Solana was trading astatine 97% discount to ether’s marketplace headdress successful January of 2023 – a wide marketplace dislocation that has closed importantly implicit the past 2 years.

Today the spread has closed to a 70% discount.

However, solana is starting to situation ether successful presumption of on-chain enactment and important web usage KPIs.

Which begs the question: Is the marketplace inactive dislocated?

In this abbreviated piece, we research this cardinal question with comparative investigation crossed 4 cardinal information points. Let’s dive in.

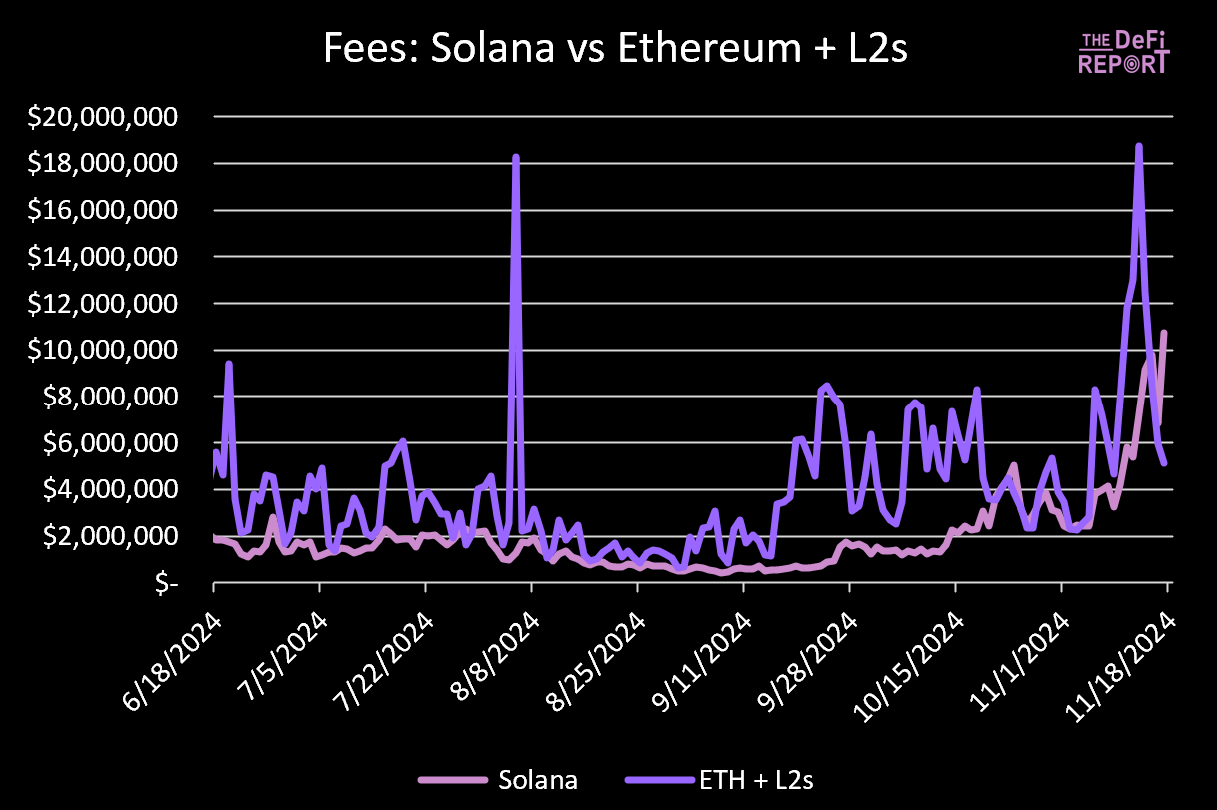

Network Fees

Data: Artemis, The DeFi Report, Gas Fees Only (does not see MEV). Please enactment that we’ve included the pursuing L2s successful the comps data: Arbitrum, Base, Optimism, Blast, Celo, Linea, Mantle, Scroll, Starknet, zkSync, Immutable, and Manta Pacific.

L2s make caller request for Ethereum L1 artifact abstraction and summation the web effects of ETH the asset. Therefore, we see them successful our comp investigation for solana.

In Q2, solana did $151M successful fees: 27% of ether + the apical L2s.

Fast guardant to the past 90 days and the ratio has jumped to 49%.

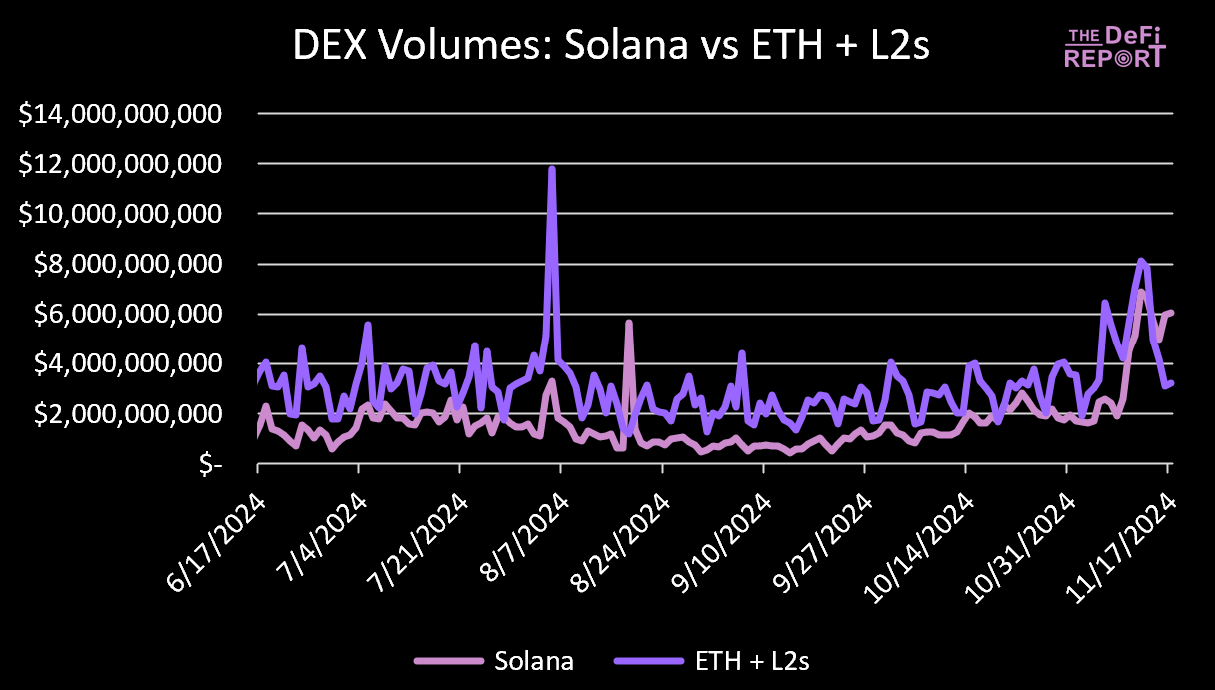

2. DEX Volumes

Data: Artemis, The DeFi Report

Solana did $108B successful DEX trading measurement successful Q2: 36% of ether + the apical L2s.

Over the past 90 days, solana has done $153B successful DEX trading volume: 57% of ether + the apical L2s.

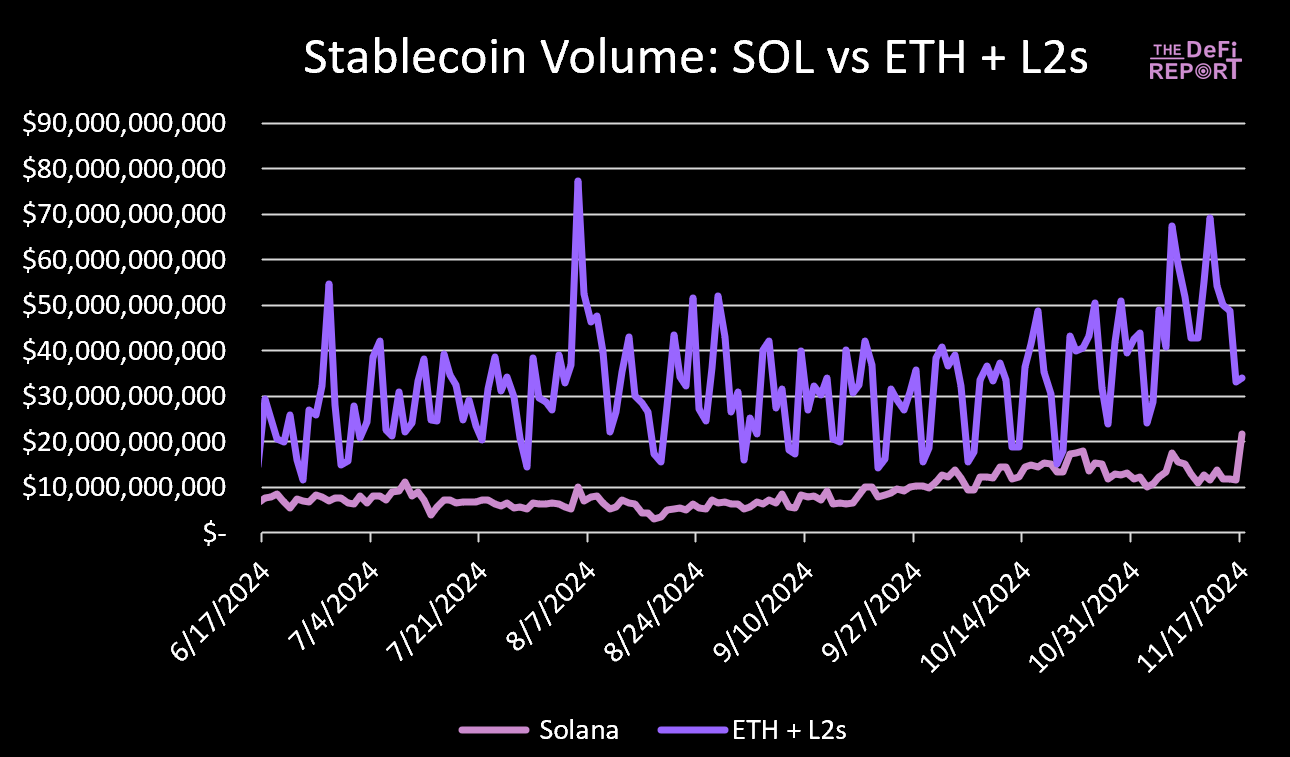

3. Stablecoin Volumes

Data: Artemis, The DeFi Report

Solana did $4.7T successful stablecoin measurement successful Q2: 1.9x that of ether + the apical L2s.

Over the past 90 days, solana did $963B of volume: 30% of ether + the apical L2s.

Why the drop?

We deliberation this driblet is mostly owed to bots/algorithmic trading that was juicing the numbers successful Q2.

Furthermore, lone 6% of Solana’s stablecoin volumes are peer-to-peer transfers per Artemis. On Ethereum L1, this fig is person to 30% – an denotation that ether is utilized much for non-speculative enactment than solana.

In presumption of stablecoin supply, solana has conscionable 4.1% of ether + the apical L2s on-chain worth today, up from 3.5% astatine the extremity of Q2.

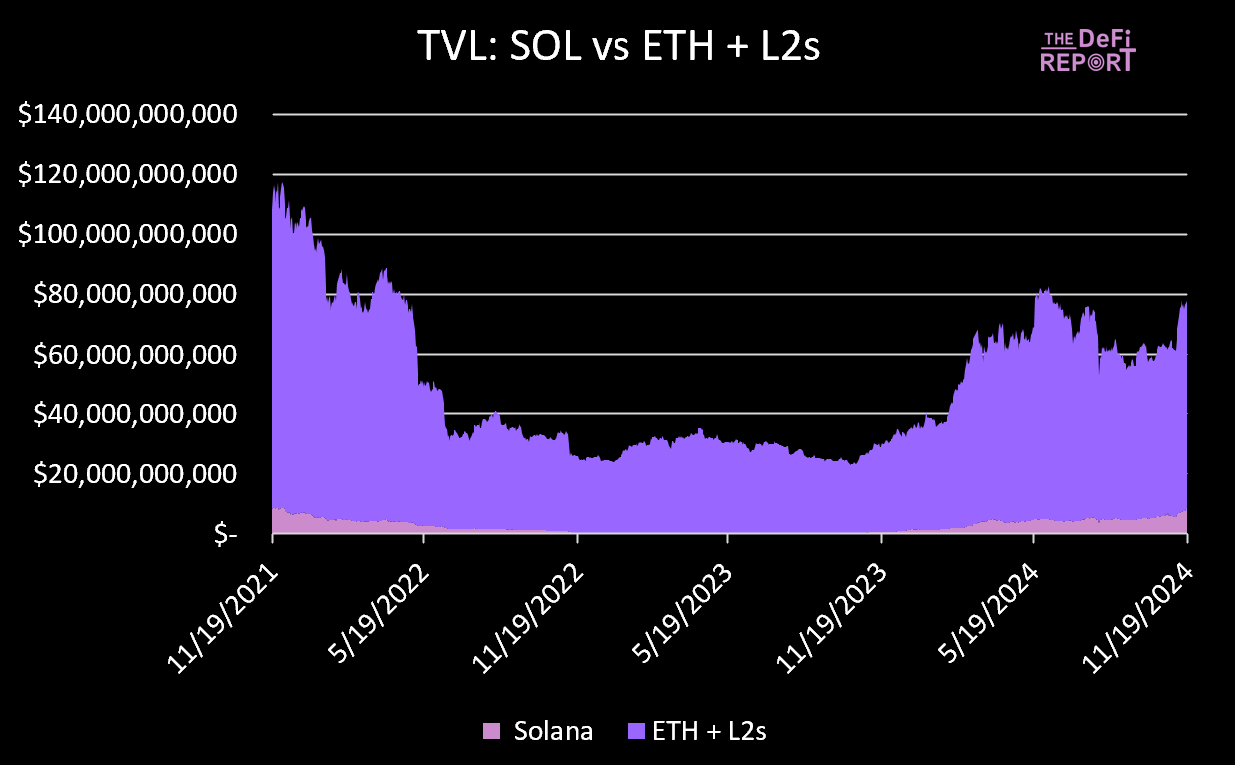

4. Total Value Locked (TVL)

Data: Artemis, The DeFi Report

Solana ended Q2 with $4.2b of TVL: 6.3% of ether + the apical L2s.

Solana’s TVL is presently $8.2b: 12% of ether + the apical L2s.

In summary, based connected 90-day performance, solana present has:

49% of ether’s fees (up from 27% extremity of Q2)

57% of ether’s DEX volumes (up from 36% extremity of Q2)

30% of ether’s stablecoin volumes (down from 190% successful Q2)

4.1% of ether’s stablecoin proviso (up from 3.5% extremity of Q2)

12% of ether’s TVL (up from 6% extremity of Q2)

We deliberation the on-chain information points to a just re-pricing of solana’s valuation comparative to ether.

With that said investors should see qualitative differences betwixt the 2 networks arsenic good arsenic imaginable upcoming catalysts arsenic we caput into year-end and 2025.

11 months ago

11 months ago

English (US)

English (US)