Every day, billions of dollars determination crossed blockchains done stablecoins. The marketplace is dominated by USDT ($175B marketplace cap) and USDC ($75B), but a increasing ecosystem of caller entrants is expanding the landscape. Stablecoins are nary longer a crypto sideshow — they’re becoming 1 of the largest fiscal innovations since the emergence of physics payments.

Their usage cases are broad, but 4 basal out:

- Hedging successful high-inflation economies

- Cross-border payments and remittances

- DeFi and programmable finance

- Trading and liquidity

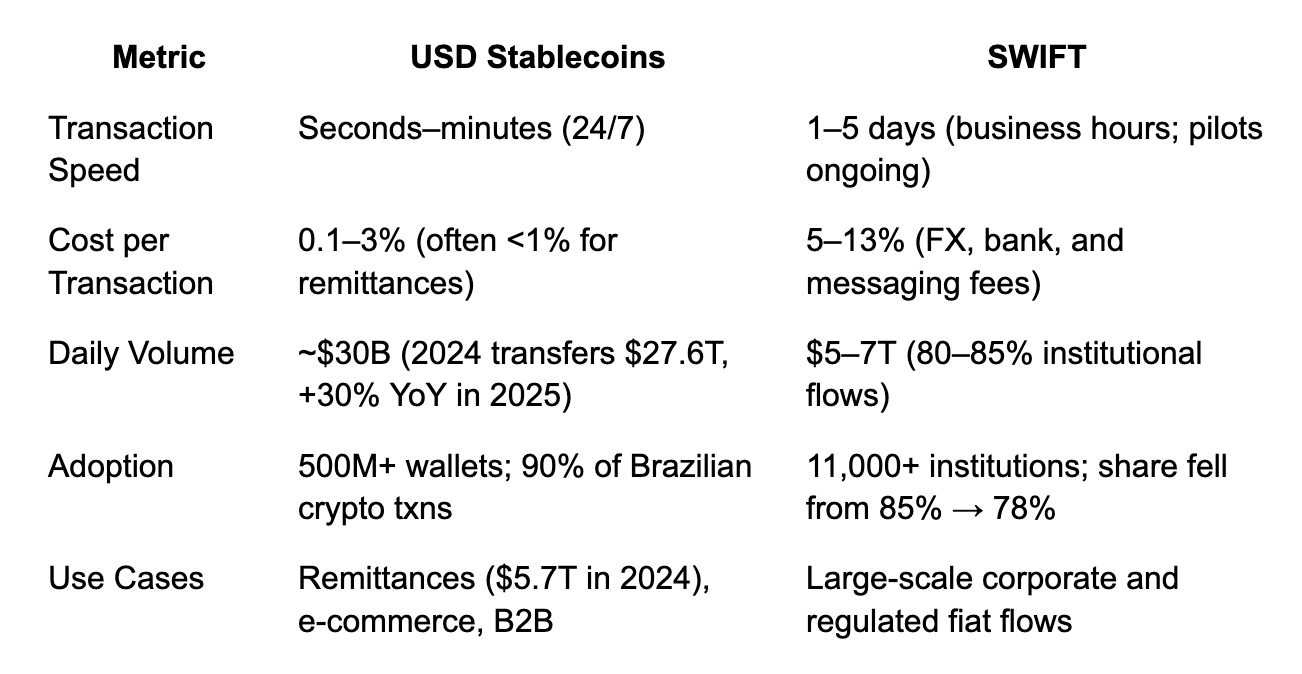

Of these, the cross-border and remittance usage lawsuit has the biggest maturation potential. USD-denominated stablecoins are softly replacing SWIFT for tiny and mid-sized flows — allowing wealth to determination crossed the satellite successful seconds, not days.

Stablecoins vs. SWIFT: reinventing cross-border money

What’s being disrupted is not SWIFT successful general, but SWIFT arsenic the planetary obstruction for dollar transfers. For decades, the U.S. dollar has been the unit of relationship for planetary commerce, and SWIFT has been the messaging strategy coordinating those flows. Now, alternatively of SWIFT arsenic the intermediary, USD stablecoins themselves service arsenic the transmission rail: programmable, verifiable and disposable 24/7.

Stablecoins aren’t yet replacing SWIFT astatine standard — they inactive relationship for little than 1% of planetary wealth flows — but successful remittances, B2B payments and e-commerce, USD stablecoins are already becoming the faster, cheaper complement to the dollar’s accepted wiring system.

Speed, cost, adoption — here’s the examination (2025):

The problem: 2 states of money

While USD stablecoins determination instantly successful the integer world, the existent system inactive runs connected local fiat. That forces liquidity providers to span 2 antithetic states of money:

- Digital (USD stablecoins).

- Fiat (local currencies).

Today, this mismatch creates friction. Liquidity providers extremity up holding pesos, reals oregon naira overnight, incapable to recycle superior until banks reopen. The fintech oregon end-user benefits from instant colony — but the supplier absorbs the outgo of locked balances. In effect, stablecoin adoption is capped by the size of supplier equilibrium sheets.

The solution: FX on-chain = 1 state

FX-on-chain protocols illness the two-state occupation into a azygous state: digital. Instead of moving betwixt stablecoins and fiat done banks, FX-on-chain enables direct swaps betwixt USD stablecoins and local-currency stablecoins.

This unlocks 2 cardinal advantages:

- Instant conversion: USDC/USDT holders tin merchantability straight into MXN-stables, BRL-stables, oregon COP-stables, which tin past beryllium redeemed for fiat instantly.

- Flow matching: Global remittance flows (selling USD to bargain local) people conscionable firm oregon organization flows (selling section to bargain USD). On-chain pools lucifer these successful existent time, netting retired exposures and recycling liquidity 24/7.

By unifying flows digitally, liquidity providers are nary longer stuck warehousing risk. Instead, superior circulates continuously on-chain — conscionable arsenic it does successful planetary FX markets, but with instant settlement, little costs and transparent liquidity.

Looking ahead

Stablecoins are nary longer conscionable a span betwixt crypto and fiat — they are becoming the rails of planetary commerce. From households successful Argentina hedging inflation, to exporters successful Nigeria settling invoices, to institutions arbitraging spreads, stablecoins are embedding themselves everywhere.

The aboriginal hinges connected 3 fronts:

- FX on-chain – collapsing fiat and integer into 1 authorities to alteration existent multi-currency settlement.

- Regulation – defining guardrails without stifling innovation.

- Non-USD stables – the emergence of euro, yen and local-currency stablecoins to further localize adoption.

If the past decennary was astir bitcoin arsenic “digital gold,” the adjacent volition beryllium astir stablecoins arsenic “digital fiat” — presently lone integer dollars and ultimately, integer fiat for everyone, everywhere.

2 hours ago

2 hours ago

English (US)

English (US)