David Bailey, entrepreneur and Bitcoin advisor to US President Donald Trump, says determination won’t beryllium different Bitcoin carnivore marketplace for respective years amid increasing organization involvement successful the crypto market.

But the four-year rhythm says otherwise, and crypto analysts archer Cointelegraph that determination are much than a fewer headwinds that could vessel the markets.

It’s the “first clip we’ve ever seen existent organization bargain in,” said Bailey successful an X station connected Saturday.

“Every Sovereign, Bank, Insurer, Corporate, Pension, and much volition ain Bitcoin. The process has already begun successful earnest, yet we haven’t adjacent captured 0.01% of the Total addressable marketplace (TAM). We’re going truthful overmuch higher. Dream big,” helium added.

He said earlier organization involvement was conscionable “outliers with marginal bets.”

Bailey, laminitis of Bitcoin Magazine and BTC Inc., served arsenic an advisor during Trump’s statesmanlike run and is credited with being a cardinal fig successful the president’s Bitcoin pivot.

Over the past 2 years, institutions person steadily gained vulnerability to crypto done concern vehicles similar exchange-traded funds (ETFs) and establishing crypto treasuries — with full holdings surging past $100 billion, made mostly of Bitcoin.

Reasons for a crypto carnivore market

A June study from task superior (VC) steadfast Breed suggested that fewer of these treasury companies would past agelong term, which could trigger the adjacent crypto carnivore market.

Speaking to Cointelegraph, ZX Squared Capital co-founder and main concern serviceman CK Zheng said crypto is inactive highly correlated with the banal market; if it slows into a carnivore market, “crypto volition follow.”

Earlier this year, the banal marketplace astir slipped into a carnivore market, but according to Zheng, it rebounded, and determination person been respective developments since that little the likelihood of a repeat.

“The question is for the remainder of the year, whether the carnivore marketplace is going to hap oregon not, and that’s an absorbing discussion, but my idiosyncratic presumption is it’s astir apt unlikely, particularly aft the Fed pivoted to little involvement rates, and Jerome Powell’s code past Friday,” helium said.

“Right present it’s 1 of the biggest signals successful presumption of the Fed consenting to chopped the involvement rate, astir likely, successful September, and that’s astir apt the opening of a low-interest-rate cycle, fixed the economical information and the labour marketplace softening.”Meanwhile, Pav Hundal, pb marketplace expert astatine Australian crypto broker Swyftx, said the marketplace has been risk-on and that’s supported a rotation into high-momentum assets similar Bitcoin and Ether (ETH).

However helium expects to spot a re-rotation backmost into fixed income instruments astatine immoderate point.

“The way of slightest absorption is higher for Bitcoin but that doesn’t mean a carnivore marketplace is years away. Macro shocks travel erstwhile you slightest expect them. My suspicion is we support seeing what we’re seeing, which is decreased terms volatility implicit each cycle,” Hundal said.

“Interest complaint rises are politically tricky, but the marketplace expects a emergence again implicit the adjacent year, and that could beryllium a catalyst for a correction.”End to crypto carnivore markets a possibility

The past carnivore marketplace was successful 2022, and earlier that, successful 2018. In some instances, a booming bull marketplace preceded the crash.

Ryan McMillin, co-founder and main concern serviceman of Australian crypto concern manager Merkle Tree Capital, told Cointelegraph the existent basal lawsuit points to a apical astir Q2 2026, past “if and erstwhile planetary liquidity reverses astir this time, apt triggering a comparatively mild carnivore marketplace by mid-2026.”

Related: Bitcoin has ‘greater than 50% chance’ of $150K earlier carnivore hits: Exec

“Leverage unwind from debt-fueled Bitcoin buys oregon a regulatory daze could spark the downturn,” helium said.

“The Direct entree trading (DAT) and organization markets adhd immense pools of demand, but they besides travel with risks, immoderate of the DATs volition beryllium precocious to the party, overleveraged and not prepared for the volatility that makes this plus people truthful interesting, perchance being the catalyst of the adjacent carnivore market.”However, McMillin says determination is besides a anticipation determination volition beryllium nary carnivore marketplace astatine all, “similar to golden station the aboriginal 2000s ETF motorboat arsenic the plus was financialised and up lone for 8 years.”

Another origin is the bull marketplace that precedes immoderate carnivore market; without a parabolic bull market, determination can’t beryllium a heavy and sustained carnivore market.

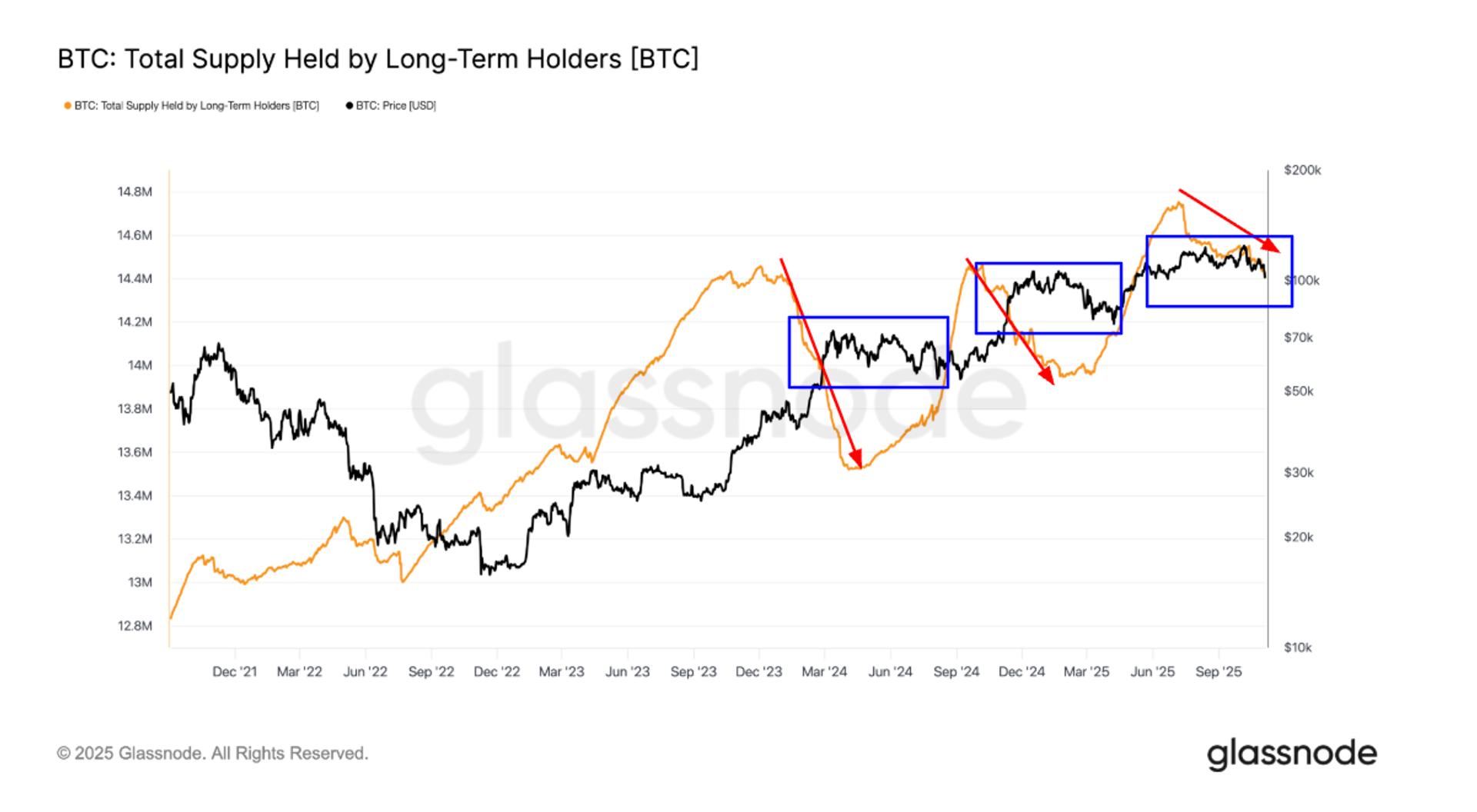

“So far, this rhythm moves up person been accompanied by periods of consolidation, leverage is reset, and the bull marketplace continues. If this operation persists, past determination is nary carnivore market; determination volition beryllium regular corrections, which are large buying opportunities,” McMillin added.

Magazine: ETH ‘god candle,’ $6K next? Coinbase tightens security: Hodler’s Digest, Aug. 17 – 23

2 months ago

2 months ago

English (US)

English (US)