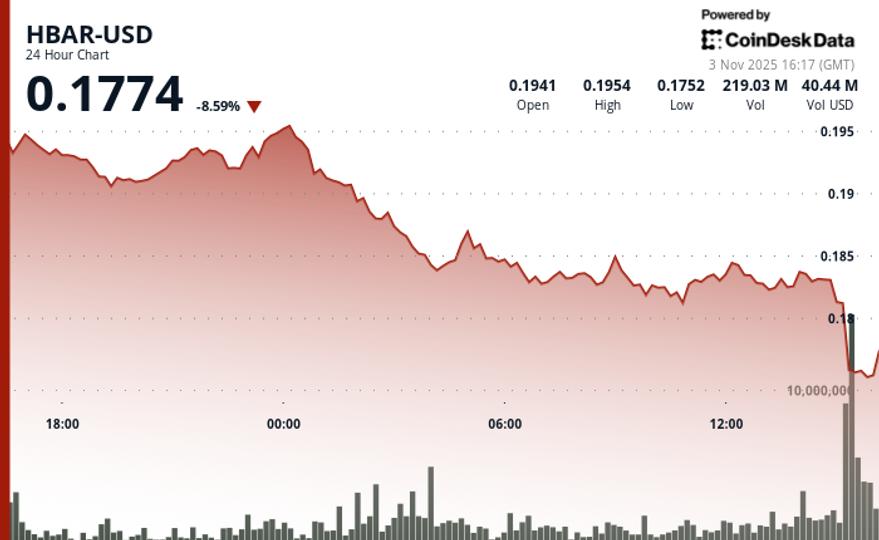

Key points:

Bitcoin slips nether $104,000 amid doubts implicit BTC terms support.

Price targets present see the CME futures spread astatine $92,000.

Short-term holders caput heavy into the red, sitting connected increasing unrealized losses.

Bitcoin (BTC) faced further losses Tuesday arsenic traders prepared for sub-$100,000 BTC terms levels.

Bitcoin terms successful “freefall” arsenic $104,000 slips

Data from Cointelegraph Markets Pro and TradingView tracked caller lows of $103,732 connected Bitstamp, with terms down implicit 2% connected the day.

Early weakness compounded during the Asia trading session, and now, marketplace participants progressively believed that $100,000 enactment would fail.

“$BTC is successful implicit escaped autumn close now,” crypto capitalist and entrepreneur Ted Pillows reacted connected X.

“There's nary beardown enactment until the $100,000 level, which means it'll astir apt get retested.”

Pillows eyed an unfilled play “gap” successful CME Group’s Bitcoin Futures marketplace at astir $92,000 — conscionable beneath the 2025 yearly open.

“If Bitcoin loses the $100,000 zone, expect a correction towards the $92,000 level, which has a CME gap,” helium added.

Trader Daan Crypto Trades warned that BTC/USD had mislaid its “main support” from caller weeks.

“Now nearing the bottommost of the scope wherever terms made its archetypal higher debased aft the bounce station 10/10 liquidation event,” an X station read, referring to the Oct. 10 crypto marketplace crash.

Daan Crypto Trades noted that, successful summation to “massive” selling by Bitcoin whales, US stocks had go little bullish, portion US dollar spot was rising — 3 imaginable headwinds for crypto.

“All successful each not a large look for the clip being,” helium concluded.

Derivatives trader Ardi was meantime among those eyeing a capable of the Oct. 10 candle wick, which connected Binance had reached $102,000.

This level features confluence with Bitcoin’s 50-week exponential moving mean (EMA) — a level untouched for 7 months.

Unrealized losses spark “capitulation”

Price unit successful crook led to renewed accent connected recent Bitcoin buyers, who were present underwater connected their holdings.

Related: Retail investors 'retreat’ to $98.5K: 5 things to cognize successful Bitcoin this week

Data from onchain analytics level Glassnode showed the Net Unrealized Profit/Loss (NUPL) indicator for short-term holders (STHs) returning to “capitulation” territory.

NUPL looks astatine the profitability of onchain transactions involving entities hodling for up to 155 days. At the clip of writing, it measured -0.058 — on the mode toward its lowest levels since April.

“Historically, specified periods of STH accent and capitulation person marked charismatic accumulation opportunities for diligent investors,” Glassnode commented connected X Monday.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 hours ago

4 hours ago

English (US)

English (US)