Bitcoin’s terms has struggled to support stableness supra $102,000 successful caller days, and information shows this is owed to an evident imbalance betwixt selling unit and caller demand.

On-chain information from CryptoQuant reveals that portion semipermanent holders person been actively taking profits, the marketplace is showing constricted capableness to sorb their sell-offs. This is simply a opposition to erstwhile phases of the bull run, wherever rising request was capable to offset accrued semipermanent holder activity.

Rising Long-Term Holder Selling Pressure Mirrors Past Bull Cycles

Data from on-chain analytics level CryptoQuant, which was initially shared by Julio Moreno, caput of probe astatine CryptoQuant, shows an absorbing alteration successful dynamics among Bitcoin holder enactment that could signifier the cryptocurrency’s adjacent move.

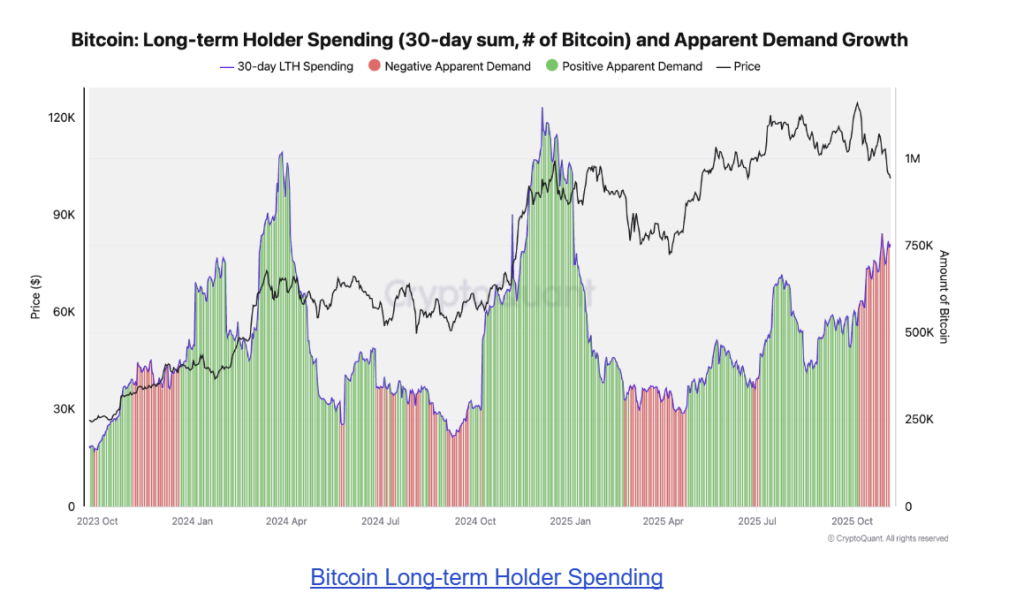

Julio Moreno explained that semipermanent holder (LTH) selling is simply a mean signifier successful bull markets arsenic investors instrumentality profits erstwhile Bitcoin approaches oregon surpasses all-time highs. The CryptoQuant information shows that the 30-day sum of LTH spending, represented by the purple enactment successful the illustration representation below, has been expanding since aboriginal October.

This behaviour follows erstwhile bullish rally phases, specified arsenic those seen successful aboriginal and precocious 2024, erstwhile profit-taking coincided with expanding demand, and truthful Bitcoin pushed to caller grounds prices.

The illustration accompanying Moreno’s station shows greenish areas representing periods of affirmative evident request maturation and reddish areas indicating contraction. During January to March 2024 and November to December 2024, LTH selloffs occurred arsenic request expanded.

Bitcoin Long-term Holder Spending

Since October 2025, however, that inclination has reversed. Even arsenic LTH selling increased, request has entered a reddish zone, showing that the market’s quality to sorb this selling unit has weakened. This has coincided with Bitcoin’s conflict to prolong its presumption supra $102,000, suggesting that terms maturation mightiness beryllium losing momentum.

Sustained Weak Demand Could Delay Next Rally

Moreno noted that the captious origin to ticker isn’t conscionable the measurement of semipermanent holder sell-offs but whether request maturation tin support pace.

When request is strong, the influx of proviso from semipermanent holders often drives steadfast consolidation earlier different terms surge. In contrast, erstwhile request falls behind, the effect tends to beryllium prolonged corrections oregon sideways movement.

A ample information of that request present comes from Spot Bitcoin ETFs, which person seen a crisp slowdown successful inflows. Data from SosoValue shows that US-based Spot Bitcoin ETFs ended past week with nett outflows of $558.44 cardinal connected Friday, November 7, 1 of the largest single-day outflows successful weeks.

Unless Bitcoin’s evident request begins to retrieve successful the coming weeks and LTH sell-offs continue, past this mightiness proceed to measurement connected terms enactment and postpone the adjacent limb of Bitcoin’s rally. In this case, we mightiness proceed to spot Bitcoin consolidating betwixt $101,000 and $103,000 for the remainder of November.

At the clip of writing, Bitcoin is trading astatine $101,655, down by 0.6% successful the past 24 hours.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)