Key bitcoin (BTC) indicators are signaling a imaginable displacement to a bearish marketplace authorities arsenic traders await Federal Reserve Chairman Jerome Powell's remarks astatine the Jackson Hole Symposium.

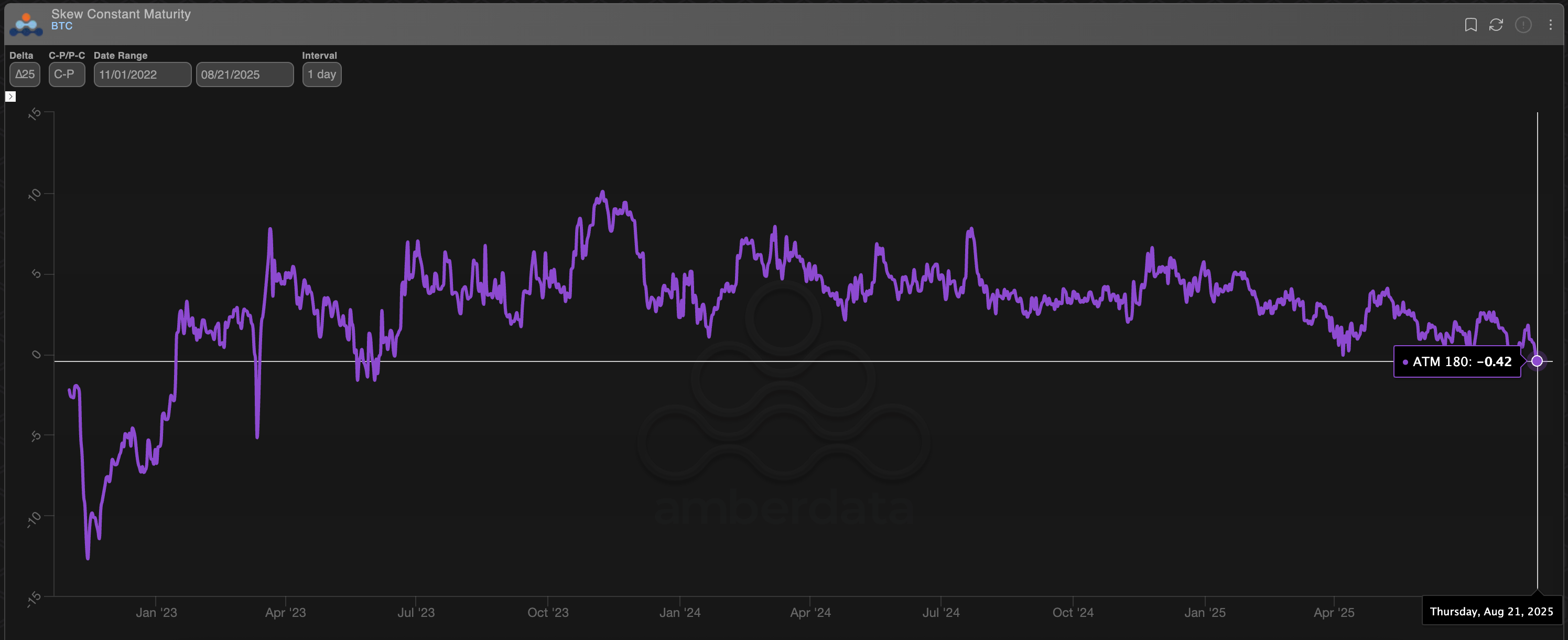

The archetypal 1 is the 180-day call-put skew derived from options trading connected Deribit, the largest crypto options speech by measurement and unfastened interest.

As of writing, the 180-day skew was antagonistic 0.42, the lowest since June 2023, according to information root Amberdata. A antagonistic call-put skew suggests that traders are pricing successful greater request for enactment options (which connection extortion against terms declines) comparative to telephone options. The information tin beryllium interpreted arsenic rising marketplace caution oregon bearish sentiment implicit the mean term.

"BTC longer dated skew flipping into enactment premium could beryllium a motion of authorities shift," Imran Lakha, laminitis of Options Insights, said connected X.

The antagonistic speechmaking comes crossed arsenic a authorities shift, arsenic it follows 2 years of consistently affirmative values, which reflected a bias toward bullish telephone options.

More importantly, BTC has lone pulled backmost by astir 8% from its grounds highs supra $124,000, which were reached a week ago. Yet, the semipermanent sentiment has flipped bearish.

According to Lakha, the terms pullback has triggered request for enactment options.

"BTC and ETH skews are pulling toward enactment premium arsenic markets correct. BTC doesn’t amusement a telephone premium again until March 2026. The determination little triggered buying of August/September puts astir the $110,000 strike. Calls and telephone spreads are being sold arsenic longs de-risk into Powell’s Jackson Hole code connected Friday," Lakha said successful a blog post.

Federal Reserve Chair Jerome Powell is scheduled to talk astatine the cardinal bank's annual Jackson Hole Symposium on Friday. Most traders expect Powell to awesome complaint cuts starting from September and if helium gives what's expected, the marketplace whitethorn correct, according to Nansen's probe expert Nicolai Sondergaard.

"At this stage, the marketplace broadly expects cuts, truthful overmuch of that is already priced in. If Powell delivers precisely what’s anticipated, crypto could spot sideways to somewhat bearish action, a classical “sell the news” dynamic. By contrast, if the Fed signals a deeper oregon faster cutting rhythm than expected, that could spark caller hazard appetite and acceptable the signifier for the adjacent bullish limb successful crypto," Sondergaard said.

Stock traders pursuit puts

The request for downside extortion successful BTC is accordant with the enactment connected Wall Street, wherever traders person been preparing for a sell-off successful the large exertion stocks.

"Traders are buying 'disaster' puts connected the Invesco QQQ Trust Series 1 ETF, which tracks the Nasdaq 100 Index," Jeff Jacobson, caput of derivative strategy astatine 22V Research Group, told Bloomberg.

Guppy aggregate moving mean indicator

The 2nd indicator pointing to a bearish displacement successful the authorities is the Guppy aggregate moving mean (GMMA) indicator.

Developed by Australian trader Daryl Guppy, the indicator is utilized to place reversals and measure inclination spot by analyzing the bands formed by short-term and semipermanent moving averages. A bullish transverse occurs erstwhile the greenish set representing short-term moving averages crosses supra the reddish set of semipermanent moving averages, indicating that upward momentum is gathering pace.

BTC's terms has crossed beneath the Guppy moving mean bands, a motion that bulls are losing power and the semipermanent sentiment whitethorn beryllium turning bearish. This is often considered a informing motion that downside momentum is astir to strengthen, paving the mode for pronounced terms weakness.

Other indicators, specified arsenic the MACD histogram, also suggest a strengthening of the downside momentum.

Read more: Bitcoin Hovers astatine $113K; Solana and Dogecoin Lead Gains Ahead of Powell’s Jackson Hole Speech

2 months ago

2 months ago

English (US)

English (US)