The U.S. needs to instrumentality intelligent, progressive, and circumstantial integer plus regularisation immediately, arsenic the Securities and Exchange Commission’s caller charges against Coinbase and Binance person brought the statement connected integer plus classification to a boiling point.

The SEC’s charges show that the enactment is not equipped to modulate integer assets competently.

Included successful the suits are lists of implicit 15 integer assets the SEC claims walk the Howey Test and are frankincense securities. In bid to win successful the suit, SEC Chair Gary Gensler told CNBC,

“All we person to amusement is that 1 of [the tokens listed by the exchanges] is simply a information and they should beryllium decently registering.”

However, erstwhile reviewing the alleged securities listed by the exchanges, determination is nary notation of the achromatic swan that was the Terra-Luna illness (save for a passing notation successful the Binance suit.) Binance presently inactive lists LUNA arsenic good arsenic the classical token LUNC, portion Coinbase listed wrapped LUNA (wLUNA) and inactive has it disposable via the Coinbase Wallet. Terra Luna’s nonaccomplishment wiped retired tens of billions of dollars from the crypto marketplace headdress and led to idiosyncratic investors losing immense amounts of money.

The SEC besides invokes tokens trading connected FTX arsenic portion of their statement that Coinbase is successful the wrong. In the lawsuit, the listing of SOL connected FTX.US is presented arsenic portion of the grounds claiming that Solana is simply a security. An astir identical conception is besides included successful the Binance suit.

At this point, it is good known that FTX and its executives had a precise well-known beingness connected Capital Hill and that SBF and his cohorts established idiosyncratic oregon moving relationships with respective members of the U.S. government, Gensler included. U.S. customers mislaid immense sums erstwhile that speech failed, leaving much than a fewer members of the authorities with an embarrassing way grounds of having snuggled up to alleged fraudsters and the uncomfortable world of having to disgorge themselves of their important run donations.

The U.S. has failed connected crypto regulation

Coinbase has been publically requesting guidance connected integer plus regularisation for years. “The SEC is 1 wherever we’ve truly struggled implicit the past fewer years,” stated Coinbase CEO Brian Armstrong successful a Twitter Space earlier this year, implying an intransigence astatine that bureau not encountered elsewhere.

Armstrong explained that Coinbase had attempted to interaction the SEC to sermon the regulatory scenery to nary avail until the SEC specifically requested to sojourn Coinbase past year. Coinbase had “30 meetings implicit the past 9 months” with the SEC, which was expected to culminate successful a gathering wherever feedback would beryllium given.

However, Armstrong alleged that the SEC canceled the gathering the time earlier it was expected to hap and sent a Wells Notice to Coinbase the pursuing week. Nine weeks later, it sued the speech for aggregate securities laws violations.

Digital Assets mentions successful Congressional Record

While determination has been a considerable increase successful legislature enactment connected integer assets implicit the past fewer years, with implicit 1,065 mentions of the word successful the record. Nevertheless, existent advancement connected integer plus regularisation has been excruciatingly slow.

Digital assets were archetypal mentioned successful a Senate hearing from 2000 titled “Utah’s Digital Economy and the Future: Peer-to-Peer and Other Emerging Technologies,” successful which they were likened to “databases.”

Digital assets were also mentioned successful a 2001 Congressional proceeding by the Energy and Commerce Subcommittee connected Commerce, Trade, and Consumer Protection. John Schwarz, the President and CEO of Reciprocal, Inc., argued that “securing integer assets and preventing unwanted integer intrusion is equivalent to defending idiosyncratic and perchance nationalist integrity.”

While Schwarz was talking astir integer files specified arsenic mp3 audio and mp4 videos, it is the archetypal authoritative notation of the word present making headlines.

The word was cited infrequently each twelvemonth until 2019, erstwhile integer plus mentions surged to 21, including the projected bills, Managed Stablecoins are Securities Act and the Keep Big Tech Out Of Finance Act.

By 2022 determination were 598 mentions of the word “Digital Assets,” including 22 bills, 14 Congressional Hearings, and implicit 500 mentions successful Congressional calendars. This year, successful 2023, determination person lone been 68 mentions to date, the legislature calendar postulation being the biggest origin of the drop, falling from 501 to conscionable 8 mentions.

Trends successful Digital Asset usage

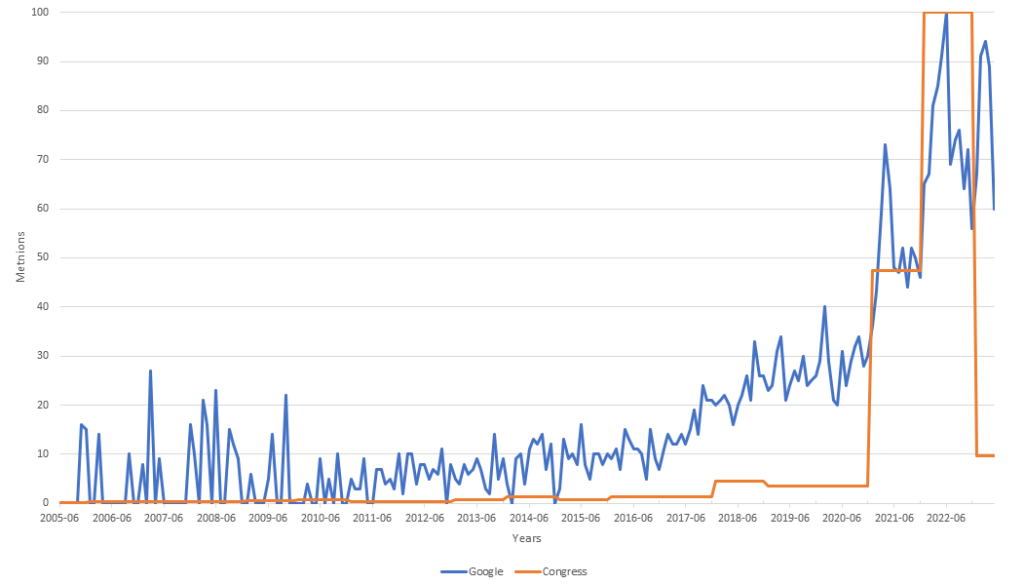

I compared the “Digital Assets” mentions connected Govinfo.gov’s Congressional and Federal databases to the hunt measurement of the aforesaid word connected Google from 2005 to the present.

The normalized illustration beneath shows involvement done Google Search picking up from astir 2017, portion it took until 2020 for the U.S. Government to summation the usage of the word connected the record.

In the chart, the information is scaled to a communal notation point, allowing for casual examination and investigation of the antithetic information sets. Notably, determination has been an utmost diminution successful mentions connected the authoritative nationalist grounds for “Digital Assets” to conscionable 9.7 astatine a clip erstwhile Google Search postulation is supra 60.

Interest from Google Search seems to person formed a treble top, with a highest successful 2021 and a little precocious astatine the commencement of 2023. The method analysts of the satellite would suggest specified a question is simply a bearish indicator if this was a banal oregon token chart.

Moreover, involvement from Congress has simply fallen disconnected a cliff, with mentions falling from 598 successful 2022 to conscionable 58 six months into 2023.

Why?

Has speech connected integer assets been moved disconnected the authoritative nationalist grounds into backmost channels and societal media? Was the surge successful 2022 related to an urgent request to specify Digital Assets?

If that were the case, past wherefore are companies who are (publicly) begging for guidance connected integer plus regularisation being sued by the SEC?

In portion 2 of this three-part feature, we volition research the implications of the SEC’s actions and research alternate approaches to crypto regularisation that could payment the manufacture and its investors.

Follow CryptoSlate connected Twitter oregon articulation our Telegram transmission to beryllium notified erstwhile the 2nd portion is available.

The station Op-ed: Why the SEC should enactment distant from crypto (Part I) appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)