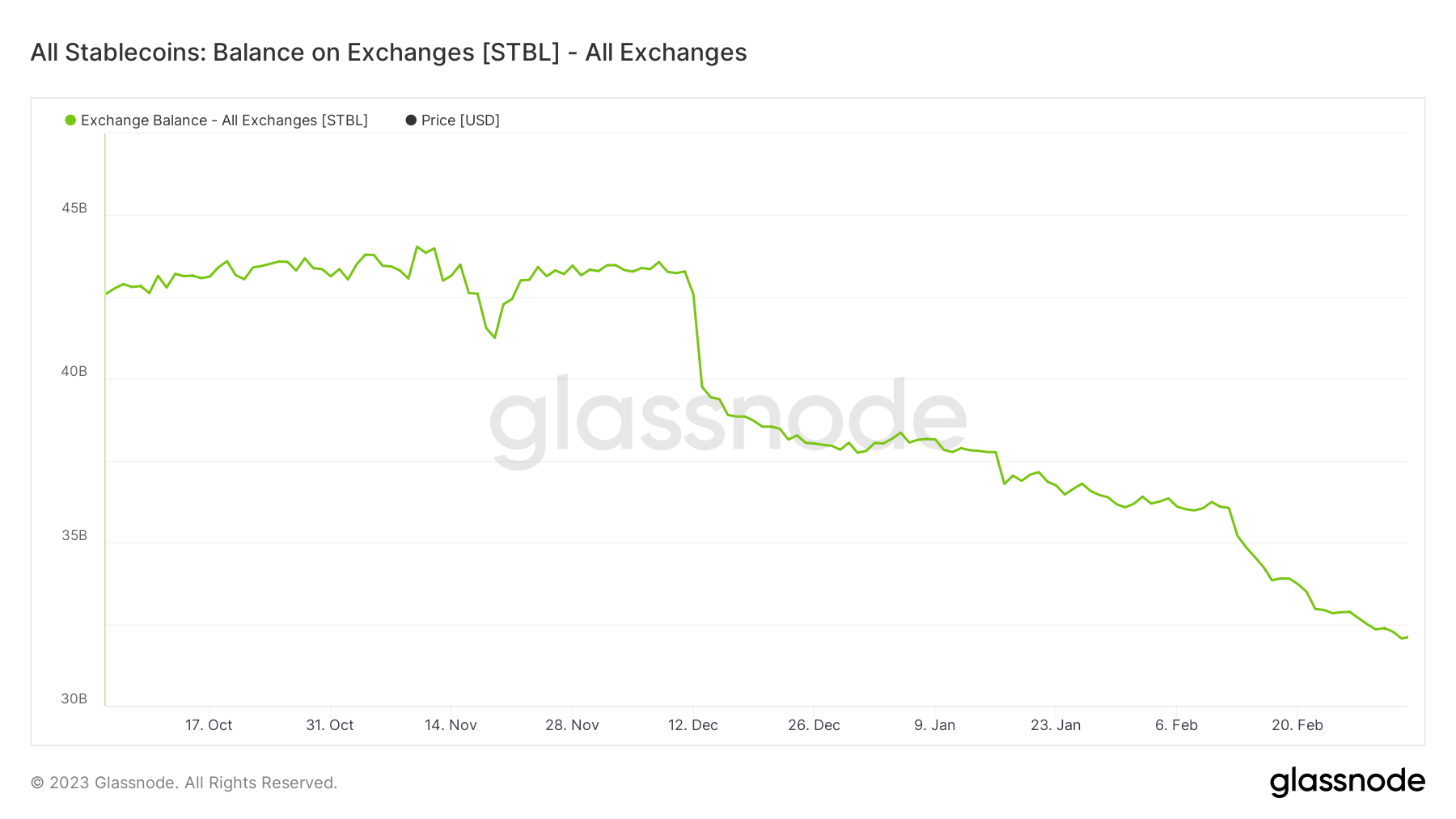

Following the FTX catastrophe successful November, the stablecoin marketplace has importantly changed, losing $12 cardinal successful value.

More recently, the contented was compounded by troubles astatine BUSD arsenic the New York Department of Financial Services (NYFDS) ordered Paxos to cease token issuance.

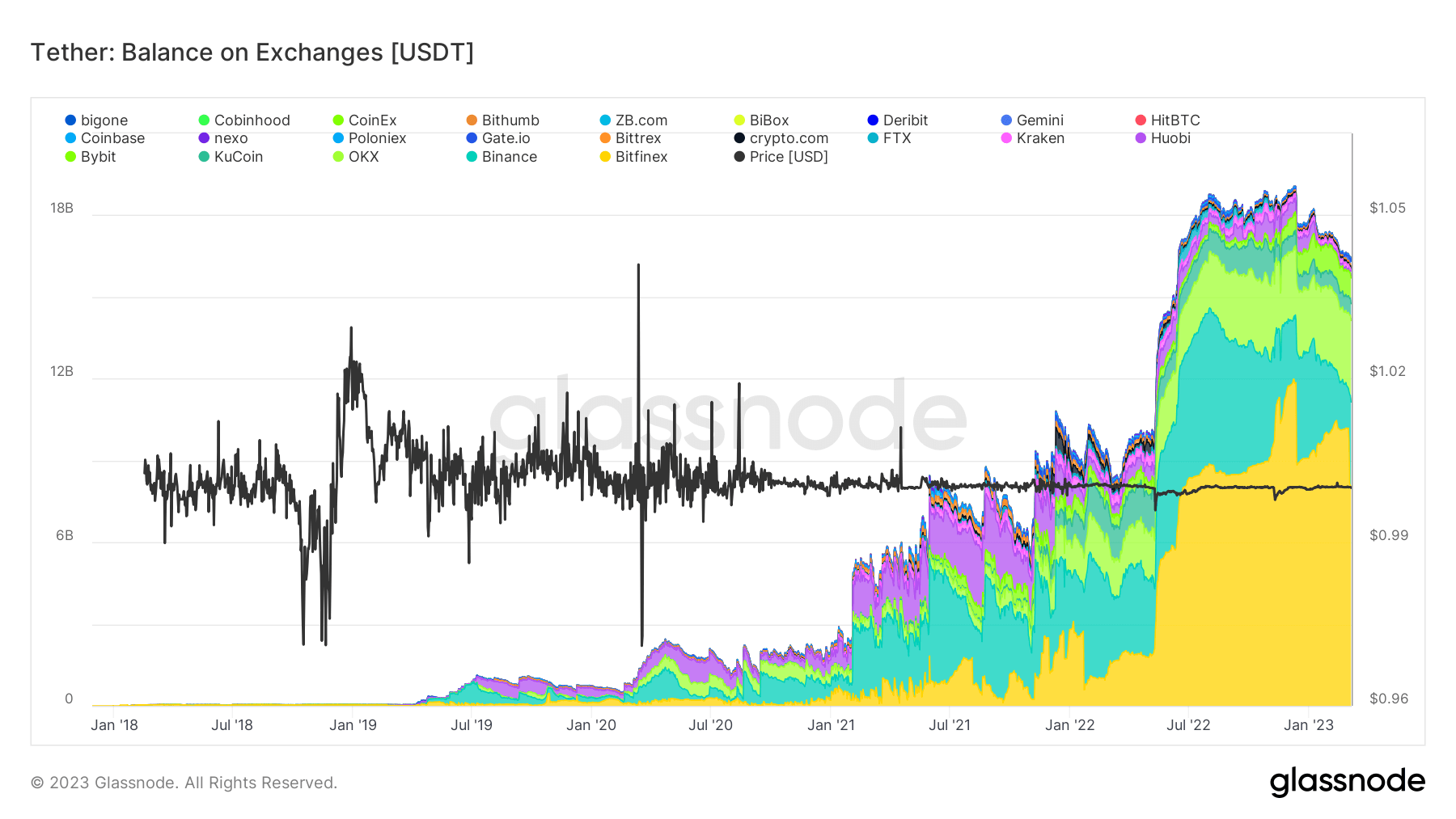

Source: Glassnode.com

Source: Glassnode.comGlassnode information analyzed by CryptoSlate showed Tether has emerged arsenic the wide victor successful the marketplace restructuring, contempt ongoing, long-running suspicions astir the token’s quality to conscionable its liabilities.

Stablecoin roundup

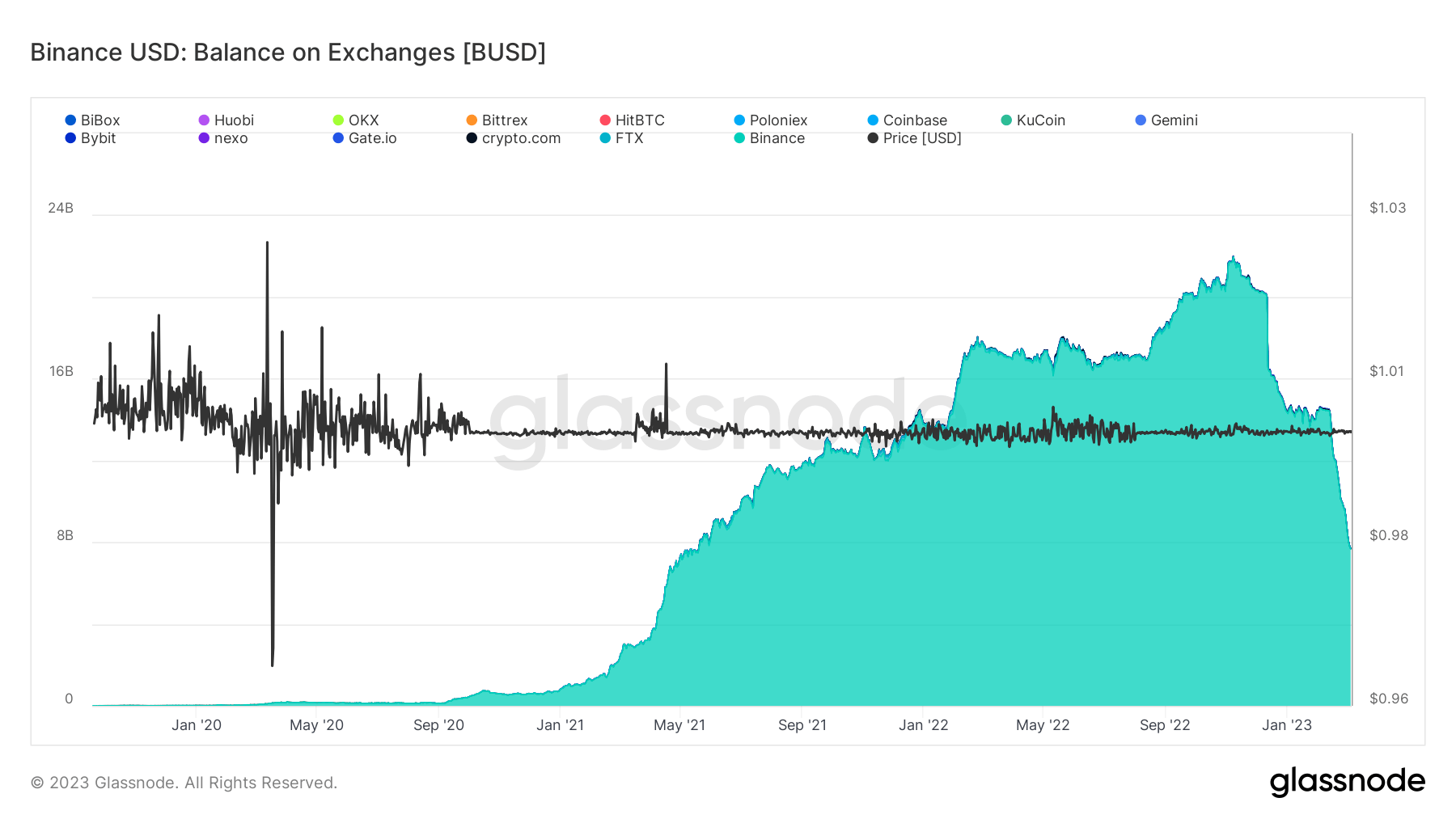

Since November 2022, the marketplace dominance of BUSD has halved, sinking from 14% marketplace stock to 7% implicit the past 4 months.

The illustration beneath shows balances held connected exchanges peaking astatine $22 cardinal astir mid-November 2022. Following that, arsenic the FTX saga took hold, a crisp dip recovered a enactment level of astir $14 billion.

However, arsenic rumors of BUSD’s reserve discrepancies circulated, different sell-off occurred, dropping the existent speech equilibrium to little than $8 billion.

Interestingly, since November 2019, Binance has held the overwhelming bulk of BUSD consistently, with different exchanges hardly featuring.

Source: Glassnode.com

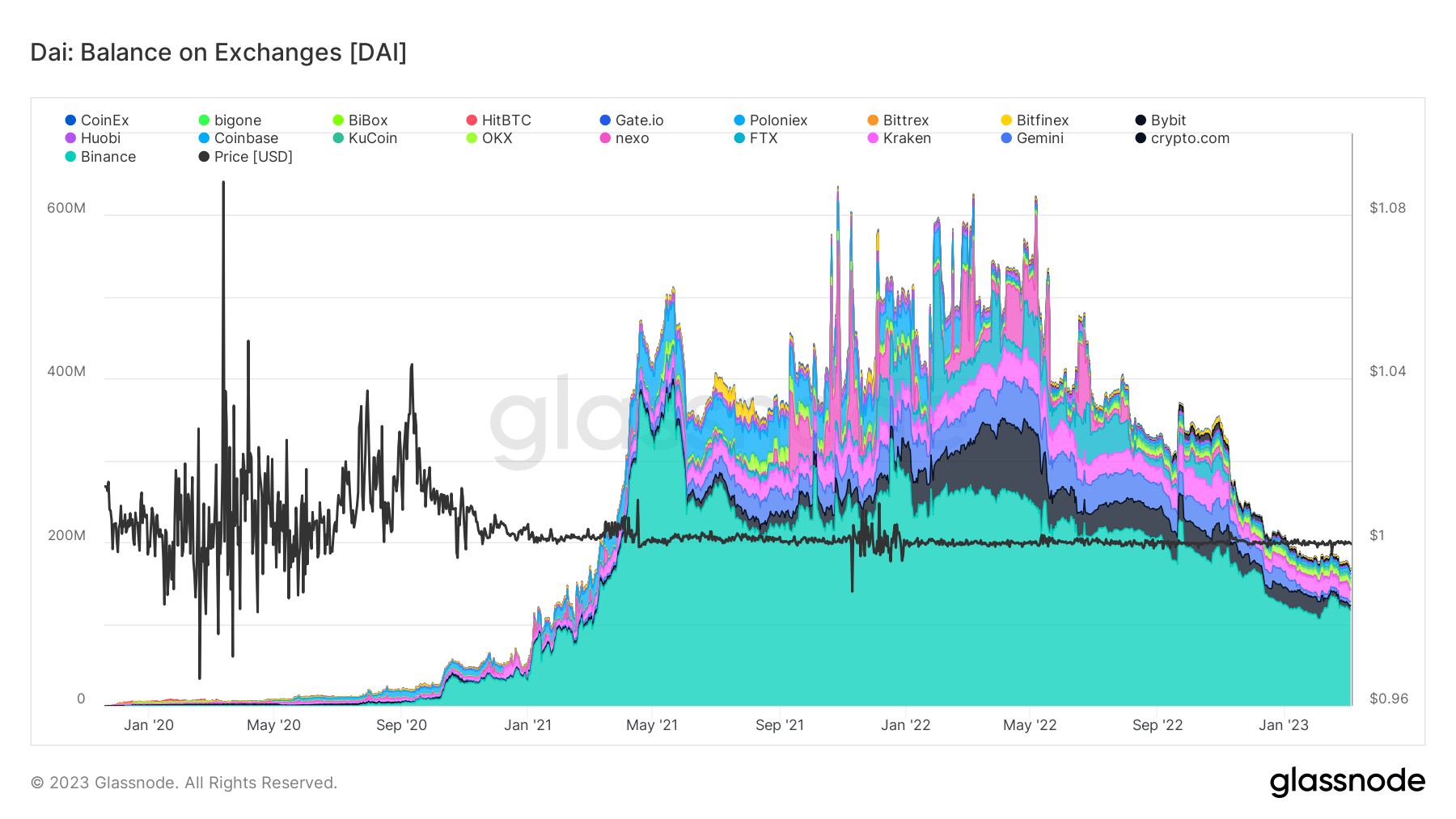

Source: Glassnode.comMeanwhile, DAI’s marketplace dominance has held comparatively flat, accounting for astir 4% of the marketplace since November 2022.

Nonetheless, arsenic depicted successful the illustration below, DAI held connected exchanges has been trending downwards since May 2022.

Binance holds the astir DAI, astatine 120 cardinal of the 160 cardinal total. But having shed its 2021 and 2022 holdings is present heading backmost to precocious 2020 levels.

Source: Glassnode.com

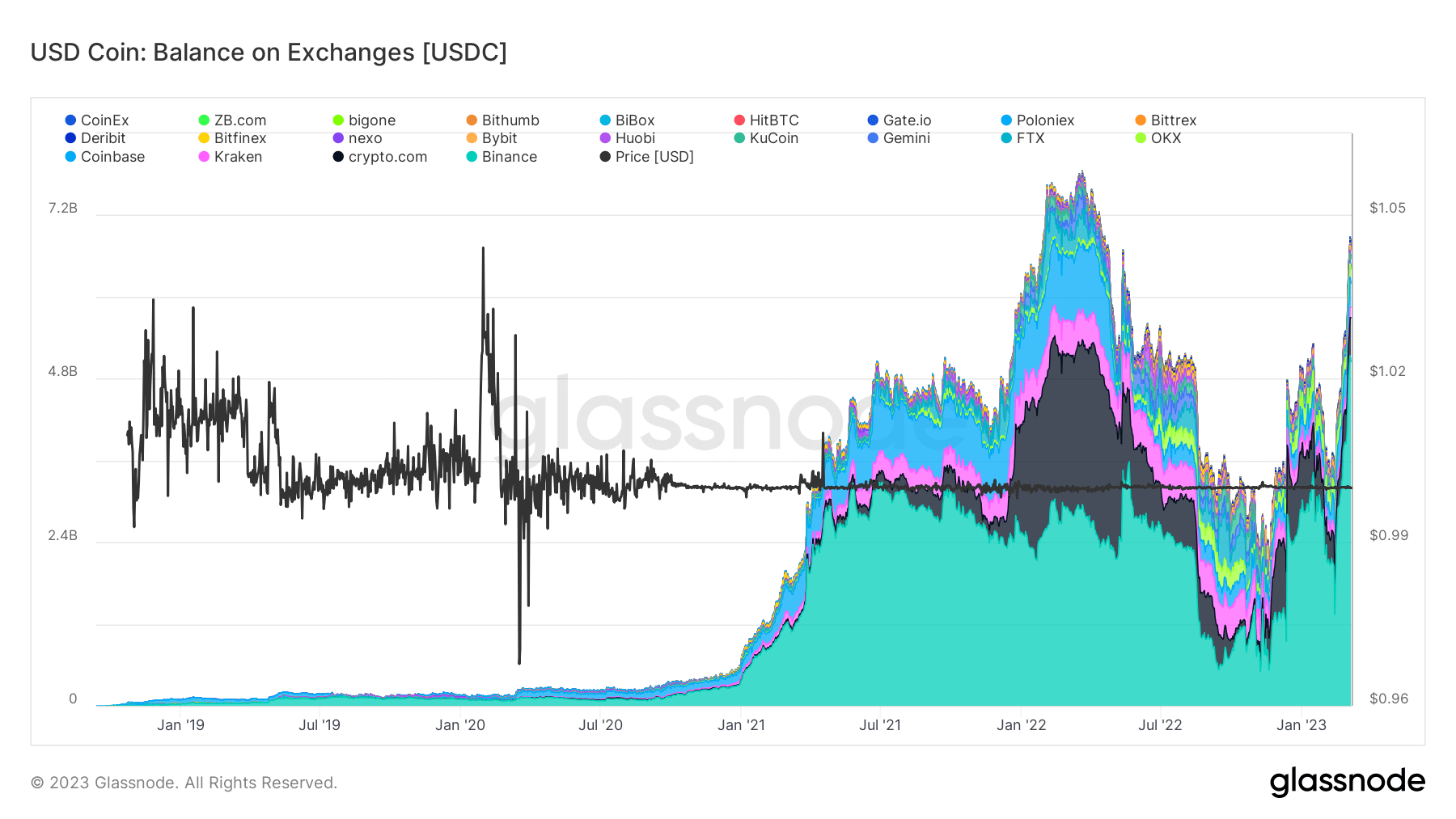

Source: Glassnode.comUSDC has experienced a nett payment from BUSD’s downfall, with dominance expanding to 34% of the stablecoin market.

The equilibrium held connected exchanges has spiked to adjacent April 2022 highs. The bulk is held connected Binance, presently accounting for 5 cardinal tokens, with Crypto.com coming successful 2nd astatine 645 million.

Source: Glassnode.com

Source: Glassnode.comTether shines

Tether has seen the astir important payment from changing stablecoin marketplace dynamics. The illustration beneath shows a important uptrend successful the USDT equilibrium connected exchanges.

Market dominance present exceeds 55%, with Bitfinex holding the bulk stake, expanding its stock from 1.8 cardinal successful June 2022 to implicit 10 cardinal astatine present.

However, this week saw Bitfinex offload astir $2 cardinal of USDT, but astir $16 cardinal remains connected exchanges.

Source: Glassnode.com

Source: Glassnode.comWhile USDC’s dominance remains flat, USDT has added astir 8% marketplace stock implicit the past 5 months, making it the starring dollar-backed stablecoin by a important margin.

The station Research: Tether shines arsenic starring stablecoin successful evolving market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)