What to Know:

- Saylor’s ‘I Won’t Back Down’ connection comes arsenic Bitcoin slides toward $80K–$85K, pressuring leveraged players and reigniting clang warnings.

- Strategy’s 649K+ BTC stack remains profitable connected paper, but the banal premium has astir vanished, investigating capitalist patience with the treasury bet. U.Today+1

- Bitcoin Hyper aims to lick Bitcoin’s throughput, fees, and programmability issues with an SVM-based Layer-2 that keeps Bitcoin arsenic the colony layer.

- The $HYPER presale has raised implicit $28M, offers astir 41% staking rewards, and targets multi-X upside if its Layer-2 roadmap and ecosystem transportation succeed.

Bitcoin conscionable pulled disconnected 1 of the nastiest rug-pull-looking dips of the full cycle. In a substance of hours, the price fell from supra $120K to sub-$90K and adjacent wicked into the $80,600 zone, wiping retired billions successful longs and reigniting the classical “it’s over, lads” chorus crossed Crypto X.

And close successful the mediate of the chaos, Michael Saylor dropped 4 words that could fundamentally beryllium printed connected his concern card: “I won’t backmost down.” This time, the enactment carried other weight.

His company, Strategy, is present sitting connected astir 649,870 BTC astatine an mean terms adjacent $74,430, inactive successful nett contempt the crash, adjacent arsenic the banal gets punished and critics wonderment however agelong a leveraged Bitcoin maxi tin look down this benignant of volatility.

Source: Strategy

Source: StrategyStrategy adjacent ran a canvass that showed astir 78% of respondents were simply HODLing done the sell-off. Hardcore Bitcoiners inactive spot turbulence, not terminal failure, but not everyone’s built for that grade of mark-to-market pain.

Retail, smaller funds, and DeFi traders are progressively searching for ways to support Bitcoin vulnerability without conscionable holding spot and praying.

That’s wherever the caller rotation communicative comes in. If Bitcoin stays the monetary backbone of crypto, the best altcoins this rhythm whitethorn beryllium the ones solving what Bitcoin can’t: throughput, fees, and programmability.

Bitcoin Hyper ($HYPER) fits that thesis astir excessively well, positioning itself arsenic a Bitcoin Layer-2 designed to marque BTC behave similar a fast, flexible, programmable asset, each without compromising the basal layer.

Bitcoin Hyper Turns Bitcoin Volatility Into Layer-2 Utility

Behind the branding, Bitcoin Hyper is targeting a precise existent structural spread successful the Bitcoin ecosystem. BTC inactive handles lone a fistful of transactions per second, and fees spike whenever enactment increases, which is wherefore astir of today’s DeFi, NFTs, and on-chain experimentation person migrated to faster environments, specified arsenic Solana.

Bitcoin Hyper’s solution is simply a rollup-style Layer-2 anchored to Bitcoin but powered by an SVM (Solana Virtual Machine) execution layer. Users nonstop BTC to a monitored main-chain address, a canonical span verifies the deposit, and the web mints an equivalent magnitude of wrapped BTC connected Hyper.

From there, transactions tally connected a high-throughput concatenation with near-instant finality and debased fees, portion zero-knowledge proofs periodically settee backmost to Bitcoin L1.

The architecture aims to sphere Bitcoin’s information portion moving existent activity, payments, DEX trades, lending, NFT markets, adjacent meme-coin chaos, onto a concatenation that feels Solana-fast.

Because it uses SVM, existing Rust developers tin larboard their apps with minimal friction, giving Hyper a realistic changeable astatine gathering an ecosystem alternatively of becoming different beauteous but bare L2.

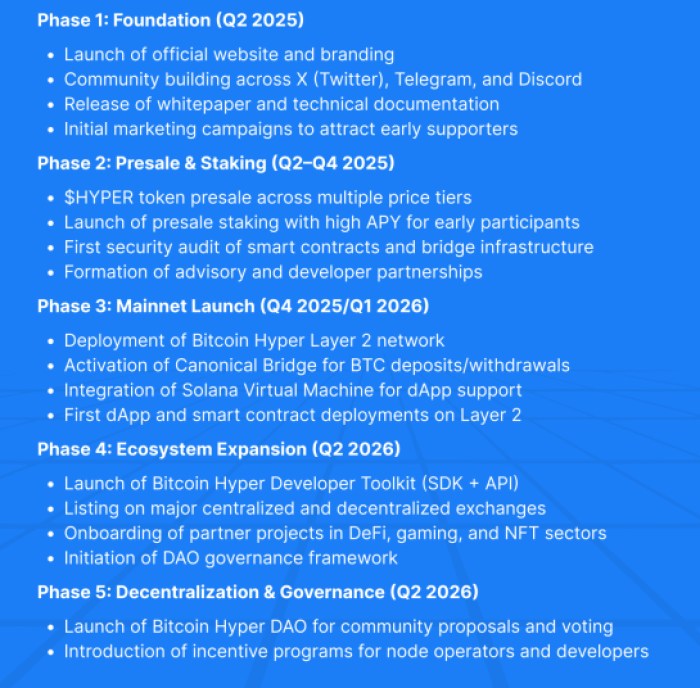

Of course, determination are risks. $HYPER is inactive successful presale, and the roadmap is ambitious: audits and presale passim 2025, mainnet and SVM+dApp integration betwixt precocious 2025 and aboriginal 2026, past token listings, SDKs, and a DAO rollout successful 2026. Execution needs to deed those milestones for the L2 thesis to play out.

Security is astatine slightest trending positively. The contracts person already cleared audits from Coinsult and SpyWolf, with nary hidden mint functions oregon evident backdoors flagged, a bully start, adjacent if it doesn’t destruct the emblematic smart-contract and marketplace risks associated with caller chains.

For anyone who wants to enactment structurally agelong Bitcoin portion besides capturing upside from wherever the adjacent question of blockspace request mightiness land, $HYPER offers a cleanable play.

If Bitcoin enactment increases and DeFi migrates toward BTC-secured infrastructure, a functioning Bitcoin-anchored Layer-2 could sorb a disproportionate stock of that value.

Inside the Bitcoin Hyper Presale and $HYPER Token Economics

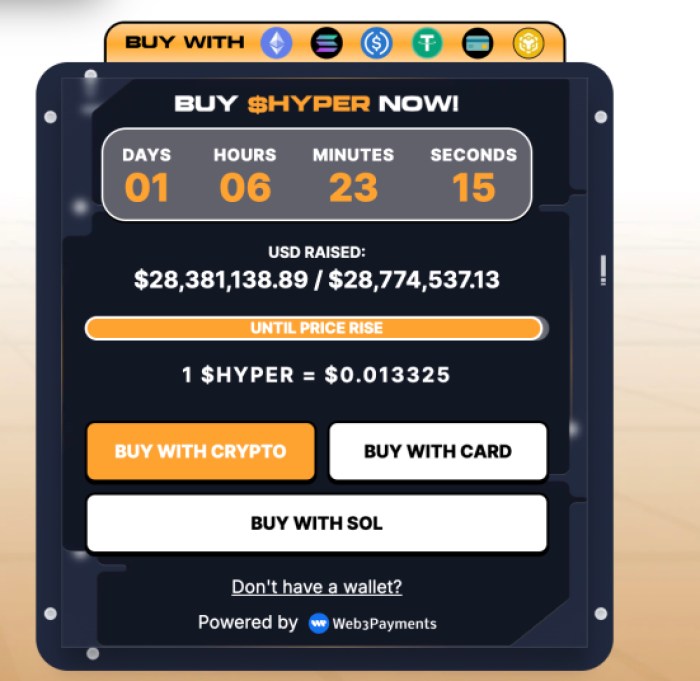

While Bitcoin has been violently whipsawing, the Bitcoin Hyper presale has been doing the opposite, grinding steadily upward. It has present crossed $28.3M raised, with the existent signifier pricing $HYPER astir $0.013325.

That inactive puts it successful micro-cap range, but the rise is present ample capable that this is nary longer a tiny degen side-quest. Real superior is flowing in.

Presale buyers tin besides involvement $HYPER astatine 41% rewards, with much than a cardinal tokens already locked. Those yields volition people taper disconnected arsenic much wallets articulation in, but the intent is clear: aboriginal participants are encouraged to behave similar semipermanent web partners, not short-term flippers.

It aligns neatly with the thought of $HYPER acting arsenic a “beta connected Bitcoin’s evolution” alternatively than conscionable different momentum meme.

On the valuation side, upside scenarios being circulated are bold but astatine slightest mathematically grounded. One wide shared cardinal reappraisal puts a imaginable 2025 precocious adjacent $0.02595 erstwhile mainnet is unrecorded and liquidity deepens, astir a 2x from the existent presale scope if the thesis holds.

More assertive models task further out, mapping a imaginable 2026 precocious astir $0.08625 and a 2030 people adjacent $0.253, assuming the roadmap lands, the ecosystem fills in, and large exchanges yet database the token.

Relative to today’s pricing, that implies astir 6–7x to the 2026 level and adjacent to 19x by 2030. Nothing is guaranteed, but it explains wherefore $HYPER keeps showing up successful alt-rotation threads whenever traders sermon asymmetric setups tied to Bitcoin infrastructure alternatively of random meme noise.

Crucially, $HYPER isn’t pitched arsenic a hedge against Bitcoin; it’s pitched arsenic a mode to amplify it.

If Saylor’s “I Won’t Back Down” stance represents the diamond-hands extremity of the spectrum, Bitcoin Hyper is wherever the much risk-tolerant assemblage is rotating: inactive ideologically agelong BTC, but looking to high-beta Layer-2 infrastructure for bigger imaginable multiples arsenic the rhythm churns done volatility.

This nonfiction is informational only; crypto, particularly presales, is highly volatile. Always bash your ain probe and ne'er hazard rent money.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/best-altcoins-saylor-wont-back-down-bitcoin-hyper-presale

2 hours ago

2 hours ago

English (US)

English (US)