According to information from the Bank for International Settlements (BIS), published successful the latest BIS Bulletin No. 69, researchers assessed that, connected average, astir users mislaid wealth connected their investments implicit the past 7 years. Onchain data, metrics from exchanges, and cryptocurrency exertion download statistic gathered by BIS researchers suggest that astir median retail crypto investors mislaid wealth from August 2015 to the extremity of 2022.

BIS Report Shows Majority of Retail Bitcoin Investors Lost Money Over the Last Seven Years

After publishing recommendations from economists astatine the Bank for International Settlements (BIS) regarding 3 policies for planetary regulators, BIS published a study that explores “crypto shocks and retail losses.” The report initially covers the Terra/Luna collapse and the FTX bankruptcy, during which the researchers observed a important summation successful retail trading activity.

At that time, BIS researchers noted that “large and blase investors” were selling, portion “smaller retail investors” were buying. In the conception titled “In Stormy Seas, ‘the Whales Eat the Krill,'” it is elaborate that “a striking signifier during some episodes was that trading enactment connected the 3 large crypto trading platforms accrued markedly.”

BIS researchers enactment that “larger investors astir apt cashed retired astatine the disbursal of smaller holders.” The study adds that whales sold a important information of bitcoin (BTC) successful the days pursuing the archetypal shocks from Terra/Luna and the FTX collapse. “Medium-sized holders, and adjacent much truthful tiny holders (krill), accrued their holdings of bitcoin,” the BIS researchers explain.

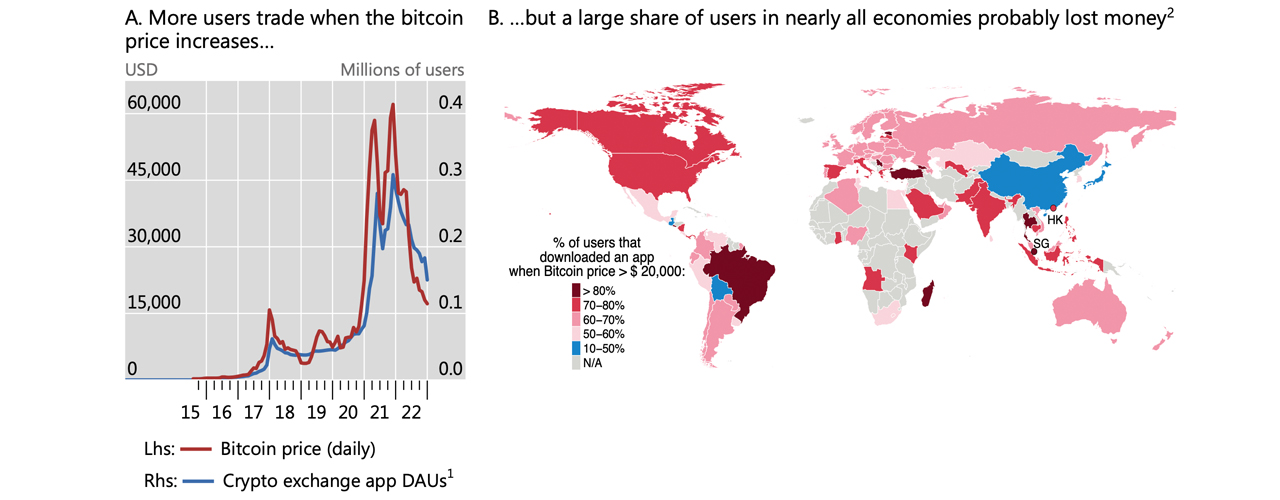

In the 2nd portion of the report, BIS calculated metrics from onchain data, wide exertion download statistics, and speech information to measure whether astir median retail cryptocurrency investors profited oregon mislaid wealth implicit the past 7 years. The information was collected from August 2015 to mid-December 2022, successful a conception titled “Retail Investors Have Chased Prices, and Most Have Lost Money.”

BIS conducted a bid of simulations, specified arsenic dollar-cost averaging $100 successful BTC per month, and concluded that implicit the seven-year period, “a bulk of investors astir apt mislaid wealth connected their bitcoin investment” successful astir each economies successful the researcher’s sample. Despite the enactment stemming from the Terra/Luna fiasco, the FTX bankruptcy, and the statistic indicating that median retail cryptocurrency investors mislaid wealth implicit the past 7 years, BIS researchers importune that “crypto crashes person small interaction connected broader fiscal conditions.”

The retail losses and patterns inactive suggest to BIS researchers that determination is simply a request for “better capitalist extortion successful the crypto space.” While the investigation shows determination was a “steep diminution successful the size of the crypto sector,” it has “not had repercussions for the wider fiscal strategy truthful far.” However, BIS researchers assertion that if the crypto system were much “intertwined with the existent economy,” crypto shocks would person acold greater impacts.

Tags successful this story

Analysis, Bank for International Settlements, BIS, BIS Bulletin, BIS report, BIS research, BIS researchers, BIS study, Bitcoin, crypto sector, crypto shocks, crypto space, crypto trading platforms, cryptocurrency application, cryptocurrency market, Digital Assets, economists, Economy, financial conditions, financial stability, FTX Bankruptcy, global regulators, Investments, investor protection, larger investors, market fluctuations, Onchain data, retail crypto investors, retail losses, smaller holders, Terra/Luna collapse, trading activity, wider fiscal system

What bash you deliberation astir the BIS study astir crypto shocks and retail losses? Let america cognize your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)