The U.S. Securities and Exchange Commission (SEC) alleged that Binance sent a overseas affiliate of stablecoin issuer Paxos astir $20 cardinal of commingled funds successful 2021, according to a declaration made by Sachin Verma, an Assistant Chief Accountant of the Commission.

In a June 7 tribunal filing, Verma stated that Binance and its CEO Changpeng Zhao controlled respective accounts astatine the defunct Silvergate and Signature Banks, which were utilized to transportation retired assorted transactions that progressive Zhao-owned companies.

Merit Peak

The declaration alleges that Binance.US, nether the sanction BAM Trading, and respective different Binance-related accounts sent millions of dollars from accounts astatine Silvergate Bank to a trading steadfast called Merit Peak Ltd.

Merit Peak is simply a British Virgin Islands institution beneficially owned by Zhao. The filing described the quality of its concern arsenic an OTC table and proprietary trading of integer assets, and Silvergate closed its relationship successful mid-2022.

Nearly $20 cardinal sent to Paxos’ overseas affiliate

Before the closure of the account, Verma stated that “millions of dollars from Binance-related accounts were commingled successful Merit Peak’s accounts” and was aboriginal transferred to a overseas affiliate of the stablecoin issuer, Paxos. The authoritative said:

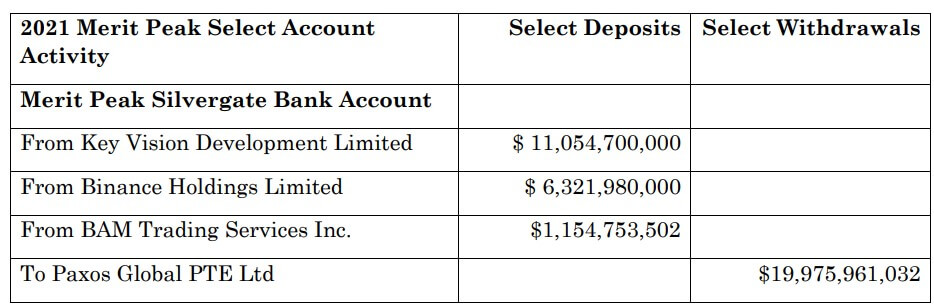

“For example, successful 2021, funds from Key Vision ($11.05 billion), Prime Trust ($1.1 billion) (through BAM Trading) and Bifinity UAB ($6.3 billion) (through Binance Holdings Limited) were transferred to Merit Peak and Merit Peak transferred each of that wealth arsenic portion of its transfers of astir $20 cardinal to a overseas affiliate of Paxos successful 2021.”

Merit Peak Transactions successful 2021 (Source: SEC Court Filing)

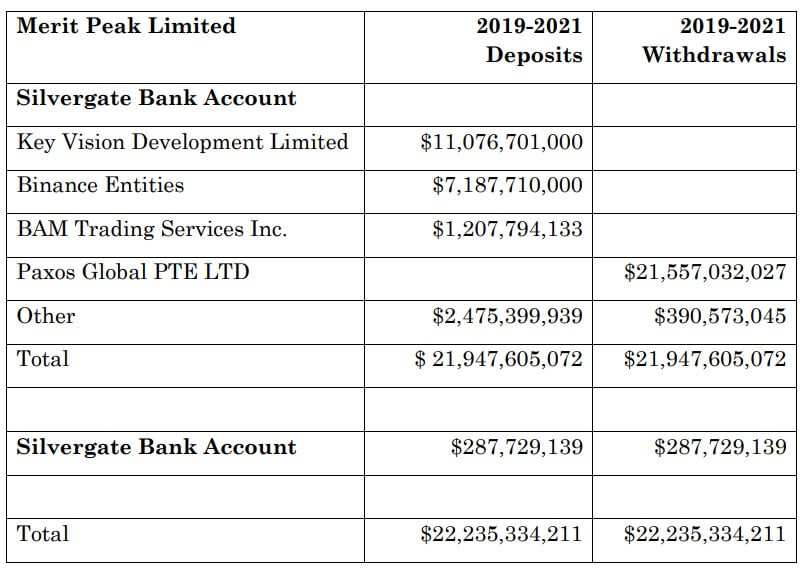

Merit Peak Transactions successful 2021 (Source: SEC Court Filing)A person look astatine the accounts’ transactions betwixt 2019 and 2021 showed that Merit Peak received $22 billion from respective Binance-related accounts, including $1.2 cardinal from Binance US. During this period, the trading steadfast transferred $21.6 cardinal to this overseas affiliate of Paxos.

Merit Peak Transactions betwixt 2019 and 2021 (Source: SEC Court Filing)

Merit Peak Transactions betwixt 2019 and 2021 (Source: SEC Court Filing)This declaration corroborates erstwhile reports that stated that Binance had commingled users’ funds successful slope accounts astatine Silvergate Bank.

Binance has consistently maintained that the reports were mendacious but was yet to respond to CryptoSlate’s petition for further commentary arsenic of property time.

Meanwhile, Paxos is the issuer of Binance USD (BUSD) stablecoin. In February, New York regulators ordered the stablecoin issuer to stop different mints of BUSD. Binance and Paxos person besides rejected the SEC’s classification of BUSD arsenic a security.

Paxos has not responded to CryptoSlate’s petition for remark arsenic of property time.

The station SEC alleges Binance sent Paxos astir $20B successful commingled funds via Merit Peak successful 2021 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)