By Omkar Godbole (All times ET unless indicated otherwise)

Suddenly, it's each astir Ethereum rival Solana and its autochthonal token SOL arsenic the broader marketplace holds its enactment up of Wednesday's Federal Reserve complaint decision.

Michael Novogratz, the laminitis and CEO of Galaxy Investment, says Solana could evolve to go a colony infrastructure successful planetary finance. Why? Because the blockchain tin grip implicit 6 cardinal transactions a day, which is mode higher than the 400 million-700 cardinal trades planetary securities markets usually woody with, helium said. Speed matters.

At BaseCamp 2025, Coinbase’s layer-2 web hinted astatine plans for a token motorboat that could accelerate decentralization and unveiled a Solana span to boost cross-chain connectivity. Pantera Capital's Dan Morehead announced that Solana is their largest bet, valued astatine $1.1 billion, calling it the fastest and best-performing blockchain, which has outpaced adjacent Bitcoin implicit the past 4 years.

If that's not enough, Kyle Samani, president of Nasdaq-listed Solana treasury institution Forward Industries, said implicit the play that the institution plans to deploy funds to boost the Solana-native decentralized concern ecosystem.

All these signs suggest SOL could outperform bitcoin (BTC), ether (ETH) and different large tokens if the Fed cuts rates by the 25 ground points this week, arsenic expected. If it surprises with a 50-basis-point move, things could get wild. Keep your eyes connected those SOL/BTC and SOL/ETH trading pairs.

Currently, SOL is trading astir $235 aft peaking adjacent $250 implicit the weekend. Other large cryptocurrencies are stuck successful neutral, trailing behind stocks, which proceed to deed caller highs.

On the stablecoin front, the Bank of England proposed limits connected however the worth of dollar-backed stablecoins an idiosyncratic tin hold, arsenic debased arsenic 10,000 pounds ($13,600), citing systemic risks. Stani Kulechov, Aave’s CEO, called the determination “absurd” and urged the crypto assemblage to basal up against specified regulations.

More countries, particularly those with existent relationship deficits, volition apt see akin measures to curb outflows that dodge accepted banks.

And arsenic for the accepted markets, Monday’s premix of rising stocks and the VIX, Wall Street’s fearfulness gauge, has immoderate observers raising their eyebrows. History shows these moments often precede marketplace corrections, truthful enactment alert!

What to Watch

- Crypto

- Sept. 16, 12 p.m.: Solana Live lawsuit connected X. Guests see Pump.fun co-founder Alon Cohen and Kyle Samani, president of Forward Industries (FORD) and the managing spouse of Multicoin Capital.

- Macro

- Sept. 16, 8 a.m.: Brazil July unemployment complaint Est. 5.7%.

- Sept. 16, 8:30 a.m.: Canada August header CPI YoY Est. 2%, MoM Est. 0%; halfway YoY Est. N/A (Prev. 2.6%), MoM Est. N/A (Prev. 0.1%).

- Sept. 16, 8:30 a.m.: U.S. August retail income YoY Est. N/A (Prev. 3.9%), MoM Est. 0.3%.

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting truthful unlocked portions persist aft burns. Voting ends Sept. 16.

- Sept. 16: Aster Network to big a community call.

- Sept. 18, 6 a.m.: Mantle to host Mantle State of Mind, a monthly downhill series.

- Sept. 16, 12 p.m.: Kava to big a assemblage Ask Me Anything (AMA) session.

- Unlocks

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $45.92 million.

- Token Launches

- Sept. 16: Merlin (MRLN) to beryllium listed connected Binance Alpha, MEXC, BitMart, Gate.io, and others.

Conferences

- Day 2 of 7: Budapest Blockchain Week 2025 (Budapest, Hungary)

- Day 1 of 2: Real-World Asset Summit (New York)

Token Talk

By Oliver Knight

- As the crypto marketplace stays wrong a choky scope aft a little highest and trough connected Monday, 1 token is moving its ain race: IMX is up 15% successful the past 24 hours with regular trading measurement doubling to $144 million.

- The emergence lifted IMX, the autochthonal token of Web3 gaming level Immutable, to a five-month high.

- Bullish sentiment astir Immutable tin beryllium attributed to an SEC probe that was dropped earlier this twelvemonth and wide optimism astir the gaming sector. Gaming is estimated to scope $200 cardinal successful gross this twelvemonth with further maturation forecast successful 2026 alongside the merchandise of Rockstar Gaming's Grand Theft Auto 6.

- Immutable is good positioned to capitalize connected that maturation aft teaming up with gaming elephantine Ubisoft connected the adjacent iteration of Might and Magic Fates successful April.

- Blockchain exertion could person a cardinal relation to play successful gaming if trends displacement toward in-game ownership of items, which could spot the implementation of non-fungible tokens (NFTs) wrong a crippled that could past beryllium collected oregon sold connected for crypto tokens.

- IMX is presently trading astatine $0.736 having breached retired of a cardinal level of resistance. It volition apt travel backmost to trial $0.70 arsenic enactment earlier perchance moving higher, provided trading measurement tin prolong astatine these levels.

Derivatives Positioning

- Most large cryptocurrencies, including BTC and ETH, continued to acquisition superior outflows from futures, starring to a diminution successful unfastened interest.

- AVAX stands retired with OI rising implicit 14% arsenic the token's marketplace headdress looks to ascent supra $13 cardinal for the archetypal clip since Feb. 2.

- Solana OI has reached a grounds precocious of implicit 70 cardinal SOL, with affirmative backing rates pointing to bullish superior inflows.

- On the CME, OI successful solana futures pulled backmost to 7.63 cardinal SOL from the grounds 8.12 cardinal SOL connected Sept. 12. Still, the three-month annualized premium holds good supra 15%, offering an charismatic output for transportation traders.

- BTC CME OI continues to improve, but wide positioning remains airy comparative to ether and SOL futures.

- On Deribit, the bias for BTC and ETH enactment options continues to easiness crossed each tenors arsenic traders expect Fed complaint cuts. SOL and XRP options stay biased bullish.

- On OTC web Paradigm, artifact flows featured BTC calendar spreads and shorting of telephone and enactment options.

Market Movements

- BTC is unchanged from 4 p.m. ET Monday astatine $115,500.55 (24hrs: +0.54%)

- ETH is unchanged astatine $4,513.45 (24hrs: -0.49%)

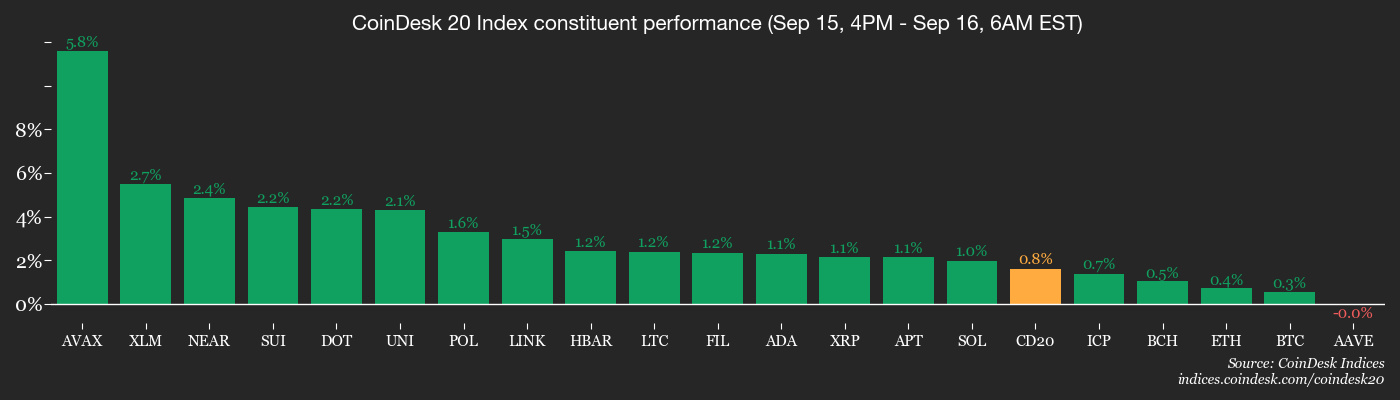

- CoinDesk 20 is up 0.48% astatine 4,271.28 (24hrs: +0.71%)

- Ether CESR Composite Staking Rate is up 5 bps astatine 2.87%

- BTC backing complaint is astatine 0.0059% (6.4616% annualized) connected Binance

- DXY is down 0.32% astatine 96.99

- Gold futures are up 0.42% astatine $3,734.70

- Silver futures are up 0.53% astatine $43.19

- Nikkei 225 closed up 0.3% astatine 44,902.27

- Hang Seng closed unchanged astatine 26,438.51

- FTSE is down 0.22% astatine 9,256.41

- Euro Stoxx 50 is unchanged astatine 5,437.55

- DJIA closed connected Monday up 0.11% astatine 45,883.45

- S&P 500 closed up 0.47% astatine 6,615.28

- Nasdaq Composite closed up 0.94% astatine 22,348.75

- S&P/TSX Composite closed up 0.5% astatine 29,431.02

- S&P 40 Latin America closed up 1.64% astatine 2,904.55

- U.S. 10-Year Treasury complaint is unchanged astatine 4.037%

- E-mini S&P 500 futures are up 0.19% astatine 6,633.75

- E-mini Nasdaq-100 futures are up 0.29% astatine 24,380.00

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,902.00

Bitcoin Stats

- BTC Dominance: 58.11% (unchanged)

- Ether to bitcoin ratio: 0.03907 (-0.36%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.98

- Total Fees: 4.41 BTC / $508,109

- CME Futures Open Interest: 140,975 BTC

- BTC priced successful gold: 31.2 oz

- BTC vs golden marketplace cap: 8.82%

Technical Analysis

- The monthly illustration shows that BTC is again probing the trendline connecting the erstwhile bull marketplace peaks.

- Bulls failed to found a foothold supra that trendline successful July and August.

- A 3rd consecutive nonaccomplishment could truly embolden sellers, perchance yielding a deeper drop.

Crypto Equities

- Coinbase Global (COIN): closed connected Monday astatine $327.02 (+1.23%), +0.27% astatine $327.91

- Circle (CRCL): closed astatine $134.05 (+6.97%), unchanged successful pre-market

- Galaxy Digital (GLXY): closed astatine $30.77 (+3.6%), +0.58% astatine $30.95

- Bullish (BLSH): closed astatine $51.08 (-1.47%), +0.59% astatine $51.38

- MARA Holdings (MARA): closed astatine $16.24 (-0.43%), unchanged successful pre-market

- Riot Platforms (RIOT): closed astatine $16.68 (+4.97%), +1.08% astatine $16.86

- Core Scientific (CORZ): closed astatine $16.32 (+2.9%), +0.37% astatine $16.38

- CleanSpark (CLSK): closed astatine $10.29 (-0.58%), +0.1% astatine $10.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $38.73 (+3.78%), +1.96% astatine $39.49

- Exodus Movement (EXOD): closed astatine $27.88 (-1.69%), -1.94% astatine $27.34

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $327.79 (-1.1%), +0.34% astatine $328.89

- Semler Scientific (SMLR): closed astatine $28.39 (-2.74%)

- SharpLink Gaming (SBET): closed astatine $16.79 (-5.14%), +0.54% astatine $16.88

- Upexi (UPXI): closed astatine $6.33 (-6.29%), +0.95% astatine $6.39

- Lite Strategy (LITS): closed astatine $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $259.9 million

- Cumulative nett flows: $57.05 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily nett flows: $359.7 million

- Cumulative nett flows: $13.74 billion

- Total ETH holdings ~6.53 million

Source: Farside Investors

While You Were Sleeping

- Gold Uptrend Intact, but Due for Correction Before Topping $4,000 successful 2026 (Reuters): Gold has surged 40% successful 2025, outpacing the S&P 500. Analysts pass it looks overbought and whitethorn diminution earlier targeting $4,000 adjacent year.

- Coinbase Policy Chief Pushes Back connected Bank Warnings That Stablecoins Threaten Deposits (CoinDesk): Coinbase’s Faryar Shirzad said concerns of stablecoin deposit formation are myths, claiming banks are truly defending profits from an outdated payments system.

- King Charles Rolls Out the Red Carpet to Woo Trump (The Wall Street Journal): U.K. Prime Minister Keir Starmer is utilizing royal pageantry to sway Trump connected tariffs and European security, portion the sojourn volition showcase caller U.S.-U.K. practice successful exertion and energy.

- Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets (CoinDesk): The Deutsche Börse subsidiary launched AnchorNote successful Switzerland, letting institutions commercialized integer assets crossed venues portion keeping them successful custody to chopped counterparty hazard and amended superior efficiency.

1 month ago

1 month ago

English (US)

English (US)