbulent year.”Other crypto executives connected X besides had ideas astir the cause. Hunter Horsley, CEO of Bitwise Asset Management, believes the four-year rhythm communicative whitethorn beryllium to blasted for the marketplace pullback, arsenic traders are spooked by the thought of a downturn each fewer years and extremity up contributing to it by selling.

Tom Lee, the president of Ether Treasury institution BitMine, thinks that marketplace makers with “a large hole” successful their equilibrium expanse mightiness beryllium falling prey to sharks circling to trigger liquidations.

Sharp corrections are a regular portion of immoderate market

However, astir crypto analysts said the underlying marketplace remains successful a beardown position.

“These kinds of crisp corrections are a mean portion of a marketplace cycle,” said Poblocki.

“What’s important is that we proceed to spot retail investors staying invested successful the marketplace and rotating toward blue-chip assets similar Bitcoin and Ethereum alternatively than exiting altogether. That’s a beardown motion of semipermanent confidence.”“ETF flows person softened somewhat successful enactment with broader hazard sentiment, but we’re not seeing large redemptions. The bigger representation hasn’t changed - that organization information remains high, and retail investors are taking a much disciplined approach,” helium added.

Arians said the marketplace pullback could reverse arsenic the fundamentals are heading successful the close direction, and determination is much regulatory clarity, much real-world usage cases and predominant instances of accepted concern stepping boldly into crypto.

“Even though prices consciousness soft, the infrastructure communicative underneath has ne'er looked stronger. Stablecoin volumes, onchain activity, developer momentum, each moving softly successful the close direction. The marketplace mightiness consciousness slow, but the rails being laid present are mounting up the adjacent cycle,” Arians added.

Crypto marketplace is inactive stronger than erstwhile cycles

McMillin shares a akin stance to macro expert and Wall Street seasoned Jordi Visser, who believes that aged Bitcoin holders are simply selling to caller traders who are acceptable to prime up the slack.

Related: Sour crypto temper could substance an unexpected rally this month: Santiment

“In anterior cycles, with this level of semipermanent holder selling, we would person seen a 70–80% drawdown by now; instead, contempt precise dense OG distribution, prices are down acold little due to the fact that ETFs and different organization channels are heavy capable to sorb a batch of that stock,” helium said.

“That’s a motion of a maturing market, and a indispensable question of coins from the fewer to the many.”Magazine: 2026 is the twelvemonth of pragmatic privateness successful crypto: Canton, Zcash and more

17 hours ago

17 hours ago

English (US)

English (US)