Solana (SOL), a furniture 1 proof-of-stake blockchain, has introduced mentation 1.16, which enhances idiosyncratic privateness done “Confidential Transfers.” This update includes encrypted Solana Program Library (SPL) token transactions, ensuring confidentiality alternatively than anonymity.

The adoption of mentation 1.16 by Solana’s web of validators has reached a bulk aft 10 months of improvement and an audit by Halborn, a blockchain information firm.

Solana Labs Rolls Out Privacy-Enhancing Update

According to the announcement made by Solana’s infrastructure supplier Helius, The update has undergone rigorous testing, with v1.16 moving connected testnet since June 7, 2023.

Volunteer and canary nodes person reportedly played a important relation successful identifying and resolving issues during the investigating phase. Solana Labs has besides deployed canary nodes connected mainnet-beta to show the stableness of v1.16 nether real-world conditions.

Solana employs a diagnostic gross strategy to forestall consensus-breaking changes, ensuring that validators moving older versions bash not fork disconnected the canonical chain.

What’s more, Consensus-breaking changes present necessitate a Solana Improvement Document (SIMD) and greater transparency done documentation.

Confidential Transfers, introduced by Token2022, utilize zero-knowledge proofs to encrypt balances and transaction amounts of SPL tokens, prioritizing idiosyncratic privacy.

Looking ahead, Solana Labs plans to follow a much agile merchandise cycle, targeting smaller releases astir each 3 months.

Room For Growth

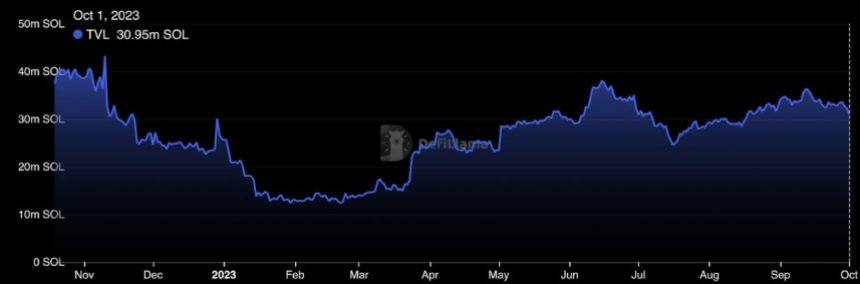

According to a Nansen report, Solana has witnessed a important surge successful its Total Value Locked (TVL) passim this year, astir doubling since the opening of 2023, and presently boasting a TVL of 30.95 cardinal SOL.

Solana’s TVL successful SOL. Source: Nansen connected X.

Solana’s TVL successful SOL. Source: Nansen connected X.Monthly transactions connected the Solana web person remained comparatively stable, with an summation successful ballot transactions, encompassing some ballot and non-vote transactions.

Furthermore, Nansen highlights that Solana has implemented innovative solutions specified arsenic authorities compression and isolated interest markets to code salient issues wrong its tech stack.

One notable solution, authorities compression, has substantially reduced the outgo of non-fungible token (NFT) minting connected Solana much than 2,000 times.

State Compression Unleashes Affordable NFT Minting

For instance, the outgo of minting 1 cardinal NFTs earlier the instauration of authorities compression would person amounted to astir $253,000. In contrast, with authorities compression enabled, the outgo is importantly reduced to conscionable $113.

In comparison, minting a akin postulation size connected Ethereum would outgo astir $33.6 million, and connected Polygon, it would magnitude to astir $32,800.

Furthermore, the liquid staking scenery connected Solana is experiencing accelerated growth, with starring platforms similar Marinade Finance, Lido Finance, and Jito taking the forefront.

However, contempt this growth, the existent magnitude of staked SOL successful Solana’s liquid staking protocols accounts for little than 3% of the full staked SOL, indicating important country for expansion.

It is worthy noting that the study by Nansen raises concerns astir the uncertainty surrounding FTX/Alameda’s SOL holdings, arsenic FTX holds implicit 71.8 cardinal SOL, representing astir 17% of the circulating proviso and 13% of the full supply.

While this concern whitethorn contiguous impermanent risks to Solana’s maturation trajectory, it is indispensable to show its interaction closely.

On the different hand, the autochthonal token of the protocol, SOL, continues to grounds important gains crossed each timeframes. The token is trading astatine $23.68, reflecting an summation of implicit 4% successful the past 24 hours.

Featured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)