Analysts suggest stabilization supra $0.165 is important for recovery, with a regular adjacent supra $0.18 needed to antagonistic bearish momentum.

Updated Nov 4, 2025, 2:19 a.m. Published Nov 4, 2025, 2:18 a.m.

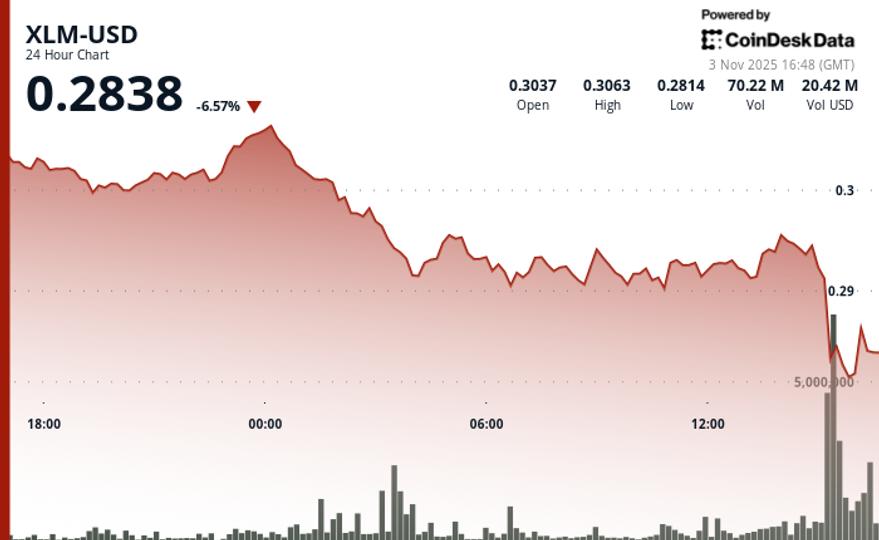

(CoinDesk Data)

What to know:

- Dogecoin fell 8% to $0.1697 arsenic whales sold $440 cardinal successful tokens, causing trading measurement to surge.

- The breakdown done $0.18 confirmed sustained organization selling and a displacement successful marketplace structure.

- Analysts suggest stabilization supra $0.165 is important for recovery, with a regular adjacent supra $0.18 needed to antagonistic bearish momentum.

Dogecoin fell sharply Tuesday, losing 8% to $0.1697 arsenic whales dumped $440 cardinal successful tokens and trading measurement surged to multi-week highs. The breakdown done $0.18 marked a decisive displacement successful structure, confirming sustained organization organisation crossed the meme-coin complex.

News Background

- DOGE declined from $0.1843 to $0.1697 implicit the 24-hour period, breaching aggregate enactment zones and establishing caller monthly lows. Volume spiked to 3.37 cardinal tokens — 426% supra regular averages — arsenic cascading stop-losses accelerated the move.

- The breakdown followed a failed defence of the 0.236 Fibonacci retracement astatine $0.1787, which triggered liquidation flows and algorithmic selling.

- Bears extended power done midday, driving DOGE to an intraday debased of $0.1641 earlier constricted dip-buying emerged.

- Market flows turned decisively antagonistic arsenic on-chain information recorded $22.27 cardinal successful regular outflows, portion futures turnover roseate 50% to $5.25 cardinal adjacent arsenic unfastened involvement slid 4% to $1.67 cardinal — grounds of wide deleveraging alternatively than caller speculative demand.

Price Action Summary

- The $0.18 breakdown represented a structural nonaccomplishment of a enactment portion defended since aboriginal October. Sellers absorbed bids crossed each rebound, confirming a descending-channel continuation pattern.

- Intraday information showed the heaviest selling betwixt 03:00–05:00 UTC, with measurement peaks supra 1 cardinal tokens.

- Attempts to reclaim $0.1760 absorption met contiguous rejection. The league closed adjacent the bottommost quartile of the range, underscoring persistent organization control.

Technical Analysis

- Whale behaviour reinforced the bearish picture. Addresses holding 10 million–100 cardinal DOGE off-loaded astir 440 cardinal tokens implicit 3 sessions, marking 1 of the steepest mid-tier wallet liquidations this quarter.

- Momentum indicators corroborate short-term capitulation risk: RSI dropped to 34.7, approaching oversold territory that historically precedes alleviation rallies.

- Still, the descending-channel enactment remains intact, projecting imaginable hold toward the $0.165–$0.150 request portion wherever erstwhile accumulation occurred.

What Traders Should Know

- DOGE’s contiguous outlook hinges connected stabilization supra $0.165. Analysts enactment the token’s caller signifier of 6–9% single-day drawdowns often precedes little method bounces, but sustained betterment requires a regular adjacent supra $0.18–$0.185 to neutralize bearish momentum.

- Short-term traders presumption rallies into $0.1760–$0.1800 arsenic organisation opportunities unless broader hazard sentiment improves.

- With whale flows antagonistic and leverage unwinding, near-term volatility remains skewed to the downside until measurement contraction confirms capitulation.

More For You

OwlTing: Stablecoin Infrastructure for the Future

Stablecoin outgo volumes person grown to $19.4B year-to-date successful 2025. OwlTing aims to seizure this marketplace by processing outgo infrastructure that processes transactions successful seconds for fractions of a cent.

More For You

XRP Triangle Tightens arsenic Token Falls 6%, Watch This Price Level For Further Breakdown

The determination reflected cautious accumulation alternatively than wide conviction, arsenic trading volumes remained beneath inclination contempt aggregate volatility spikes during the session.

What to know:

- XRP gained 2.75% to $2.34, underperforming the broader crypto marketplace with trading volumes beneath trend.

- The token faced absorption astatine $2.44 and established $2.33 arsenic a enactment basal amid precocious intraday volatility.

- Traders are focused connected the $2.54 absorption portion for imaginable breakout confirmation, with marketplace volatility expected to stay elevated.

6 hours ago

6 hours ago

English (US)

English (US)