Defined arsenic addresses that person held Bitcoin for implicit 155 days, semipermanent holders are often considered the backbone of the market. They make enactment arsenic they thin to accumulate BTC erstwhile prices are declining, and substance bull rallies arsenic they administer the accumulated coins erstwhile the marketplace is successful an upswing.

Therefore, determining the Bitcoin bottommost requires looking astatine the behaviour of semipermanent holders, arsenic a existent bottommost is reached lone erstwhile LTHs capitulate.

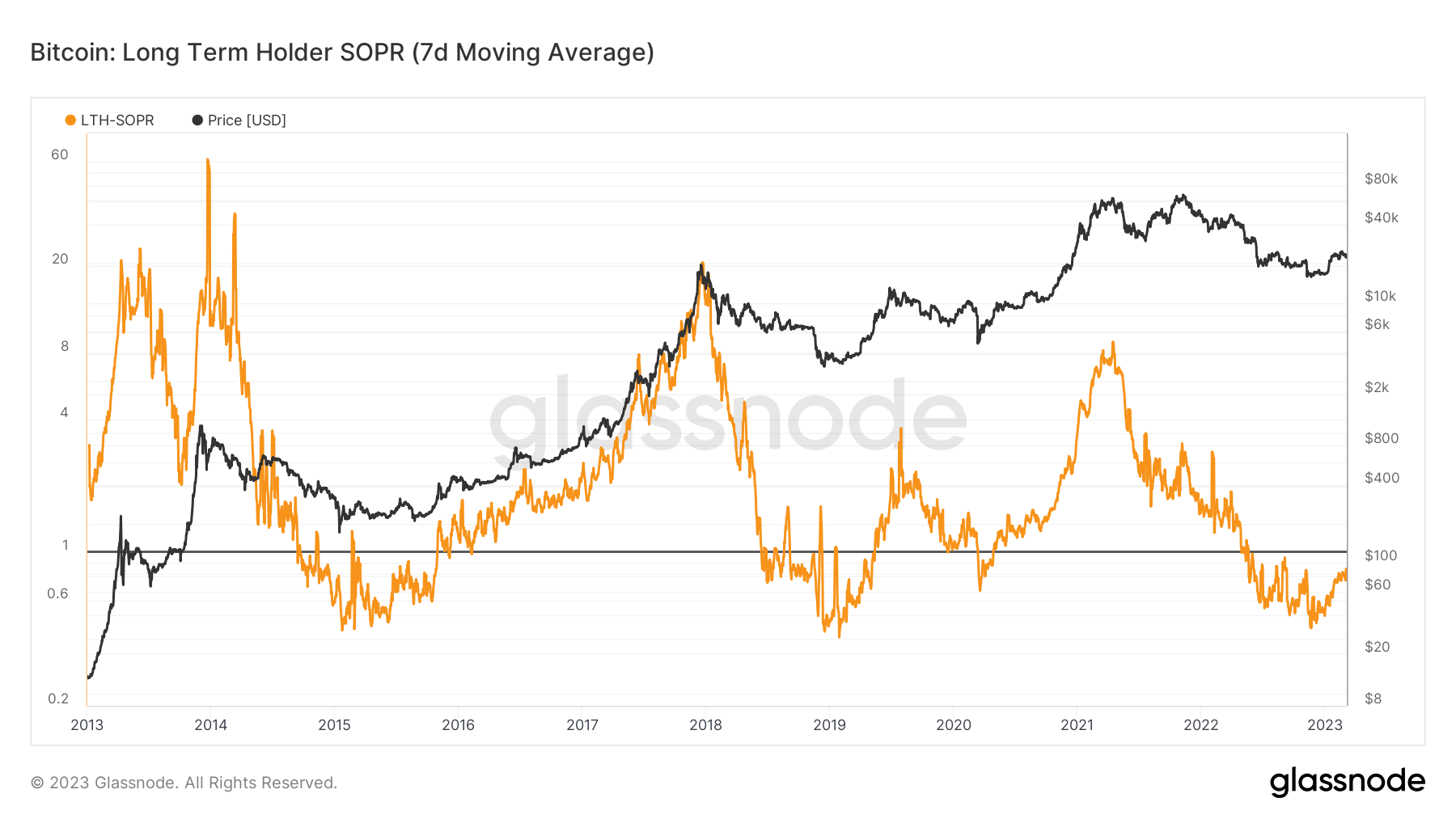

Spent Output Profit Ratio (LTH SOPR) is simply a metric that provides a wide penetration into the behaviour of Bitcoin holders. When applied to LTHs, it shows the grade of realized nett for each coins LTHs moved implicit a peculiar clip frame.

A SOPR worth greater than 1 implies that the coins were selling astatine a profit, portion a SOPR worth little than 1 shows the coins are selling astatine a loss. A SOPR trending higher shows nett is being realized, portion a downward trending SOPR indicates losses.

Data analyzed by CryptoSlate showed that the LTH SOPR has been trending upward since the opening of the twelvemonth aft bottoming to a three-year debased successful December 2022.

Graph showing Bitcoin LTH SOPR from 2013 to 2023 (Source: Glassnode)

Graph showing Bitcoin LTH SOPR from 2013 to 2023 (Source: Glassnode)Unlike SOPR, which takes into relationship lone spent outputs with a lifespan of much than 155 days, LTH MVRV takes into relationship lone unspent outputs (UTXO).

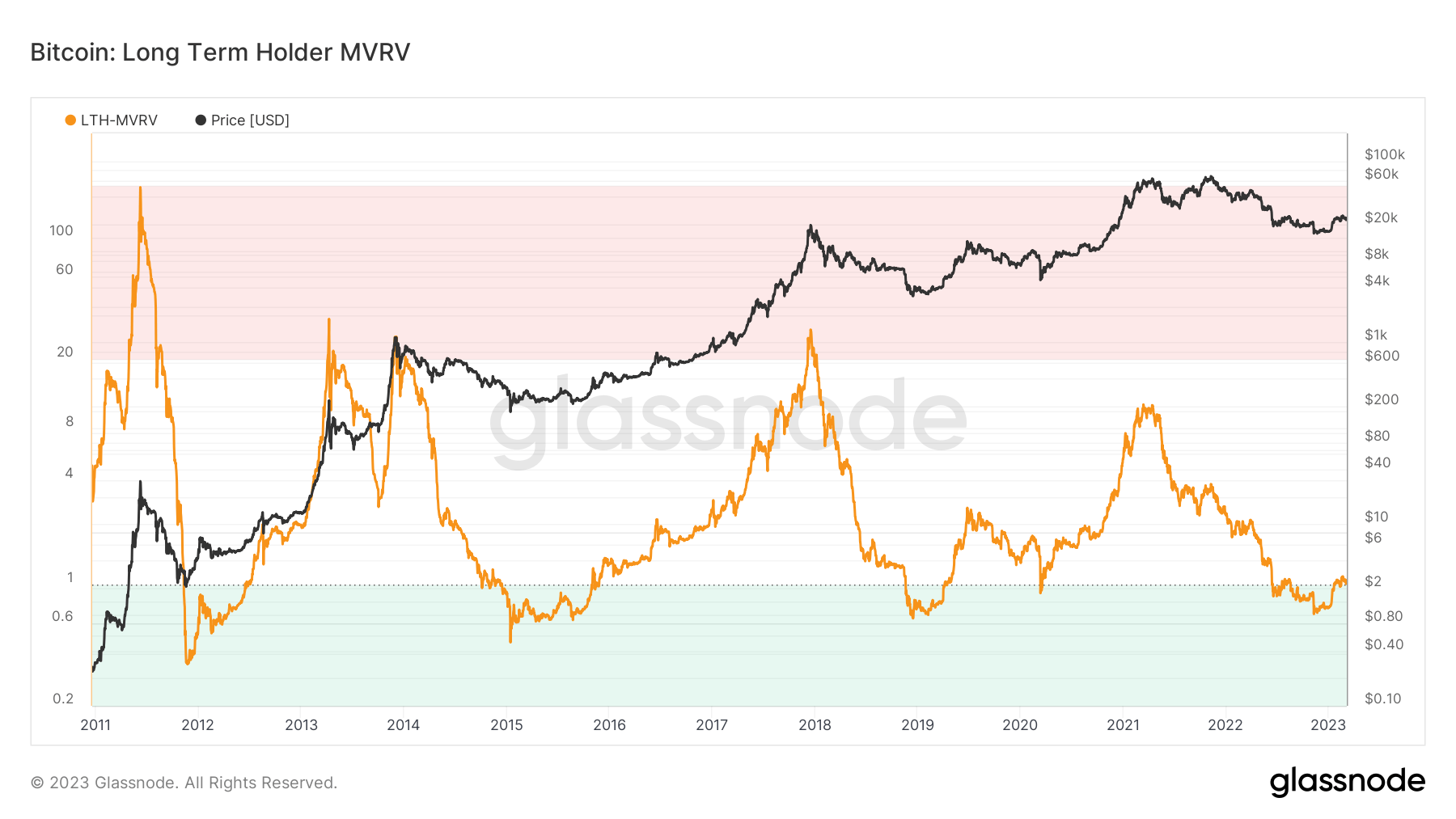

The MVRV ratio shows the ratio of Bitcoin’s marketplace headdress and its realized headdress to find whether it’s trading supra oregon beneath just value. Like SOPR, it provides a coagulated appraisal of marketplace profitability arsenic utmost deviations betwixt marketplace worth and realized worth tin beryllium utilized to place marketplace tops and bottoms.

A rising MVRV ratio indicates a larger grade of unrealized nett and the imaginable for organisation arsenic investors contention to fastener successful profits. A decreasing oregon debased MVRV shows a smaller grade of unrealized profits that could awesome undervaluation and mediocre demand.

When the MVRV ratio drops beneath 1, a ample information of the proviso is held either astatine break-even prices oregon astatine a loss. This is usually a motion of marketplace capitulation and indicates that the carnivore accumulation signifier mightiness beryllium coming to an end.

CryptoSlate investigation recovered that the LTH MVRV ratio has conscionable breached supra 1, indicating a imaginable extremity to the carnivore market.

Graph showing Bitcoin LTH MVRV ratio from 2011 to 2023 (Source: Glassnode)

Graph showing Bitcoin LTH MVRV ratio from 2011 to 2023 (Source: Glassnode)Compiling some SOPR and the MVRV ratio shows a somewhat hesitant extremity to the carnivore market.

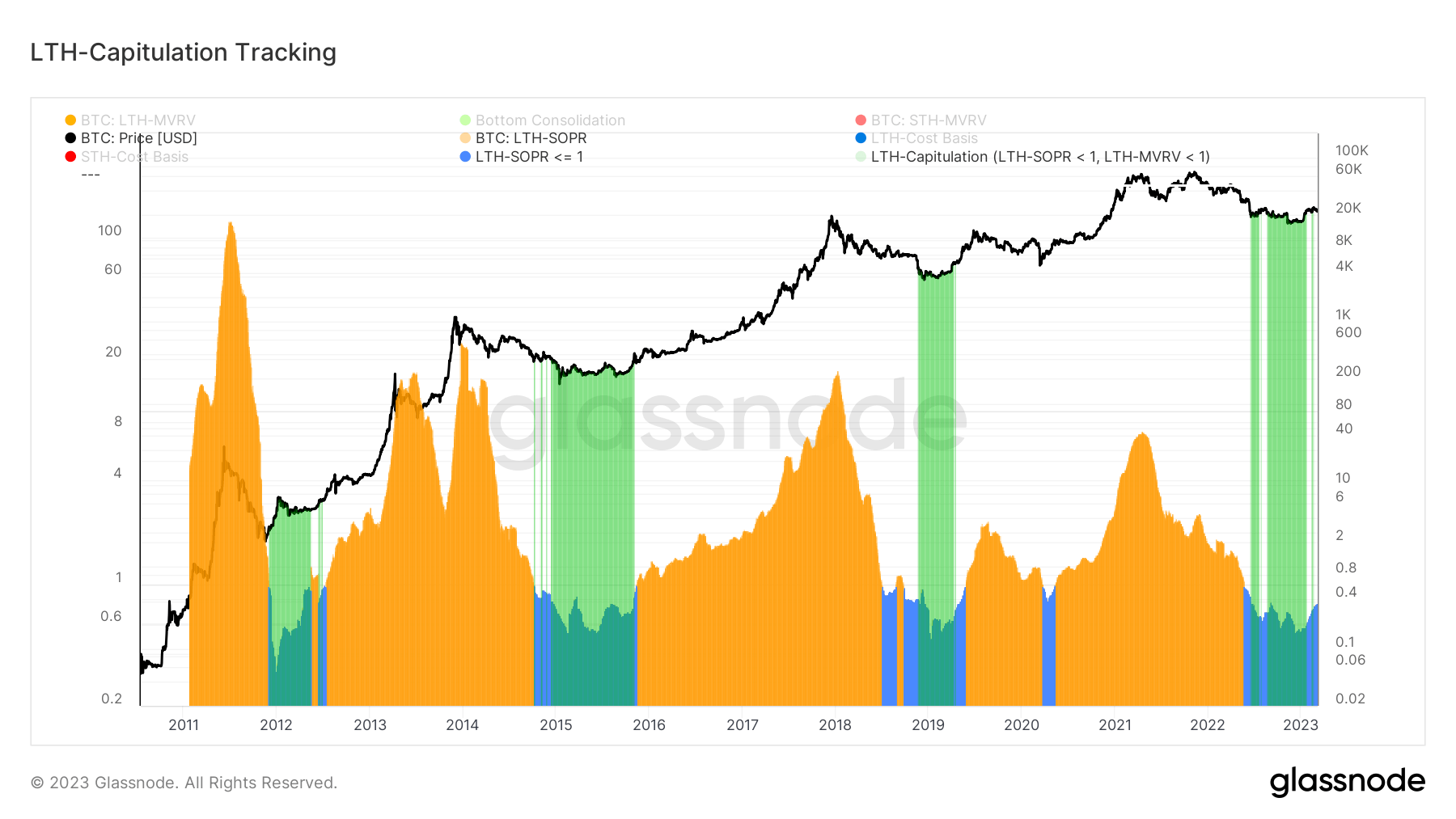

Green highlights connected the graph beneath amusement periods erstwhile some the LTH SOPR and the LTH MVRV ratios trended astatine oregon beneath 1. When the 2 ratios driblet beneath 1, it shows marketplace capitulation arsenic some spent coins are being sold astatine a nonaccomplishment and a ample information of the circulating proviso is being held astatine an unrealized loss.

Graph overlaying the Bitcoin LTH SOPR and MVRV ratios from 2011 to 2023 (Source: Glassnode)

Graph overlaying the Bitcoin LTH SOPR and MVRV ratios from 2011 to 2023 (Source: Glassnode)CryptoSlate investigation confirms that the marketplace is firmly retired of capitulation. However, arsenic the LTH SOPR is inactive trending astatine conscionable nether 1, the marketplace inactive lacks the assurance to participate into a full-blown rally.

The station Research: A look astatine however semipermanent holders find extremity of carnivore markets appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)