Six days ago, a fewer hours earlier the blockchain infrastructure level Paxos announced it would nary longer mint BUSD stablecoins, $2.86 cardinal worthy of BUSD were redeemed. Currently, Binance is the astir progressive speech trading BUSD tokens, and the stablecoin inactive commands astir 10.7% of the crypto economy’s $67.71 cardinal successful planetary commercialized measurement implicit the past 24 hours.

BUSD Supply Shrinks by 17.77% successful 6 Days

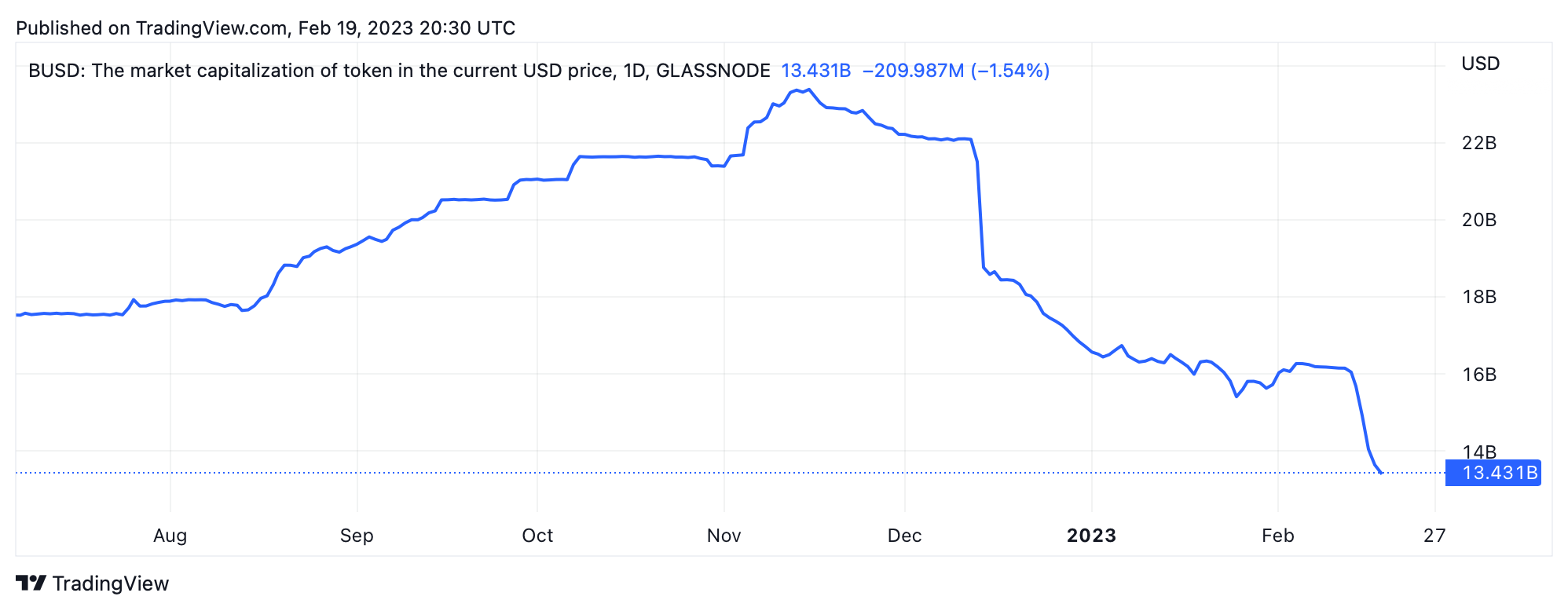

Statistics amusement that a important magnitude of BUSD has been redeemed implicit the past six days, with the proviso dropping by 17.77% during that clip frame. Over the past 30 days, the proviso of BUSD has shrunk by 19.2%. On Feb. 13, 2023, Paxos, the institution that issues, manages, and redeems BUSD, announced that it would nary longer mint caller BUSD going forward.

Redemptions kicked into precocious cogwheel aft Paxos made the announcement, with $290 cardinal being redeemed within 8 hours. At the clip of the announcement, determination was $16.1 cardinal BUSD successful circulation. As of Feb. 19, 2023, determination are astir 13,238,824,118 BUSD successful circulation, meaning that the 17.77% of BUSD redeemed accounted for 2.861 cardinal tokens being removed from the market.

Statistics from Glassnode amusement the proviso astatine 13.43 cardinal portion coingecko.com statistic amusement the proviso astatine 13.23 billion.

Statistics from Glassnode amusement the proviso astatine 13.43 cardinal portion coingecko.com statistic amusement the proviso astatine 13.23 billion.The blockchain quality steadfast Nansen has been monitoring the Paxos Treasury wallet, which sends millions of BUSD to the pain address, efficaciously removing the stablecoins from circulation. According to Nansen’s exchange portfolio tool, Binance presently holds 10.9 cardinal BUSD arsenic of Feb. 19, 2023. Metrics amusement that BUSD inactive accounts for $7.24 cardinal of the day’s $67.71 cardinal successful planetary commercialized volume, which represents 10.7% of the total.

Binance dominates astir of BUSD’s trading volume, with the stablecoin’s astir fashionable trading brace contiguous being tether (USDT). According to statistic from cryptocompare.com, 5.52% of BUSD measurement connected Sunday was besides paired with the Turkish lira. Although BUSD had the astir redemptions successful the past 30 days, USDC saw 2.9% of its proviso removed during that period.

Notably, Paxos’ different stablecoin, pax dollar (USDP), has seen its proviso alteration by 19.3%. A important magnitude of pax golden (PAXG) has besides been removed, arsenic 11.3% of the circulating proviso has been erased successful 30 days. In contrast, tether (USDT) has seen its proviso summation by 5.8%, resulting successful a marketplace capitalization of much than $70 billion.

Tags successful this story

8 hours, Altcoins, Binance, Binance Paxos, Blockchain, blockchain intelligence, Burn Address, BUSD, BUSD redemptions, BUSD stablecoins, Charges, circulating supply, Circulation, crypto economy, Cryptocompare, cryptocompare.com, Cryptocurrency, Exchange, fully-backed, Global Trade Volume, halting, Market Capitalization, Market Trends, minting, Nansen, NYDFS, Pax dollar, PAXG, Paxos, Paxos Trust Company, Portfolio Tool, press release, Redeemable, redemptions, Stablecoin, stablecoin news, Stablecoins, Statistics, Supply Shrinkage, Tether, trade volume, trading, Turkish Lira, USDC, USDP, USDT

What bash you deliberation the aboriginal holds for BUSD successful airy of these caller developments and redemptions? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)