A question of regulatory unit rippling done the U.S. crypto marketplace has pushed traders distant from Bitcoin (BTC) and Ethereum (ETH) and towards the seeming information of stablecoins.

This displacement aligns with the emergence of a burgeoning governmental question successful the U.S. aiming to enforce stringent controls connected the crypto and mining sectors. Proponents of the caller regularisation reason that the disruptive quality of cryptocurrencies demands a tighter regulatory grip to guarantee stableness and information successful the fiscal ecosystem.

On the different hand, critics explicit concerns that heavy-handed regularisation could stifle innovation and thrust the manufacture offshore. This polarizing statement has created an ambiance of uncertainty that is reshaping trading behaviors.

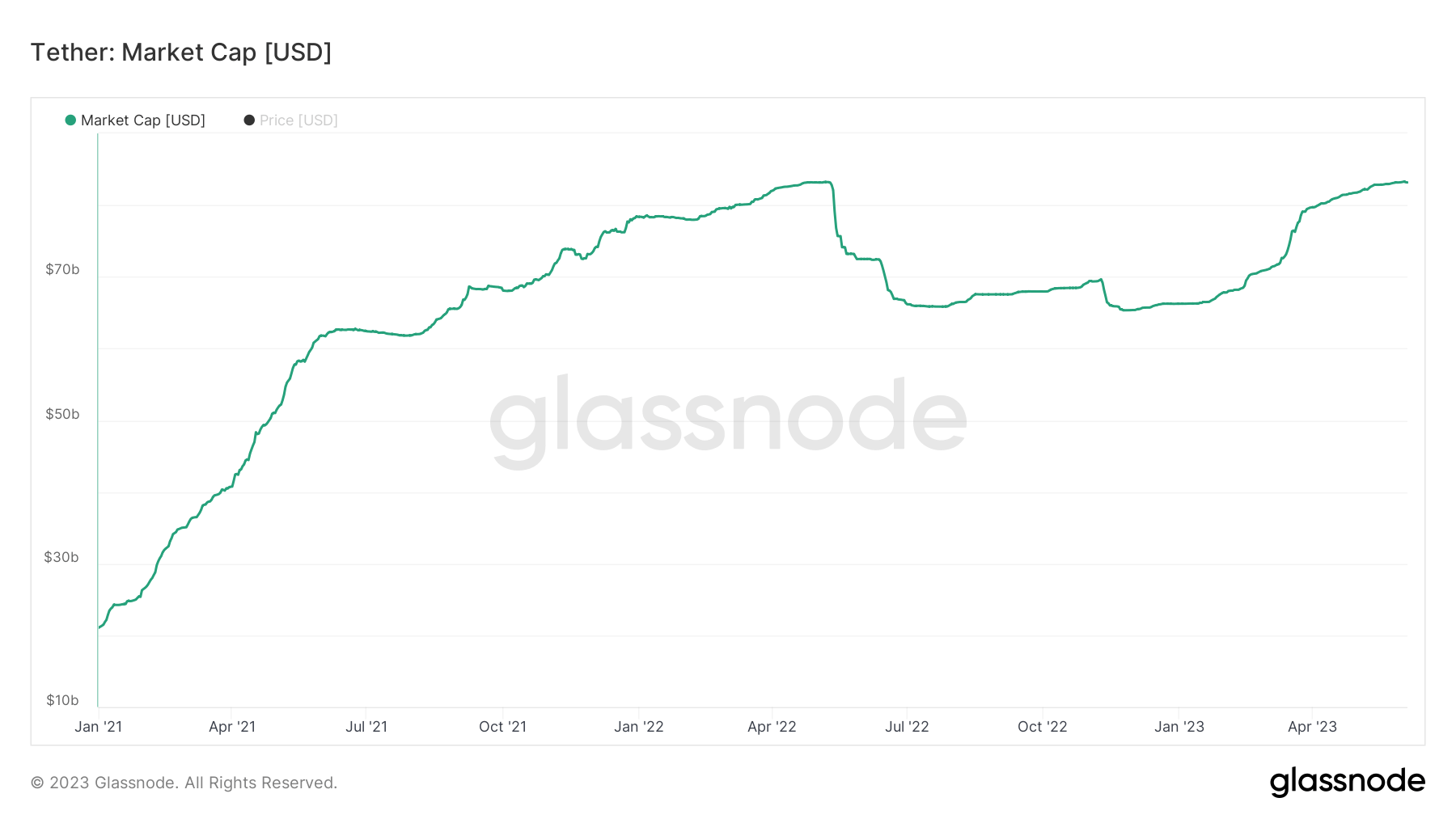

These regulatory pressures look to beryllium nudging traders toward the stableness of stablecoins. This is distinctly observed successful the behaviour of Tether’s USDT, whose proviso reached an all-time high of $83.2 cardinal connected June 3rd. Around $17 cardinal of this fig has been added to Tether’s marketplace headdress successful 2023 alone.

Graph showing Tether’s marketplace headdress from January 2021 to June 2023 (Source: Glassnode)

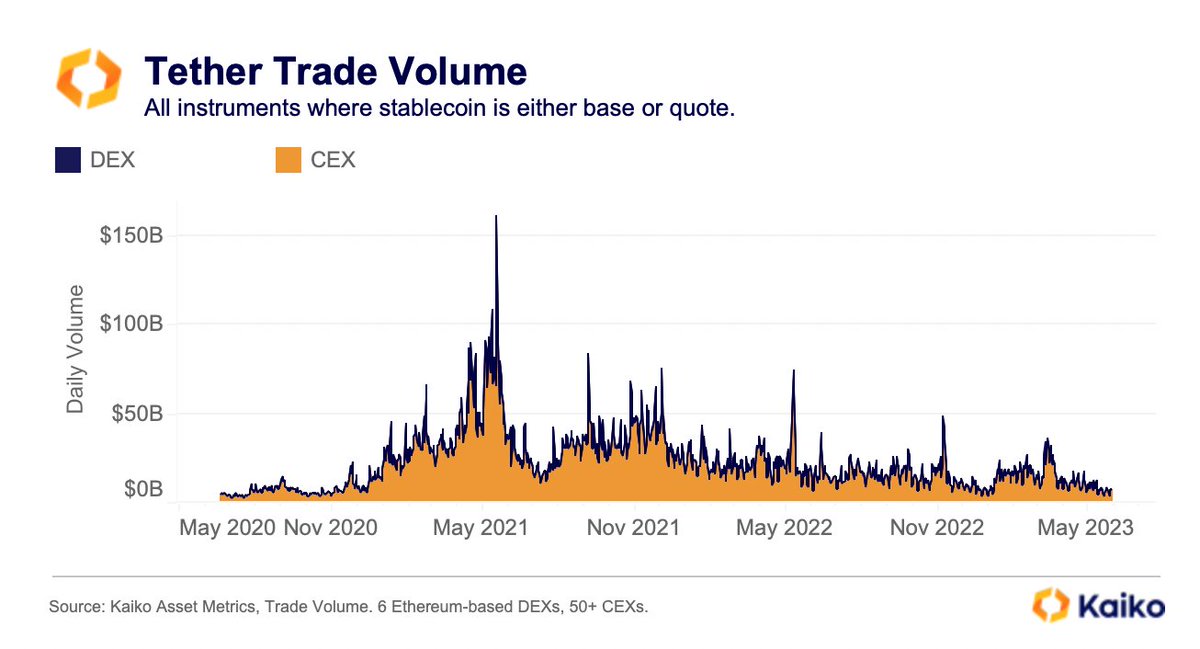

Graph showing Tether’s marketplace headdress from January 2021 to June 2023 (Source: Glassnode)However, contempt Tether’s increasing marketplace capitalization, its trading measurement is experiencing a downward trend. Data from Kaiko showed that connected some CEXs and DEXs, regular USDT measurement averaged astir $7 cardinal successful May, reaching multi-year lows. This seeming contradiction indicates that portion the wide proviso is increasing, progressive trading of the plus is decreasing.

Graph showing Tether’s trading measurement connected centralized and decentralized exchanges from May 2020 to May 2023 (Source: Kaiko)

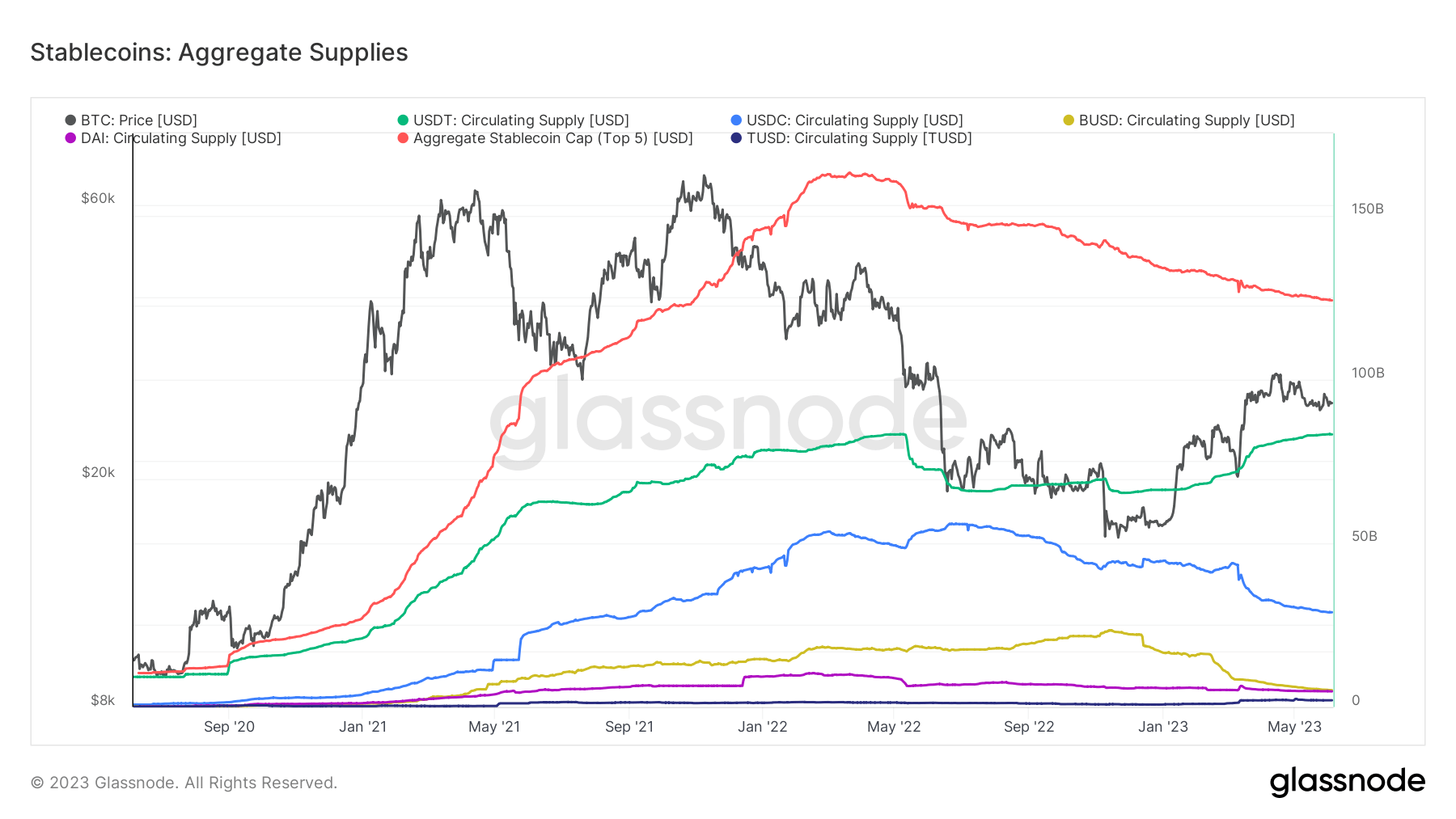

Graph showing Tether’s trading measurement connected centralized and decentralized exchanges from May 2020 to May 2023 (Source: Kaiko)Conversely, different important players successful the stablecoin market, USDC, and BUSD, witnessed their proviso driblet to multi-year lows.

Graph showing the aggregate proviso of stablecoins from June 2020 to June 2023 (Source: Glassnode)

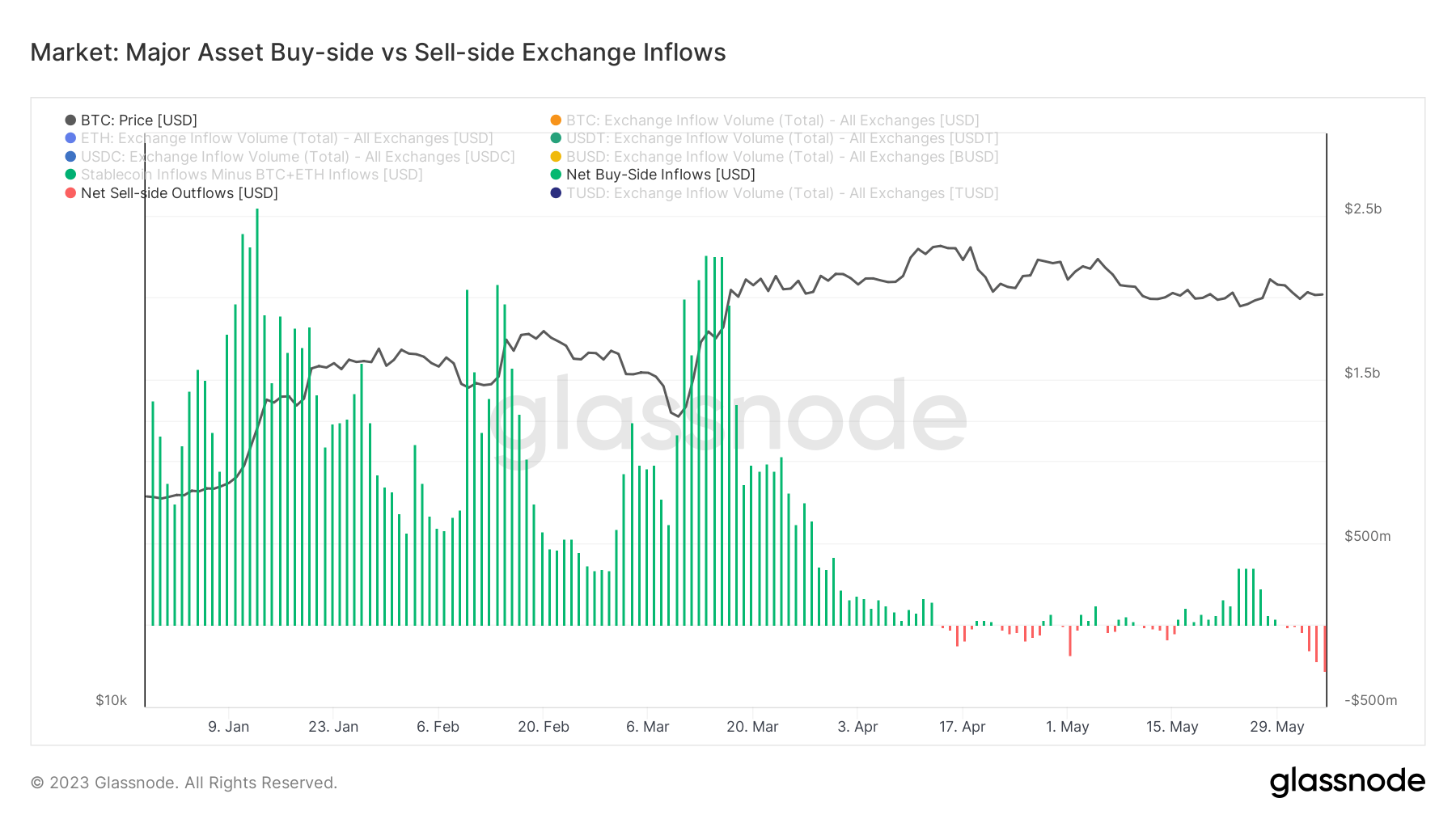

Graph showing the aggregate proviso of stablecoins from June 2020 to June 2023 (Source: Glassnode)Analyzing speech inflows reveals an breathtaking trend. Since April, request for stablecoins connected exchanges has weakened, with BTC and ETH inflows compensating for this. Despite the sustained inflow, the 2 cryptocurrencies person been chiefly trading sideways oregon experiencing adverse terms action, indicating that astir inflows are apt sell-side.

Graph showing the buy-side and sell-side inflows for Bitcoin and Ethereum successful 2023 (Source: Glassnode)

Graph showing the buy-side and sell-side inflows for Bitcoin and Ethereum successful 2023 (Source: Glassnode)Stablecoins, being non-interest bearing and exempt from superior gains taxes, connection a definite allure to traders. Their quality doesn’t make the taxable events integral to trading BTC oregon ETH, which is peculiarly charismatic to U.S. traders starting to consciousness the compression of accrued regulatory scrutiny and imaginable enforcement actions.

The station Traders crook to stablecoins arsenic regulatory unit successful the US ramps up appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)