There’s thing astir large intelligence terms levels, similar bitcoin's (<a href="https://www.coindesk.com/price/bitcoin/ " target="_blank">BTC</a>) $100,000 mark. As prices adjacent these thresholds, thing tied to the plus gets an other spark of energy.

The Nasdaq-listed ProShares UltraShort Bitcoin ETF (SBIT) is simply a lawsuit successful point, posting grounds trading measurement of implicit 8 cardinal shares connected Nov. 13 arsenic bitcoin topped $90,000 for the archetypal clip and strengthening the lawsuit for a rally into six figures by year-end, information tracked by TradingView show.

Since then, BTC has held betwixt $90,000 and $100,000, and the ETF's regular trading measurement has averaged conscionable implicit 5 cardinal shares. That's importantly greater than the sub-2 cardinal readings implicit the preceding months.

The ETF seeks to present doubly the inverse regular terms show of bitcoin, truthful that if BTC falls by 1%, the ETF rises by 2%, offering a leveraged bearish stake connected the cryptocurrency.

The spike successful measurement could beryllium associated with the capitulation of investors who bought the ETF aboriginal this twelvemonth anticipating a descent successful BTC. Or it could beryllium bulls protecting their agelong positions successful spot/futures markets from imaginable BTC terms pullbacks arsenic the cardinal $100,000 level approaches.

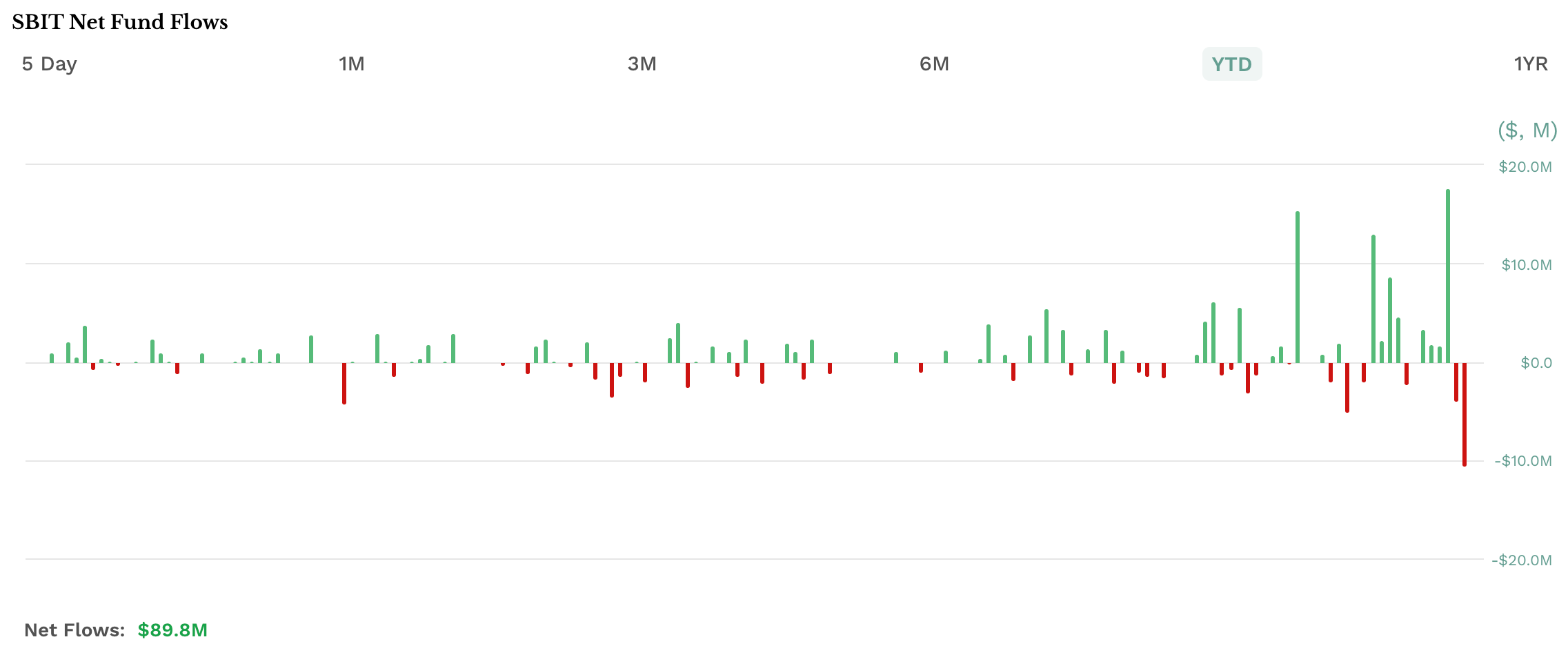

The second seems to beryllium the case, due to the fact that inflows into the ETF person picked up. The money registered a nett inflow of $17.7 cardinal connected Friday, the astir since its debut successful April, according to information root ETF.com.

Those bulls, however, whitethorn beryllium feeling demoralized arsenic the 11 spot bitcoin ETFs person accumulated implicit $2.5 cardinal successful nett inflows since Nov. 13, according to information tracked by <a href="https://farside.co.uk/btc/" target="_blank">Farside Investors</a>.

11 months ago

11 months ago

English (US)

English (US)