US President Donald Trump is reportedly acceptable to motion an enforcement bid that could let American 401(k) status plans to put successful alternate assets extracurricular of stocks and bonds, specified arsenic cryptocurrencies.

The enforcement bid could beryllium signed sometime this week, the Financial Times reported connected Thursday, citing 3 radical who person been briefed connected the plans.

The caller 401(k) concern options could tally crossed a wide spectrum of assets, including digital assets, metals and funds focused connected infrastructure deals, firm takeovers and backstage loans.

The enforcement bid would instruct Washington regulatory agencies to analyse the champion way guardant for 401(k) plans to commencement investing successful crypto, and analyse immoderate remaining obstacles to making it a reality, according to the Financial Times.

Trump has the last accidental connected whether it’s official

However, successful a connection to Cointelegraph, White House spokesperson Kush Desai said thing should beryllium deemed arsenic authoritative unless it comes from Trump himself.

“President Trump is committed to restoring prosperity for mundane Americans and safeguarding their economical future,” helium said.

“No decisions should beryllium deemed official, however, unless they travel from President Trump himself.”In May, the US Labor Department rescinded guidance issued during the Biden medication that constricted the inclusion of cryptocurrency successful 401(k) status plans.

Meanwhile, successful April, Cointelegraph reported that fiscal services institution Fidelity, which has $5.9 trillion successful assets nether management, introduced a caller status relationship allowing Americans to put successful crypto.

Standard 401(k) focuses connected stocks and bonds

A 401(k) is simply a status savings program offered by galore US employers that allows employees to prevention and put a information of their paycheck successful the funds earlier taxes are taken out.

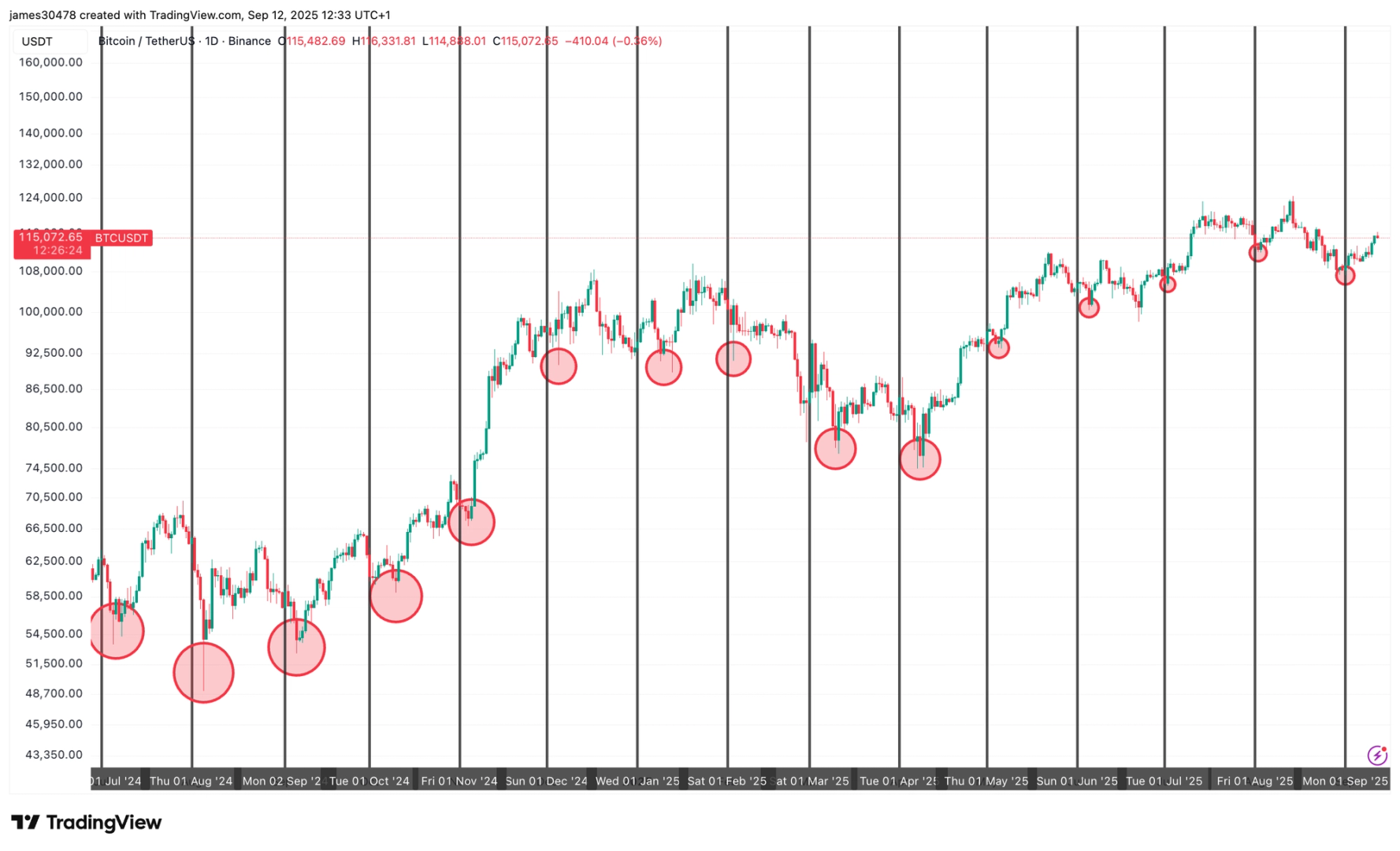

Typically, investments absorption connected communal funds, exchange-traded funds, stocks and bonds, depending connected the plan. The 401(k) marketplace held $8.9 trillion successful assets arsenic of Sept. 30, 2024, successful much than 715,000 plans.

Related: 20% of Gen Z, Alpha sees crypto arsenic status alternative: Report

At a authorities level, successful March, North Carolina lawmakers already introduced bills successful the House and Senate that could spot the state’s treasurer allocate up to 5% of assorted authorities status funds into crypto similar Bitcoin (BTC).

Other countries are looking astatine crypto successful status plans

In November past year, the United Kingdom-based pension specializer Cartwright reported that an “unnamed scheme” had made a 3% allocation of Bitcoin into its pension fund.

Meanwhile, Japan’s Government Pension Investment Fund was also considering Bitcoin arsenic a imaginable diversification tool successful March of past year.

Magazine: Older investors are risking everything for a crypto-funded retirement

1 month ago

1 month ago

English (US)

English (US)