Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) traded little connected Tuesday arsenic sentiment among crypto traders remained bearish.

The bitcoin Fear & Greed Index has been stuck successful "fear" portion implicit the past period and reached its second-lowest recorded fearfulness level successful the index's past past week. Still, the scale has recovered somewhat implicit the past fewer days, which suggests utmost bearish sentiment could commencement to wane, particularly if BTC recovers supra $30,000.

For now, astir alternate cryptos (altcoins) underperformed bitcoin connected Tuesday, which suggests a little appetite for hazard among traders. For example, ether (ETH) declined by 4% implicit the past 24 hours, compared with a 2% diminution successful BTC. Avalanche's AVAX dipped by 9% and Fantom's FTM token fell by 14% connected Tuesday.

Typically, alts diminution much than BTC successful down markets due to the fact that of their higher hazard profile.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

From a method perspective, price bounces could beryllium constricted until semipermanent momentum improves. That could constituent to a afloat twelvemonth of little returns for stocks and cryptos comparative to the beardown uptrend successful 2020.

Volatile markets could connection opportunities for short-term traders who bash not perpetrate to terms trends and tin instrumentality agelong oregon abbreviated positions. Likewise, investors who are nimble capable to trim hazard tin deploy unused currency for the adjacent up rhythm successful plus prices.

But timing terms shifts tin beryllium hard implicit the abbreviated term. For example, connected average, bitcoin tends to output affirmative returns during periods of utmost bearish sentiment, according to Arcane Research. "Bitcoin has besides seen continued sell-offs pursuing utmost fear. Thus, you should not blindly expect that buying into fearfulness and mediocre momentum is profitable."

●Bitcoin (BTC): $29,369, +0.81%

●Ether (ETH): $1,962, −1.17%

●S&P 500 regular close: 3,941, −0.81%

●Gold: $1,866 per troy ounce, +0.97%

●Ten-year Treasury output regular close: 2.76%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

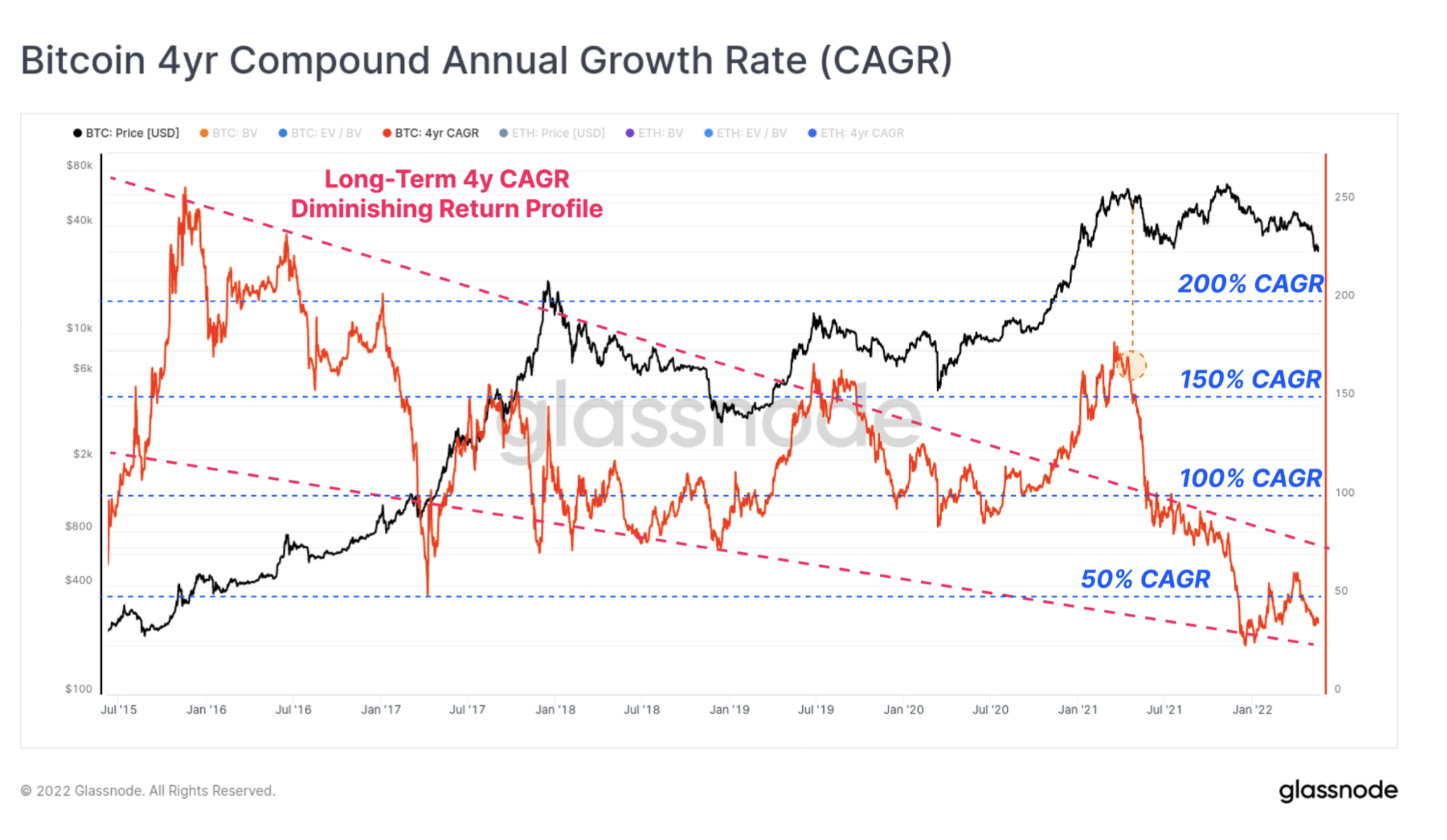

The illustration beneath shows a semipermanent diminution successful bitcoin's compound yearly maturation rate (CAGR), provided by Glassnode, a crypto information platform.

As bitcoin's marketplace size increases, much superior is required to determination marketplace prices. That tin effect successful diminishing returns implicit clip arsenic the crypto plus matures.

"We tin spot the marked diminution successful four-year CAGR pursuing the May 2021 sell-off, which we person argued was apt the genesis constituent of the prevailing carnivore marketplace trend," Glassnode wrote successful a blog post.

Bitcoin four-year CAGR (Glassnode)

But diminishing returns are not conscionable a effect of larger marketplace size.

From a macro perspective, a agelong play of accommodative monetary argumentation underpinned a beardown rally successful speculative assets, specified arsenic stocks and cryptos, implicit the past fewer years. Bitcoin, successful particular, has traded wrong four-year bull and carnivore cycles that produced higher returns comparative to stocks, albeit with much volatility.

Currently, planetary investors are grappling with tighter monetary argumentation amid precocious ostentation and slowing economical growth. That could nutrient diminishing returns successful some accepted and crypto markets.

"If ostentation stays precocious for galore years, some past and today's precocious starting valuations suggest it volition beryllium precise hard to make affirmative existent returns (adjusted for inflation) successful astir accepted fiscal plus classes," Deutsche Bank wrote successful a probe note. "Nominal returns (without considering inflation) volition besides apt notably underperform their semipermanent trend. Commodities could beryllium the exception."

Milady tumbles amid drama: Minimum prices (also called level prices) for the fashionable non-fungible token (NFT) postulation “Milady Maker” person slumped astir 70% successful the past week. The large terms deed was an isolated lawsuit successful the NFT marketplace and apt linked to the play that revealed its creator to person been a arguable property linked to a fashionable online cult. The postulation of 10,000 anime-inspired, computer-generated icons already had troubling baggage with sporting the sanction of a Nazi attraction campy connected immoderate of the artworks. Read much here.

Terra fiasco brings scrutiny to exchanges: South Korean authorities are looking to present measures to clasp crypto exchanges to greater scrutiny aft Terra's collapse, according to local reports. Korea Times wrote that determination are astir 280,000 investors successful the state who are believed to person been victims of UST stablecoin and LUNA tokens falling to adjacent zero successful a fewer days. Authorities volition besides analyse whether Do Kwon, the CEO of Terra creator Terraform Labs, committed fraud successful targeting investors with his crypto project. Read much here.

Crypto firms propulsion backmost against taxation rule: Crypto manufacture representatives are battling with OECD to exempt decentralized finance and non-fungible token (NFT) transactions from taxation reporting rules. The OECD, an planetary enactment that includes astir developed economies, is trying to present caller rules to halt crypto from being utilized to stash assets retired of show of the taxman. On the different hand, integer plus companies opine that immoderate crypto assets conscionable don’t acceptable the aforesaid mold arsenic different accepted assets, specified arsenic stocks oregon gold, and that applying the aforesaid rules would enactment excessively overmuch load connected them. Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)