The emergence of the Ordinals protocol has transformed Bitcoin from a somewhat stale single-asset concatenation into thing overmuch much exciting.

However, this newfound excitement has sparked pushback from laser-eyed purists, who reason that BTC was not intended for non-monetary transactions – immoderate going arsenic acold arsenic calling the protocol a spam onslaught connected the network.

Brushing speech the protests, Ordinals Capitalists accidental a permissionless strategy besides includes the liberty to utilize Bitcoin successful immoderate mode 1 chooses. They impeach purists of attempting to spoil their fun.

The divergent viewpoints person acceptable the signifier for a imaginable concatenation divided – which yet serves nary one’s champion interest.

Taproot opened Pandora’s box

The Taproot brushed fork was rolled retired successful November 2021. At the time, it was chiefly regarded arsenic an upgrade to amended web security, efficiency, and scalability. However, it besides enabled executable commands and the implementation of definite scripts – frankincense laying the instauration for Ethereum-like functionality specified arsenic astute contracts and dApps.

In January, the interaction of this further Ethereum-like functionality began to instrumentality signifier arsenic developer Casey Rodarmor released Ordinals. This protocol allows for each of the 100,000,000 satoshis successful a Bitcoin to beryllium inscribed with further metadata, including text, images, video, and code.

By February, the Ordinals protocol was utilized to constitute a wizard jpeg into the blockchain, opening the doorway to a Bitcoin NFT market. But arsenic a “square peg, circular hole” usage of the technology, acquiring and trading Bitcoin NFTs was a cumbersome and technically challenging feat, requiring cognition of node synching and trusting a 3rd enactment to merchandise the NFT upon payment.

Recently, supporting wallets, including Ordinals Wallet, Xverse, and Hiro Wallet, person rolled retired to code these symptom points, making the process much similar the modular acquisition NFT buyers are utilized to.

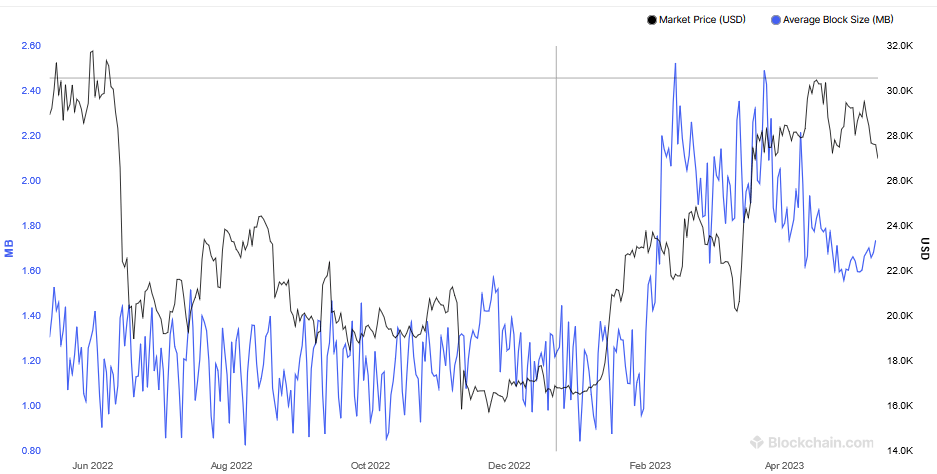

Before Ordinals NFTs went live, the mean artifact size was hovering astir 1.2 MB, but since its rollout, consequent blocks person much than doubled connected mean – negatively affecting velocity and scalability. Additionally, higher transaction fees and concatenation bloat, done a backlog of unconfirmed transactions, person added to useability problems.

Source: Average BTC artifact size from Blockchain.com

Source: Average BTC artifact size from Blockchain.comHere travel the BRC-20 tokens

Things stepped up successful March erstwhile anonymous developer “Domo” launched BRC-20 tokens – bringing a fungible token modular to Bitcoin. By attaching a JavaScript Object Notation (JSON) to satoshis, details of the BRC-20 token’s characteristics, including its minting and organisation values, are preserved successful the network.

Spurred by meme coin season, BRC-20 tokens saw a highest marketplace headdress valuation of $1 billion connected May 8. However, wider marketplace uncertainty and the prevalence of meme coin rugs person since seen a important drawdown – falling to $574 cardinal astatine the clip of press.

Per KuCoin, the booming popularity of BRC-20 has worsened the problems seen with NFTs, causing important web delays, with immoderate users reporting 4-hour confirmation times. In addition, BRC-20 tokens person further contributed to rising transaction fees.

Despite useability issues, miners are reaping the benefits with on-chain metrics, including Miner Hash Price, which measures miners’ income comparative to web contribution, and Miner Percent Mined Supply Spent, which looks astatine the complaint miners merchantability mined coins, pointing to a reinvigoration of the Bitcoin mining space.

CryptoSlate’s investigation concluded that if the momentum continues astatine its existent pace, miners volition acquisition boosted profitability and a greater consciousness of assurance successful the network, starring to a penchant to clasp onto mined coins.

Community divided connected Ordinals

Prominent members of the Bitcoin assemblage person voiced their enactment of Ordinals. For example, MicroStrategy Chair Michael Saylor said the protocol was liable for flipping sentiment bullish – adding that if helium was a miner, helium would beryllium ecstatic.

Moreover, helium pointed retired that the exertion volition pb to galore caller applications successful the agelong term, immoderate of which could lick captious societal issues – giving the illustration of inscribing a volition connected the blockchain.

“I could besides inscribe my past volition and testament, and if my past volition and testament is moving a cardinal dollars from maine to you, however overmuch is it worthy to you to person that burned onto the blockchain and cryptographically verified?”

Meanwhile, Willy Woo expressed a much pragmatic view, saying determination are bully and atrocious points to consider. While further transaction fees supply beardown incentives for miners, which volition go much captious successful the aboriginal arsenic artifact rewards dwindle with each halving, this comes astatine the outgo of much centralization owed to less radical being consenting to tally higher bandwidth nodes.

For now, fixed that decentralization is not “anchored” in, Woo said Ordinals, and the associated boon for miners, arrived excessively soon for his liking.

“I would person preferred the interaction of ordinals to person been a batch aboriginal erstwhile the information fund becomes much pressing, it would beryllium astatine a clip erstwhile decentralisation is already anchored.“

Jan3 co-founder Samson Mow played down the value of Ordinals. He said congestion and precocious fees are thing to interest about, arsenic paying monolithic fees to miners is unsustainable implicit the agelong term.

“It’s a question people connected however agelong they tin bash that for. Maybe it’s a fewer much days. Maybe it’s a week. But definately it’s not a sustainable exemplary to propulsion wealth away.”

Clarifying his position, Mow explained that Ordinals is simply a mostly hype-driven marketplace fueled by short-term wealth grabs. What’s more, helium predicts the assemblage volition vanish erstwhile the token issuers person made capable money.

“They beryllium to get immoderate gullible radical to wage attraction to them by doing immoderate brainsick antics…

But similar astir projects that are successful the blockchain space, they slice distant successful relevance erstwhile the issuers of the tokens person made their money.”

What would Satoshi think?

Satoshi Nakamoto cannot explicit an sentiment connected whether Ordinals are bully oregon atrocious for Bitcoin. But radical person turned to his Bitcointalk forum posts to effort and enactment retired his position connected the matter.

In a December 2010 post, Nakamoto supported the thought of keeping the blockchain thin and escaped from bloat with a presumption to maximizing scalability.

“Piling each proof-of-work quorum strategy successful the satellite into 1 dataset doesn’t scale.”

Nakamoto spoke of segregating non-monetary transactions onto a abstracted concatenation called BitDNS – which was conceived arsenic a sidechain oregon furniture 2 utilizing the Domain Name System net protocol. Later, this task became an altogether abstracted alt chain, rebranding to Namecoin.

“Bitcoin and BitDNS tin beryllium utilized separately. Users shouldn’t person to download each of some to usage 1 oregon the other. BitDNS users whitethorn not privation to download everything the adjacent respective unrelated networks determine to heap successful either.”

Based connected this, it seems Nakamoto wanted to support the mainchain exclusively for monetary transactions and for a sidechain/layer 2 to grip ample information features.

The Bitcoin halfway devs besides look to person adopted the purist’s stance, arsenic indicated by @frankdegods, who publicized dev plans to widen Taproot spam filters to region Ordinals altogether.

Bitcoin civilian war

In a throwback to 2017 and the Bitcoin Cash hard fork, the question of whether Bitcoin should summation its artifact size to accommodate Ordinals has ignited statement wrong the community.

Given the deficiency of statement connected the champion way forward, the anticipation of a further concatenation divided looms progressively likely. But, of the 105 BTC forks to date, it’s worthy noting that each person faded into obscurity.

The astir palmy fork, Bitcoin Cash, is down 98.9% against Bitcoin from its 0.43 highest successful November 2017. This suggests that an Ordinals fork would apt look important challenges, making a divided futile.

Source: BCHBTC connected TradingView.com

Source: BCHBTC connected TradingView.comThere is nary shortage of alternate furniture 1s offering tokenization with the added payment of much blase features, specified arsenic lawsuit logic handling. Moreover, these alternate furniture 1s tin run astatine a larger standard and little outgo than Bitcoin – making Ordinals thing of a dinosaur successful comparison.

Yes, Ordinals has breathed caller beingness into Bitcoin, peculiarly from a novelty and mining sustainability constituent of view. But different chains are amended astatine tokenization.

Moreover, to date, the protocol’s superior usage lawsuit is meme coin investing, which lacks utility, has nary corporate benefit, and does not lend to the extremity of doing distant with the corrupt fiat wealth system.

Ordinals are atrocious for Bitcoin due to the fact that it impedes the nonsubjective of revolutionizing money.

The station Op-ed: Why Ordinals, BRC-20 is atrocious for Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)