Crypto expert Astronomer (@astronomer_zero) posits a beardown bullish outlook for Bitcoin successful the 4th fourth of 2024. Leveraging humanities data, Astronomer provides an analysis via X, suggesting an 82% probability of an ultra bullish inclination based connected the show of Bitcoin successful September.

The crypto expert opens his investigation with an accent connected the unexpected affirmative show of Bitcoin successful September. “September is astir to adjacent and to the wide public’s surprise, it’s looking similar it’s going to beryllium greenish (by a agelong shot), with the accidental of mounting the greenest September successful 2024, supporting our breakout thesis we person been connected for a portion now,” helium writes.

Delving into the sentiment of the market, Astronomer notes a important disconnect betwixt nationalist cognition and existent marketplace positions. “And though we’re not the lone ones anymore that are connected the afloat bull thesis, information is and remains data. And aft thorough inspection, contempt the talking/analysis posts, astir are not positioned yet, took nett excessively aboriginal oregon volition cheer for dips and accidental they are a acquisition for the crushed of wanting one,” helium explained.

He further elaborates connected the sentiment wrong closed circles: “This reflection is not conscionable coming from nationalist posts oregon Twitter, but besides from the array of paid groups partaken successful to behaviour these analyses. Not allowed to stock names oregon details, but astir groups so are agelong and took nett early, are looking for an entry, oregon are short. So the market’s manus seems to beryllium working.”

82% Chance Bitcoin Will Be Bullish

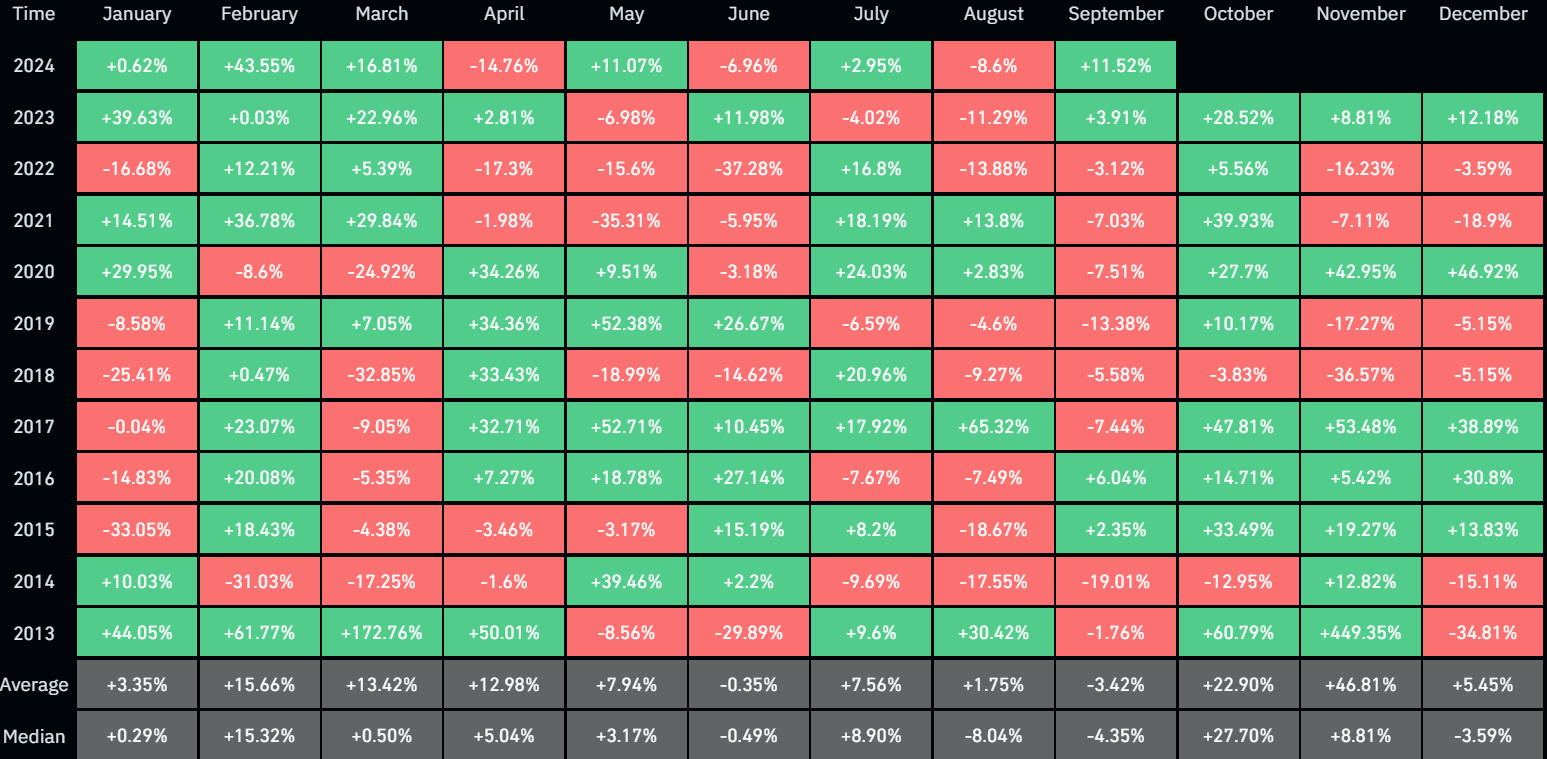

Astronomer’s bullish thesis leans connected humanities data, peculiarly the cyclical quality of the Bitcoin price. “The information investigation is reasonably elemental here: each clip BTC had a greenish September, it was followed by nary little than 3 greenish months after, i.e., a greenish October, November, and December. And this has happened 3/3 times since BTC inception,” helium asserts, signifying a beardown seasonal pattern.

Bitcoin show by period | Source: X @astronomer_zero

Bitcoin show by period | Source: X @astronomer_zeroHowever, helium is speedy to temper this with a critique of his methodology, admitting to the imaginable pitfalls of debased information samples: “Now similar I said, I americium not the biggest instrumentality of seasonality and our investigation lone has 3 information points, which gives america lone a 67% assurance to marque the assertion that the adjacent 3 months volition so beryllium greenish (low information fallacy). But to adhd significance, by the binary quality of bullish/bearish, determination is besides exclusivity to the data: if September is not green, 6 retired of 8 times, Q4 has not been greenish each month.”

He refines his thesis further, “So, by including the exclusivity, a much wide and easier to construe claim, utilizing much information points is that: ‘The absorption of September has determined the wide absorption of Q4 and if September is greenish and not red, a bullish (not bearish) Q4 has followed 9 retired of 11 times. So if September closes supra $59k, determination is an 82% accidental Q4 volition beryllium bullish’.”

The prediction stirred dialog wrong the community. A idiosyncratic @pieceofsheet99 commented skeptically, suggesting the imaginable for an unexpected downturn: “If September turned retired to beryllium greenish to everyone’s surprise, October tin besides crook retired to beryllium reddish to everyone’s astonishment arsenic well.” Astronomer responded, reaffirming his reliance connected humanities trends, “Indeed, but that’s not what we person seen typically. So, I personally, arsenic always, instrumentality to the data.”

Astronomer’s investigation concludes connected a enactment of strategical optimism, emphasizing the value of aligning with marketplace dynamics and humanities patterns alternatively than speculative impulses. “How bullish? We volition spot (time is much important than price), but it’s not astir readying for status and making accelerated money. It’s astir being connected the close broadside of the trade, clip aft clip aft time, enjoying the marketplace stress-free and not having excessively galore regrets done losing wealth oregon being sidelined (enjoying the process). And this way, yet (rather soon), you deed your goals.”

At property time, BTC traded astatine $64,622.

Bitcoin terms marks a higher precocious | Source: BTCUSDT connected TradingView.com

Bitcoin terms marks a higher precocious | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)