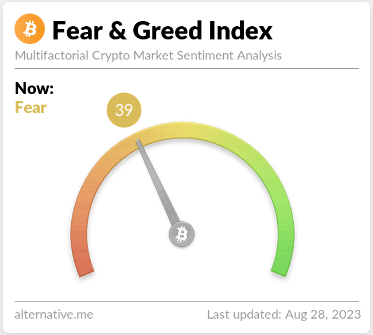

Bitcoin (BTC) is presently marked by cautious sentiments arsenic the Crypto Fear and Greed Index holds dependable wrong the fearfulness zone, scoring 39 retired of 100 and showing a flimsy summation from the erstwhile day.

This sentiment reflects the prevailing uncertainty successful the cryptocurrency realm. Amidst this backdrop, Bitcoin’s terms inclination takes halfway stage, influenced by the evolving dynamics of the market.

Zooming successful connected the terms enactment reveals a chiseled signifier connected the 4-hour timeframe. Bitcoin’s price, guided by a falling transmission pattern, traces a accordant downtrend, oscillating betwixt 2 parallel trendlines.

This terms question hints astatine the enactment of a well-recognized bullish reversal pattern, known arsenic the falling parallel channel.

At its existent valuation of $25,877 according to CoinGecko, Bitcoin experienced a insignificant 0.6% dip successful the past 24 hours and a marginal 0.3% diminution implicit the past week.

Despite these fluctuations, the terms behaviour strikingly emulates the falling parallel channel, suggesting the imaginable for a displacement successful momentum.

Deciphering Bitcoin Falling Parallel Channel

The falling parallel transmission is simply a method signifier often observed during a downtrend. It features 2 parallel trendlines encompassing the terms enactment wrong a defined range.

The little trendline provides a enactment level, portion the precocious trendline acts arsenic resistance. This signifier typically indicates a imaginable inclination reversal, with a breakout supra the precocious trendline indicating an imminent bullish recovery.

For Bitcoin, a important breakout involving a 4-hour candle closure supra the precocious trendline could trigger the anticipated bullish bounce. This imaginable surge, according to price analysis, has the capableness to propel prices upwards by astir 8%, starring to a retest of the $28,500 resistance.

However, prudence remains paramount arsenic the overarching inclination inactive displays antagonistic undertones. Traders and cryptocurrency holders are urged to proceed cautiously astatine this absorption point, arsenic the imaginable for sellers to regain bearish momentum persists, perchance resulting successful an extended corrective phase.

Understanding The Fear And Greed Index’s Significance

In a sentiment-driven market, the Crypto Fear and Greed Index holds important importance. It offers invaluable insights into the corporate intelligence authorities of investors and traders, shedding airy connected their wide outlook.

A prolonged beingness wrong the little spectrum, exemplified by the existent fearfulness people of 39/100, underscores the prevailing apprehension and uncertainty among marketplace participants. This underscores the request for judicious decision-making amidst the interplay of method patterns and marketplace sentiment.

The sustained presumption of the Crypto Fear and Greed Index wrong the fearfulness zone, coupled with Bitcoin’s terms dynamics marked by the falling parallel channel, underscores the intricate interplay of forces wrong the cryptocurrency market.

As traders intimately show the imaginable breakout and its imaginable repercussions, exercising caution remains pivotal successful navigating this intricate landscape.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Makersplace

2 years ago

2 years ago

English (US)

English (US)