During the week ending March 15, 2 Federal Reserve backstop facilities were utilized by US banks to get a full of $164.8 billion.

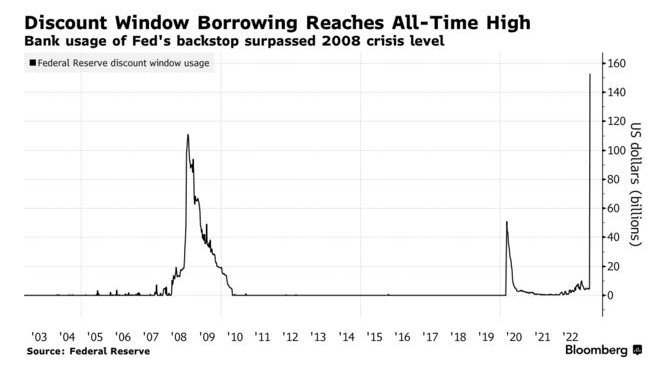

The accepted liquidity backstop for banks, besides known arsenic the discount window, saw a record-high borrowing of $152.85 billion, which accrued importantly from the erstwhile week’s $4.58 billion.

According to a March 17 study successful Bloomberg, this surpasses the all-time precocious of $111 cardinal reached during the 2008 fiscal crisis.

(Source: Bloomberg)

(Source: Bloomberg)According to the data, the Bank Term Funding Program, which is simply a caller exigency backstop launched by the Fed connected Sunday, recorded $11.9 cardinal successful borrowing. The combined recognition extended done some backstops highlights that the banking strategy is inactive susceptible and struggling with deposit outflows resulting from the caller collapses of Silicon Valley Bank of California and Signature Bank of New York.

Banking contagion

On March 16, the largest banks successful the state reached an statement to deposit astir $30 cardinal with First Republic Bank arsenic portion of an inaugural led by the US authorities to stabilize the struggling California-based lender.

This aft the determination past play by the US Treasury and the Federal Deposit Insurance Corp. (FDIC) to safeguard each depositors of SVB and Signature, going beyond the accustomed deposit security bounds of $250,000.

However, Reuters reported that immoderate slope bidding for Signature, 1 of the distressed banks that had a slope relationship belonging to Circle, would beryllium forced to springiness up immoderate crypto-related aspects of the business.

As it means for crypto, Circle, the founders of the 2nd largest stablecoin marketplace cap, USDC, the stablecoin was yet capable to get to its $1.00 peg, contempt trading to arsenic debased arsenic .88 cents implicit the weekend.

Read more: Circle says substantially each USDC minting, redemption backlogs are resolved aft chaotic week

“Trust, safety, and 1:1 redeemability of each USDC successful circulation is of paramount value to Circle,” CEO Jeremey Allaire said connected a March 16 episode of the Bankless podcast.

“I’m a precise heavy believer successful full-reserve banking,” Allaire added, the “idea that we don’t request to person a fractional reserve, wherever the basal furniture successful authorities work money, and the outgo strategy innovation built connected apical is done via the net utilizing software.”

The station US Banks get record-high $164.8B from Fed backstop facilities appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)