Inflation is 1 of the astir important planetary topics of 2022, with the U.S. hitting 8.3%, the UK arsenic precocious arsenic 10.1%, and countries specified arsenic Turkey seeing figures arsenic precocious arsenic 79.6%. These figures are good beyond the people complaint of 2% ostentation by the large cardinal banks.

Central banks specified arsenic the Federal Reserve, European Central Bank, and Bank of England purpose to support ostentation debased and stable. An ostentation people of 2% helps everyone program for the future. If ostentation is excessively precocious oregon it moves astir a lot, it’s hard for businesses to acceptable the close prices and for radical to program their spending.

What is the interaction of 2% inflation?

To recognize the interaction of inflation, you request to look astatine the compound interaction implicit a bid of years. Suppose you person $50,000 successful your savings account; astatine 2% ostentation compounding annually implicit 20 years, your spending powerfulness volition person reduced to conscionable $33,648. Your savings volition efficaciously beryllium reduced by astir $17,000 by conscionable sitting successful the bank.

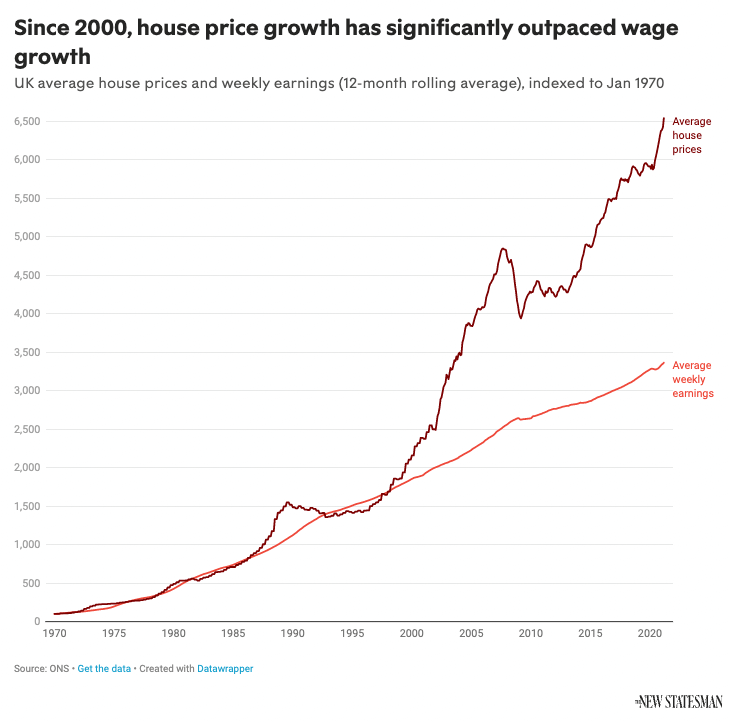

If wages summation by the nonstop fig of 2% per year, past this is balanced out. However, historically this is not the case.. The mean location terms successful the UK has drastically outpaced mean net growth. Therefore, since astir the crook of the millennium, it has go progressively hard for the mean idiosyncratic to prevention to bargain their ain home.

Source: New Statesmen

Source: New StatesmenDealing with inflation

Central banks are expected to yet get ostentation nether power utilizing tools they person astatine their disposal. There has been precocious ostentation successful the past, truthful it is not unreasonable to presume that akin methods volition beryllium implemented successful 2022 to trim ostentation based connected past successes.

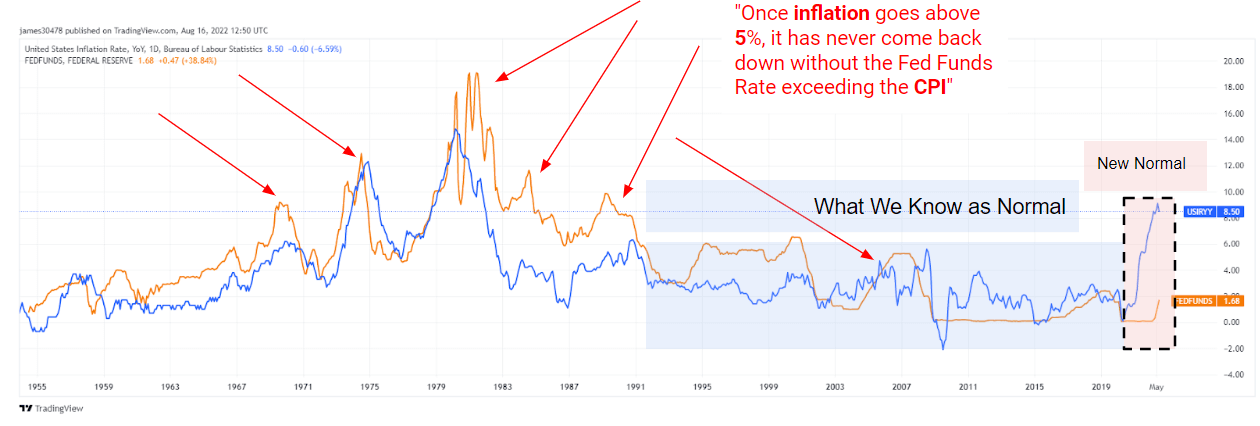

Historically, to woody with ostentation anytime it has risen supra 5%, the Federal Reserve has accrued the national funds complaint to transcend the level of CPI inflation. The reddish arrows connected the illustration beneath bespeak this has been implemented six times successful the past 20 years.

Source: TradingView

Source: TradingViewFor the champion portion of the past 20 years, CPI ostentation has averaged astir the extremity of 2%. In 2022, determination is speech of a “new normal.” Never has determination been a much important disconnect betwixt CPI and FED funds complaint with ostentation truthful acold supra involvement rates.

The strategy to combat ostentation spikes akin to those presently affecting planetary markets has besides been to summation involvement rates beyond that of inflation.

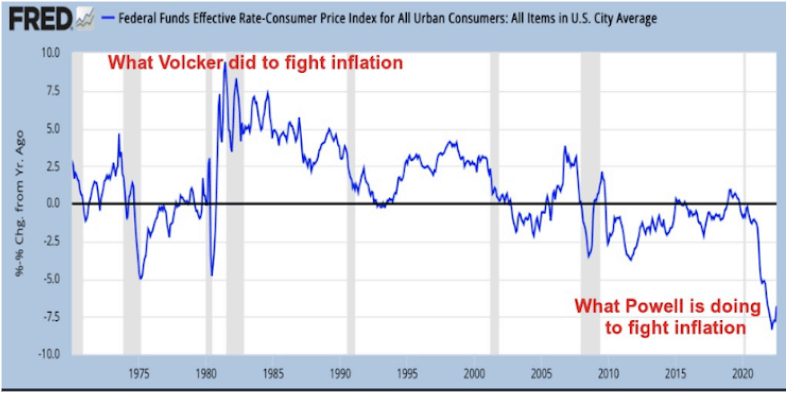

In the 1970s, erstwhile CPI ostentation was successful the treble digits, Paul Volcker, FED seat astatine the time, managed to get the FED funds complaint implicit 12%. However, the actions of the existent FED chairman, Jerome Powell, are worlds isolated from Volcker’s. The illustration beneath illustrates the narration betwixt the FED funds rates and CPI ostentation since 1970. Volcker facilitated an implicit 7.5% YoY change, portion Powell has had the other effect with a antagonistic 7.5% change.

Federal Funds Effective Rate-Consumer Price Index for All Urban Consumers (Source: Federal Reserve)

Federal Funds Effective Rate-Consumer Price Index for All Urban Consumers (Source: Federal Reserve)Crypto inflation

Bitcoin tin beryllium viewed arsenic an plus to support yourself from currency debasement, but it does person ostentation of its own. The ostentation of Bitcoin is programmed into the protocol. At present, Bitcoin’s ostentation complaint is 1.75%; however, successful 2024, it volition trim to 0.875%, and it volition proceed to alteration pursuing each halving event.

The lone flimsy variance successful the ostentation complaint for Bitcoin relates to the hashpower of the web comparative to the web difficulty. If determination is simply a alteration successful the hashrate, it is automatically adjusted by expanding oregon decreasing the web trouble to power inflation.

Bitcoin’s ostentation exemplary aims to gradually trim it implicit clip alternatively than support ostentation astatine a acceptable rate. The tools to power ostentation are programmed into the protocol, truthful determination is nary request for a cardinal slope oregon different governing assemblage to marque immoderate decisions to get ostentation nether control.

Further, Ethereum is going done a important alteration successful its ostentation rates this year. Before The Merge, Ethereum’s ostentation complaint is astir 2.6%. This was chopped successful fractional aft the implementation of EIP-1559 successful 2021.

EIP-1559 has chopped the ETH yearly ostentation complaint from 4.2% to 2.6%.

Once the merge happens successful a fewer months and PoS is live, this volition beryllium a antagonistic number.

Ethereum volition beryllium unafraid portion ETH deflationary. The champion crypto monetary argumentation that exists.

— eric.eth (@econoar) August 7, 2021

After The Merge, the issuance volition beryllium drastically reduced, perchance resulting successful a antagonistic ostentation complaint beneath 0%, with ETH issuance astir 0.3%. The alteration results from the triple halving that volition instrumentality spot arsenic the 13k ETH regular miner rewards are removed, leaving conscionable the 1.3K ETH from staking.

Lucas Outumuro from Into the Block projected that it could spell arsenic debased arsenic -4.5% erstwhile considering web fees.

$ETH volition go deflationary pursuing the merge

ETH's nett issuance is apt to scope betwixt -0.5% to -4.5% depending connected web fees

Here is simply a projection of what that would look similar based connected 2022 humanities information pic.twitter.com/KdWq072Mbz

— Lucas (@LucasOutumuro) July 22, 2022

Bitcoin and Ethereum were created aft the 2008 recession to respond to the problems that person plagued the accepted banking strategy for years. Neither protocol aims to support ostentation astatine a fig adjacent to 2%. Both networks trim ostentation implicit time, expanding the underlying assets’ buying power. A antagonistic ostentation complaint means holding Bitcoin oregon Ethereum volition marque it worthy much successful existent presumption implicit a agelong capable timeframe.

Unlike holding fiat currencies which, adjacent astatine the cardinal banks’ people ostentation rate, volition autumn successful buying power, Bitcoin and Ethereum are programmed to bash rather the opposite. Fiat ostentation rates are, portion slowing, inactive rising globally. Yet, Ethereum volition acquisition an upgrade successful September, causing 1 of the largest deflationary events successful history. How this volition impact speculation connected the terms of Ethereum volition beryllium precise absorbing to watch.

It is important to enactment that economics is not arsenic elemental arsenic “inflation bad, deflation good.” In fact, determination are galore consequences of deflation that tin beryllium harmful to the economy. The extremity of a 2% inflationary people is to guarantee that the velocity of wealth continues astatine a steadfast rate.

If determination is 0% oregon antagonistic inflation, past it is omniscient to refrain from spending. Holding connected to an plus with antagonistic ostentation means it volition beryllium worthy much implicit time, truthful you are losing retired connected aboriginal spending powerfulness by spending it now. This inclination tin origin an system to grind to a halt arsenic the velocity of wealth falls. Therefore, the cardinal banks acceptable a debased inflationary people to guarantee spending continues.

However, arsenic the illustration astatine the commencement of this nonfiction illustrated, adjacent 2% ostentation drastically reduces your savings implicit 20 years. Ethereum and Bitcoin person little ostentation rates portion besides being programmed by planetary assemblage consensus.

There is nary cardinal slope for Bitcoin oregon Ethereum and, therefore, nary chairperson to misjudge the handling of the economy. The system is already decided and baked into the code. If the extremity of 2% ostentation is to guarantee radical tin program their future, what amended mode than to person the adjacent 100 years acceptable retired successful beforehand of you, arsenic is the lawsuit with Bitcoin?

The station Research: Will reducing US ostentation from 8.3% to 2% comparison to Bitcoin and Ethereum? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)