The Bitcoin marketplace remains successful a prolonged correction phase, registering a 10.4% terms driblet successful the past 7 days. As aggregate analysts effort to illustration the asset’s terms trajectory amid this volatile period, caller on-chain information person revealed imaginable section bottommost targets.

$55,900 Or $44,700 – How Low Can Bitcoin Go?

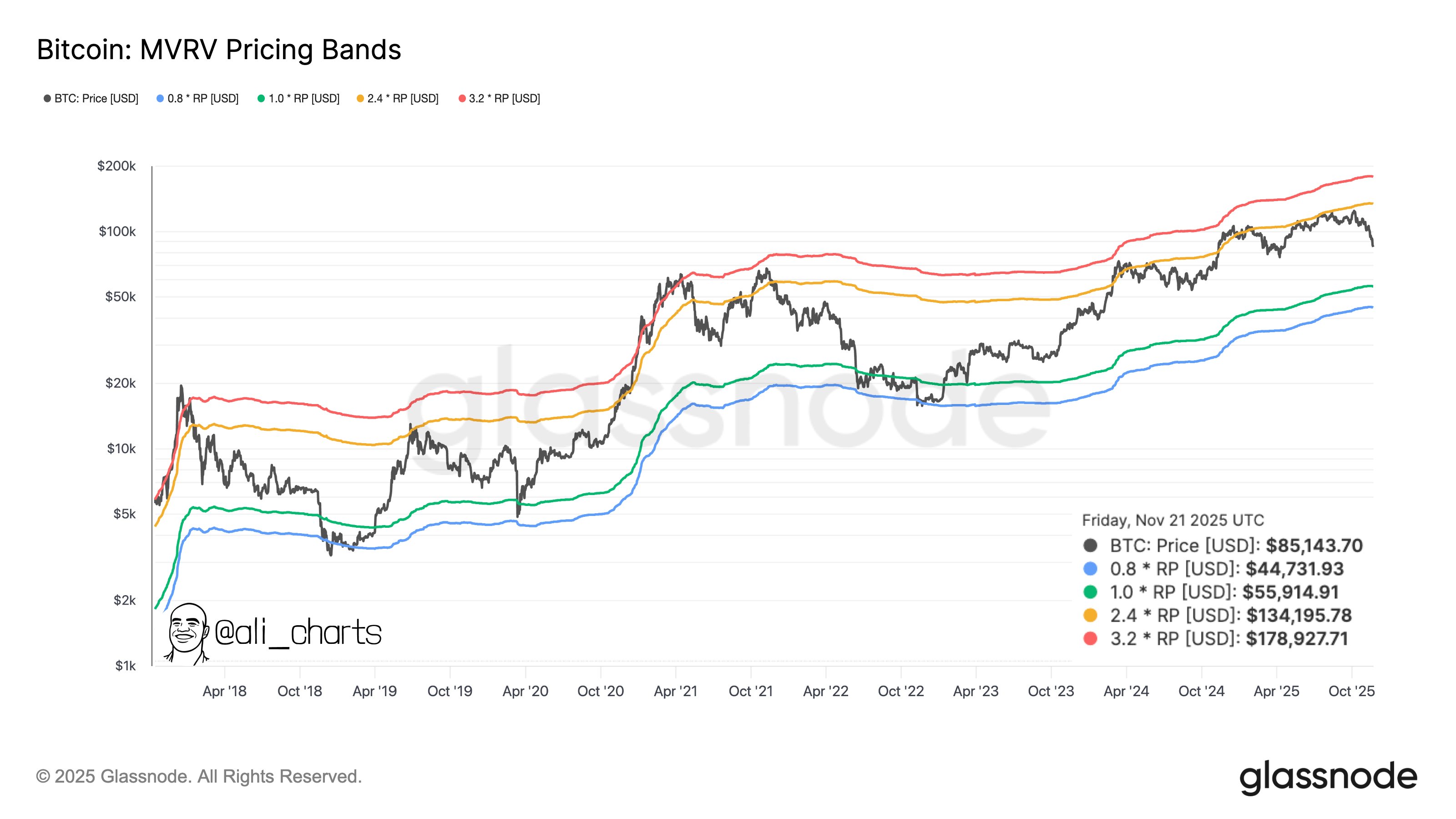

In an X post connected November 23, salient marketplace expert Ali Martinez shares immoderate penetration connected Bitcoin’s imaginable downside targets, amid the dense terms correction seen successful caller weeks. Since hitting a caller all-time precocious of $126,198.07 successful aboriginal October, the starring cryptocurrency has recorded aggregate dense terms drops, trading arsenic debased arsenic $81,000. Despite increasing fears of a carnivore market, respective analysts inactive see the caller downswings to beryllium a specified correction, with the anticipation of a section bottommost and eventual terms rebound successful the coming weeks. Using information from the MVRV Pricing Bands, Martinez has identified 2 imaginable targets for this anticipated terms bottom.

Source: @ali_charts connected X

Source: @ali_charts connected XGenerally, the MVRV Pricing Bands are terms levels derived from the Market Value to Realized Value (MVRV) ratio that bespeak whether a cryptocurrency is apt overvalued, undervalued, oregon reasonably valued comparative to the mean terms paid by investors. As seen successful the illustration above, these pricing levels person fixed multiples, i.e, 0.8x, 1.0x, 2.4x, 3.2x, that correspond assorted degrees of undervaluation oregon overvaluation.

According to Martinez, Bitcoin has historically shown to found a section bottommost anytime it dipped beneath the 1.0*Realized Price (RP) (green line), and 0.8*RP (blue line), arsenic seen astir October 2018, April 2020, and November 2022. Presently, the 1.0*RP and 0.8*RP basal astatine $55,914 and $44,713, respectively, suggesting the premier cryptocurrency could inactive acquisition further terms correction betwixt 35% to 48% earlier relaunching different bullish wave.

On the different hand, if a bullish rebound occurs earlier oregon aft hitting the section bottommost targets, the MVRV pricing bands uncover awesome upside targets astatine $134,195 (2.4*RP) and $178,927 (3.2*RP), respectively.

Bitcoin Market Overview

At the clip of writing, Bitcoin continues to commercialized astatine $85,938 pursuing a flimsy terms summation of 1.15% successful the past day. Meanwhile, the asset’s regular trading measurement is down by 68.09% and valued astatine $40.75 billion.

Amid Bitcoin’s terms struggles, the US BTC Spot ETFs person besides witnessed a likewise important level of capitalist flight. According to data from SoSoValue, these concern funds person registered a full nett outflow of $4.339 cardinal successful the past 4 weeks.

Featured representation from Flickr, illustration from Tradingview

1 hour ago

1 hour ago

English (US)

English (US)