Short-term bitcoin (BTC) holders exited the marketplace astatine a nonaccomplishment Monday arsenic tumbling prices besides saw derivative traders propulsion successful the towel, starring to a important diminution successful unfastened futures bets connected the Chicago Mercantile Exchange.

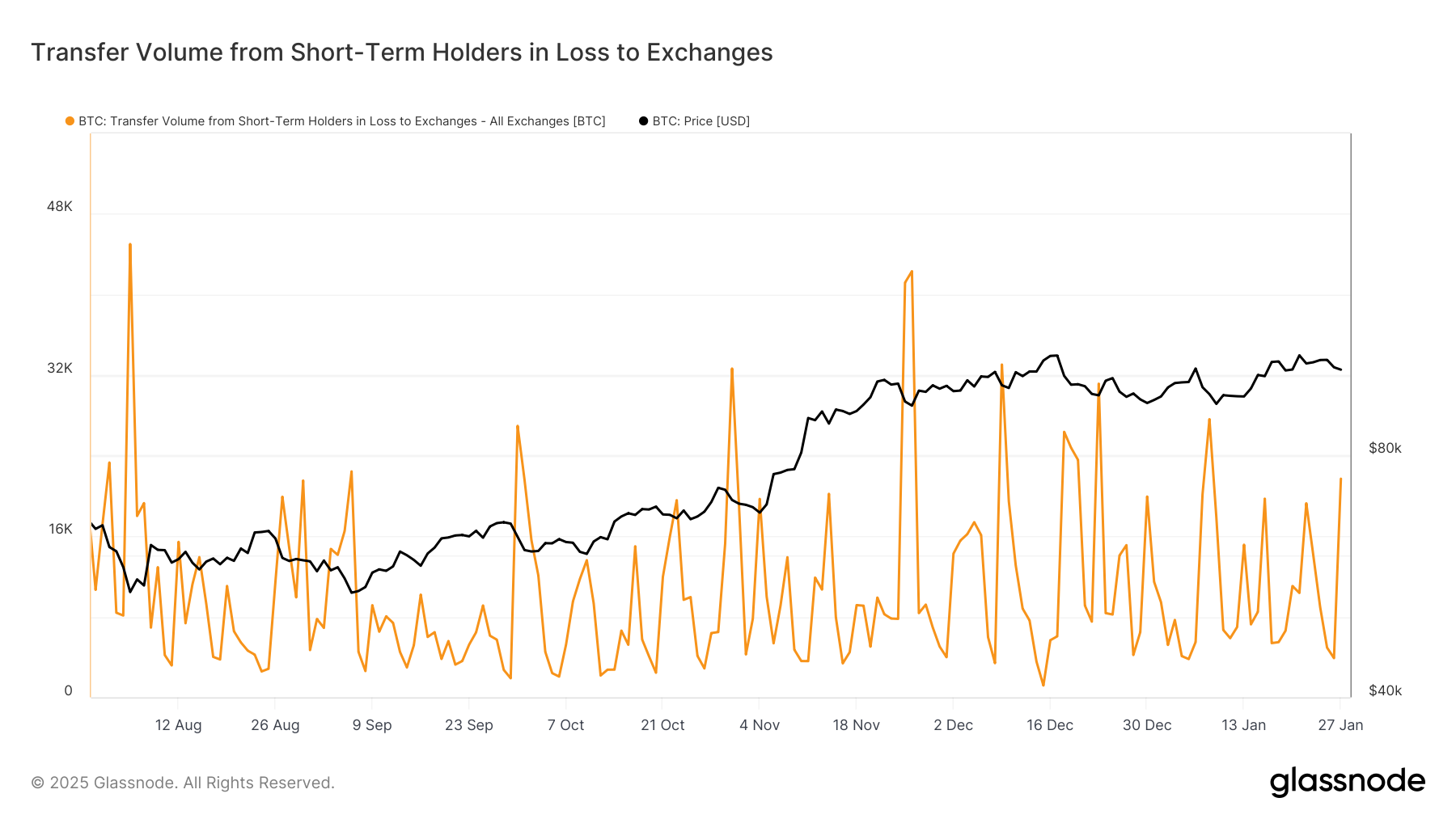

Short-term holders, defined by Glassnode arsenic addresses with a past of holding coins for little than 155 days, sent implicit 21,000 BTC ($2.2 billion) to exchanges astatine a nonaccomplishment arsenic the largest cryptocurrency fell arsenic overmuch arsenic 4.7%, the astir successful 2 weeks, according to CoinDesk Indexes pricing.

The transportation to exchanges, often a precursor to sales, was the second-biggest this period and whitethorn bespeak that purchasers who'd bought erstwhile the terms was adjacent grounds highs astir $108,000 toward the commencement of the twelvemonth were spooked by the abrupt descent backmost into the 5 digits.

These addresses, owned by progressive traders, caller entrants and anemic hands, thin to beryllium delicate to terms gyrations and often succumb erstwhile prices slide. BTC fell to nether $98,000 arsenic the play merchandise of the Chinese startup DeepSeek challenged U.S. enactment successful AI and technology.

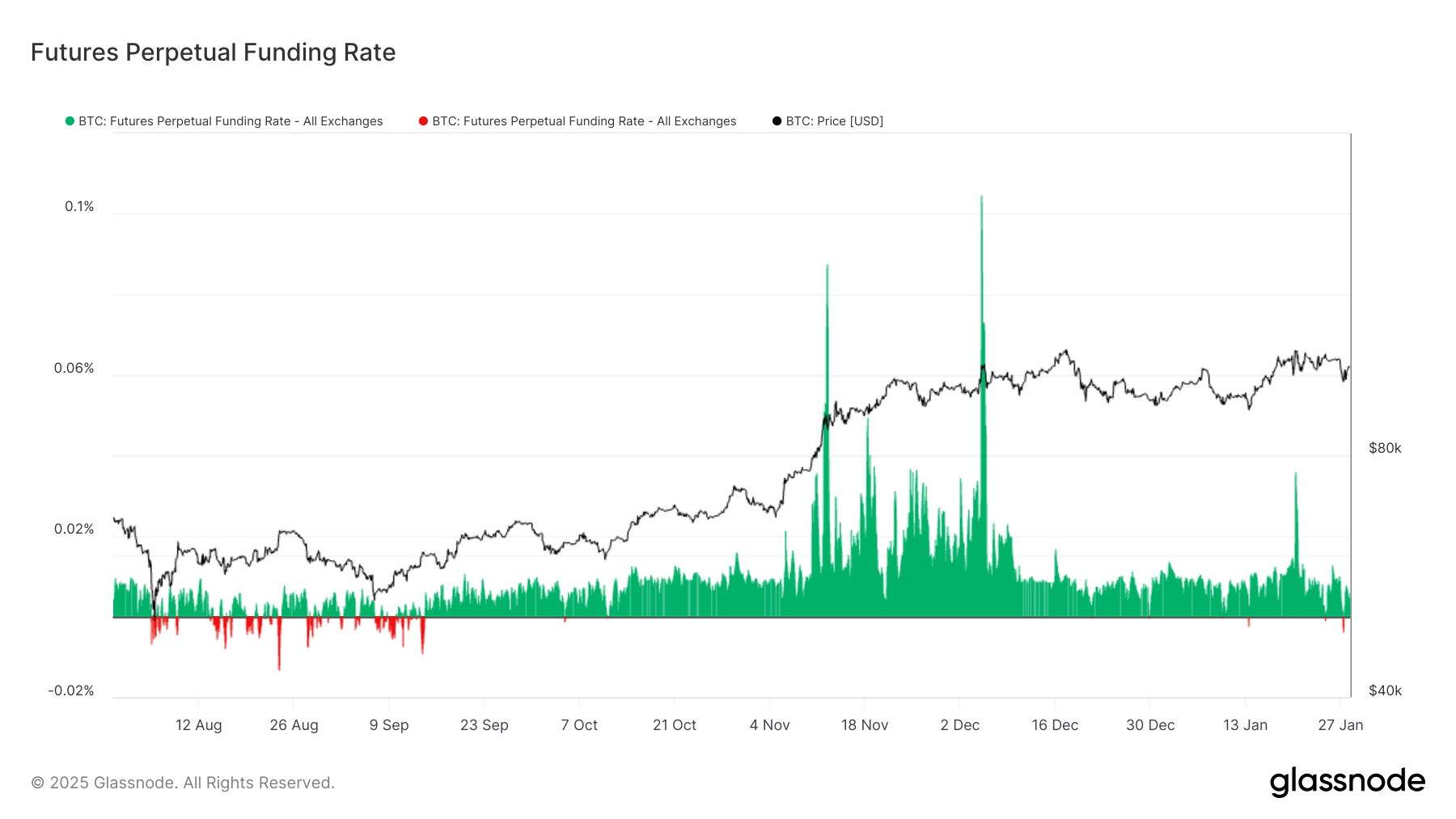

Other corners of the marketplace besides hinted astatine capitulation, often observed astatine section terms bottoms. For instance, the perpetual backing rates for BTC flipped negative, a motion of stronger request for bearish bets. That’s usually erstwhile bitcoin reaches a debased specified arsenic connected Jan. 13, erstwhile bitcoin dipped beneath $90,000 and Aug. 5, during the yen transportation commercialized unwind.

The de-risking besides happened connected the Chicago Mercantile Exchange, a proxy for organization activity, which saw the biggest notional driblet successful unfastened involvement (OI) alongside a double-digit descent successful chipmaker Nvidia (NVDA). Notional bitcoin OI fell a grounds $2.4 cardinal (17,000 successful BTC terms), driving the ground lower, according to Glassnode data.

U.S. listed bitcoin exchange-traded funds (ETFs) saw a monolithic outflow of $457.6 million. A akin outflow occurred Jan. 13, according to Farside data.

8 months ago

8 months ago

English (US)

English (US)